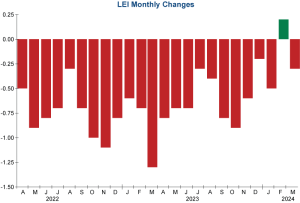

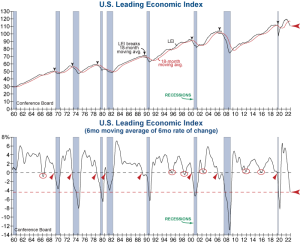

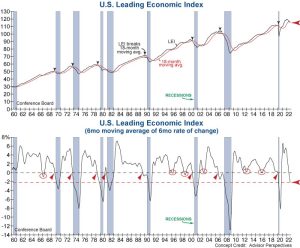

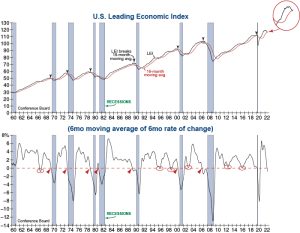

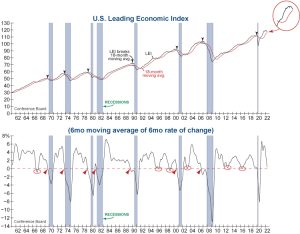

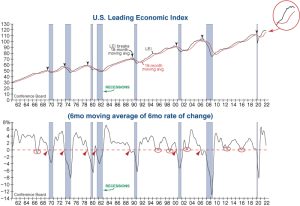

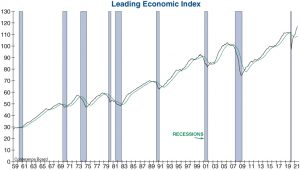

The Leading Economic Indicator (LEI) from the Conference Board has fallen 0.3% in March after a brief, one-month improvement in February. It has declined 24 out of the last 25 months and continues to provide a recessionary outlook.

Subscribe To Read MoreMarket Insights & Economic Trends

Market Insights & Economic Trends

Keep up with InvesTech’s review of economic news and data releases and how these may affect your investing. Visit regularly to read new Market Insights & Economic Trends posted below.

If you are a subscriber and some of the following articles are not available for you to read, please ensure you are logged into your online account. If you are not a subscriber and are interested in reading more, visit our Subscription Offers to sign up!

To see when upcoming releases are scheduled, select the following Economic Trends Calendar. Release dates represent when data is available from their respective sources. Check back here for the latest updates!

2024 Economic Release Calendar (PDF)

Also available in our Google Calendar Here

Follow us on Social Media:

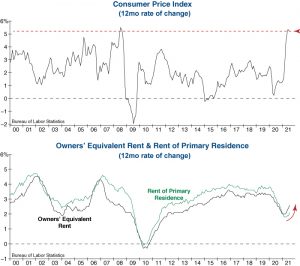

March CPI Report Comes in Hot

The S&P 500 is experiencing a selloff and long-term bond yields are jumping as investors digest a hotter than expected CPI report.

Subscribe To Read MoreISMs Show Improvement

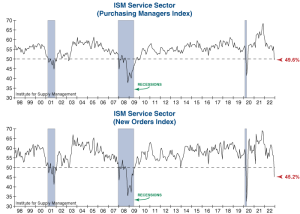

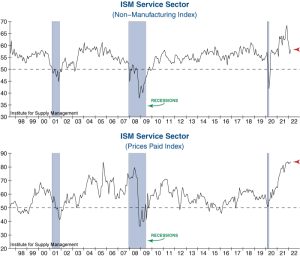

This week, the Institute for Supply Management (ISM) released their Purchasing Managers Index for both Services and Manufacturing for the month of March, which both saw improvement.

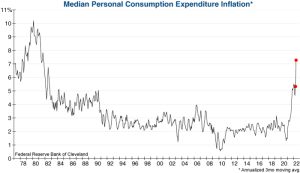

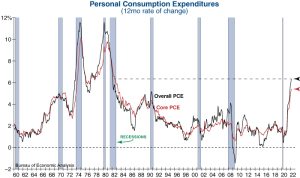

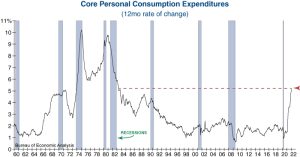

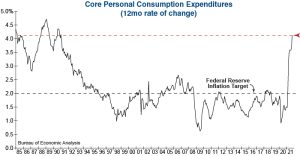

Read MoreInflation Data In-Line but Fed Wants to See More Progress

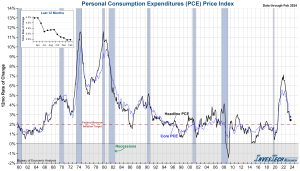

This morning’s Personal Consumption Expenditures (PCE) came in as expected, but isn’t falling as quickly as the Fed would like, leaving the door open to potential surprises in either direction.

Subscribe To Read MoreLeading Economic Index Sees First Increase in Two Years

The Conference Board’s (CB) Leading Economic Index (LEI) increased 0.1% in February – its first monthly increase since February 2022.

Subscribe To Read MoreAnother Hotter-Than-Expected Inflation Print

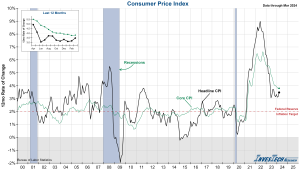

This morning’s Headline CPI print came in hotter than expected, going from 3.1% to 3.2% year-over-year (YoY) while Core CPI ticked down from 3.9% to 3.8% YoY but was still higher than consensus.

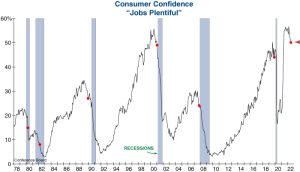

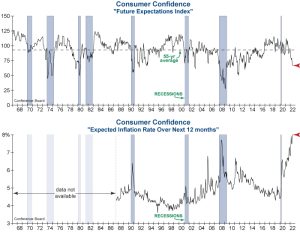

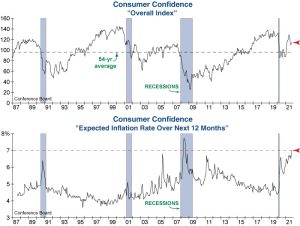

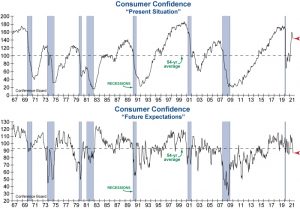

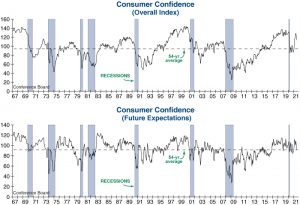

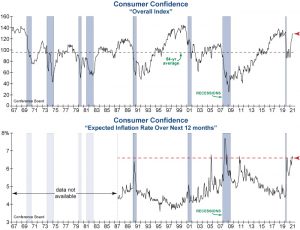

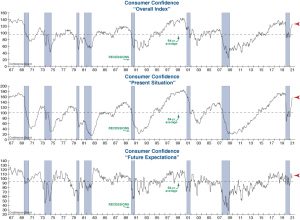

Read MoreConsumer Confidence Retreats in February

The Conference Board’s Consumer Confidence Index fell to 106.7 in February from a downwardly revised 110.9 (from 114.8) in January. This downward revision to January’s figure was significant and suggests that “there was not a material breakout to the upside in confidence at the start of 2024”…

Subscribe To Read MoreLEI Falls for 23rd Consecutive Month in January

This morning’s release of the Conference Board’s Leading Economic Index (LEI) for January disappointed expectations and fell for the 23rd consecutive month, its second longest stretch in the series’ history.

Subscribe To Read MoreThe Last Mile to 2% Gets Bumpy

Yesterday’s report for January Consumer Price Index (CPI) came in higher than expected at 3.1% year-over-year, but still lower than the 3.4% year-over-year (YoY) reading for December.

Read MoreRegional Fed Manufacturing Surveys Show Significant Weakness

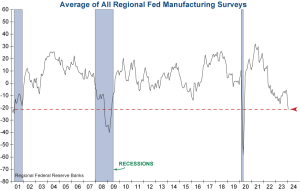

Today’s Texas Manufacturing Outlook Survey from the Federal Reserve Bank of Dallas showed further contraction in January after some improvement in December and was a significant downside surprise compared to forecasts.

Subscribe To Read MorePending Home Sales Jump in December – Not So High

This morning, the National Association of Realtors (NAR) released their December report for Pending Home Sales. Sales in December were up 8.3% from November and up 1.3% from December 2022. Today’s “surprising” jump in Pending Home Sales doesn’t seem like the huge improvement it’s made out to be…

Subscribe To Read MoreU.S. Leading Economic Indicator Contracts for 22nd Consecutive Month

Yesterday, the latest data for the Conference Board’s Leading Economic Indicator (LEI) was released for December. December saw a 0.1% decrease for its 22nd consecutive month after falling 0.5% in November. Benchmark revisions were made going back to the start of the series.

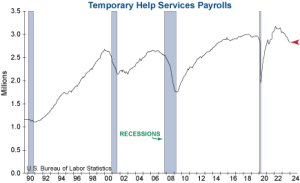

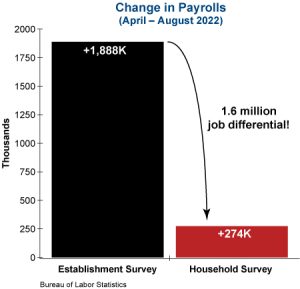

Subscribe To Read MoreEmployment Strength: Weaker Than Meets the Eye

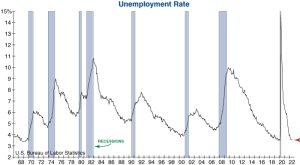

Recent releases have highlighted apparent strength in the employment market, but digging deeper we find things may not be as rosy as they seem…

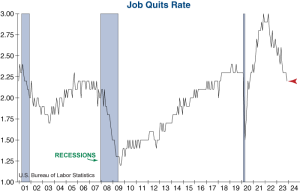

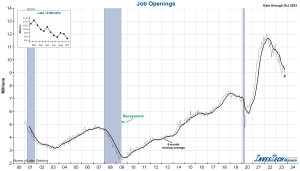

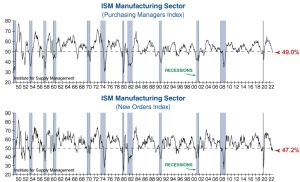

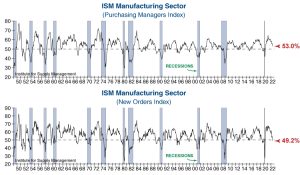

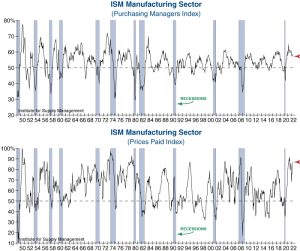

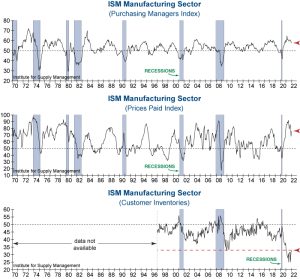

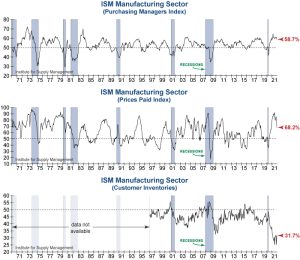

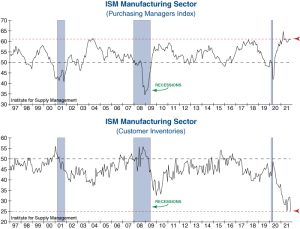

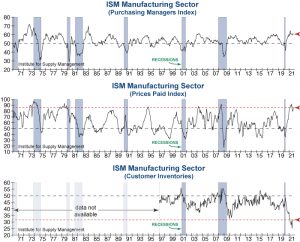

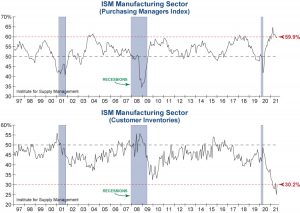

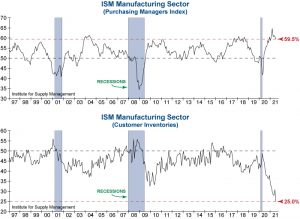

Read MoreISM Manufacturing and Job Quits & Hires Slide Past Prepandemic Levels

Today's economic news included the ISM Manufacturing PMI release for December and the Job Openings and Labor Turnover report. Minutes from the last FOMC meeting were released as well.

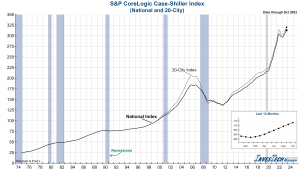

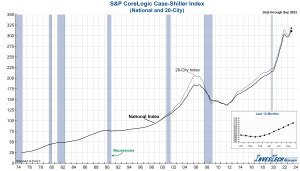

Read MoreHome Prices at All-Time Highs as Pending Home Sales Remain at All-Time Lows

This week’s economic news has been light due to the shortened holiday week. However, housing market data continues to highlight extreme dichotomies.

Subscribe To Read MoreYear-End Housing Update

A slew of economic releases point to a surprising upturn in housing activity. However, as affordability remains a serious concern, we wonder how long this euphoria can last…

Read MoreInflation Remains Firm as Small Businesses Struggle

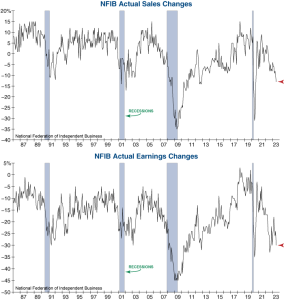

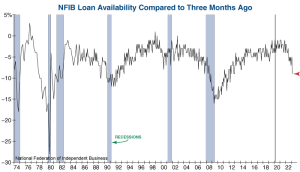

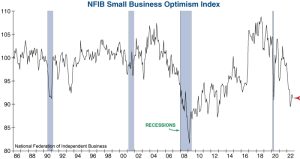

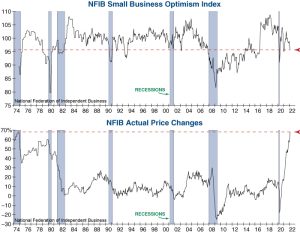

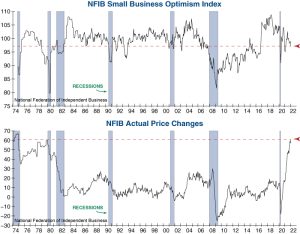

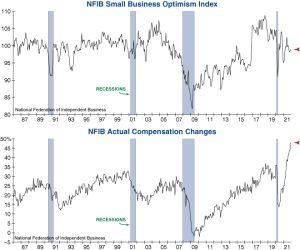

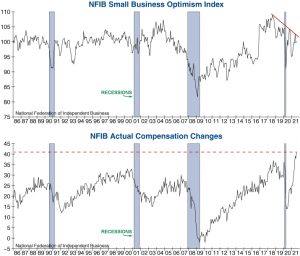

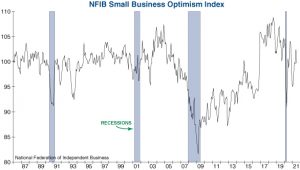

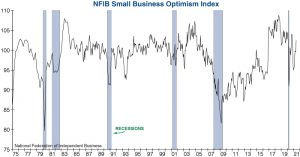

Both CPI and NFIB’s Small Business Index were released this morning for November. Inflation remained firm as small businesses continue to struggle…

Subscribe To Read MoreJob Openings and Labor Turnover (JOLTS)

This morning’s JOLTS report for October registered 8.773 million job openings, which was down notably from September’s downwardly revised 9.350 million openings.

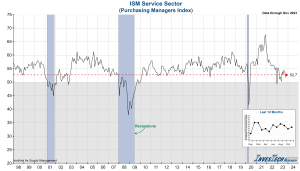

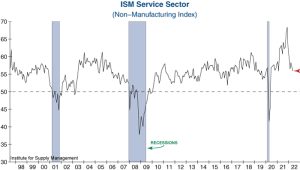

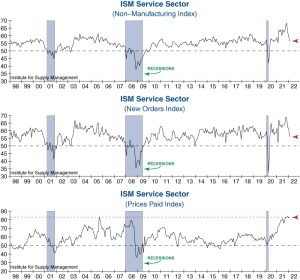

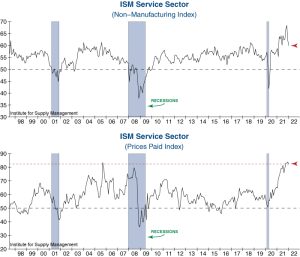

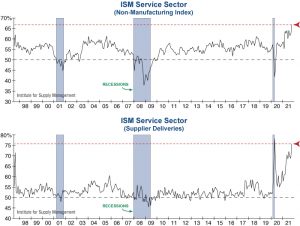

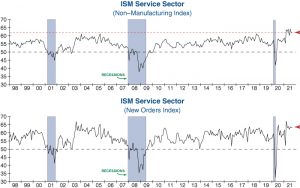

Read MoreISM Services

The latest ISM Services Index for November came in at 52.7%, slightly above expectations and 0.9 percentage points above the October reading of 51.8%. The ISM Services Index now sits at the mid-point of this year’s readings, which have ranged from 50.3 to 55.2

Read MorePending home sales hit a record low

Pending Home Sales from the National Association for Realtors hit a record low in October, reaching 71.4 – the worst reading in its 22+ year history. Pending home sales typically leads existing home sales for the following month, so this decrease will likely…

Subscribe To Read MoreConference Board Consumer Confidence

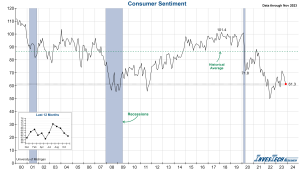

This morning’s Consumer Confidence Index for November came in at 102.0, up from a downwardly revised 99.0, slightly better than forecast, and its first improvement in three months.

Read MoreS&P CoreLogic Case-Shiller Home Price Index

The latest S&P CoreLogic Case-Shiller National Home Price Index (not seasonally adjusted - NSA) for September saw a 3.9% increase year-over-year (YoY), up from a 2.5% YoY change the previous month.

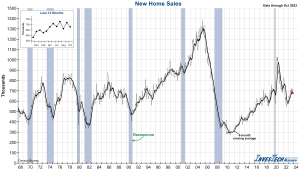

Read MoreNew Home Sales

Sales of new single-family homes for the month of October came in at 679,000, down from a revised 719,000 for September and lower than expected. This represents a 5.6% decrease month-over-month, but a 17.7% increase from this time last year.

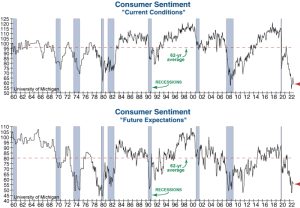

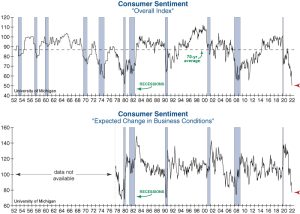

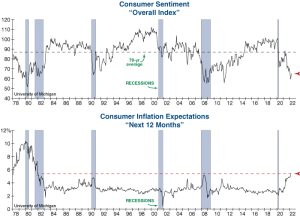

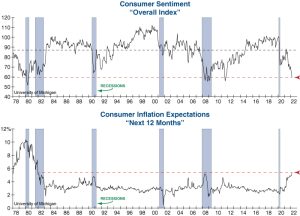

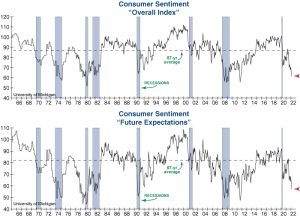

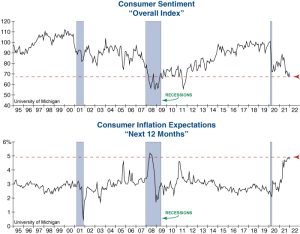

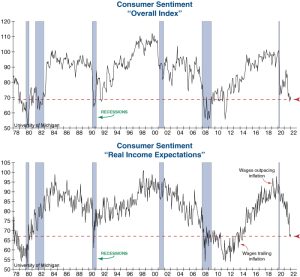

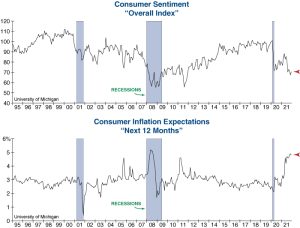

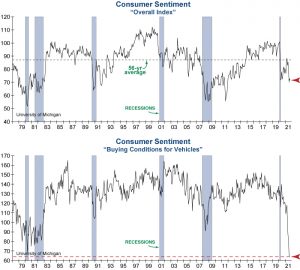

Read MoreUniversity of Michigan Consumer Sentiment

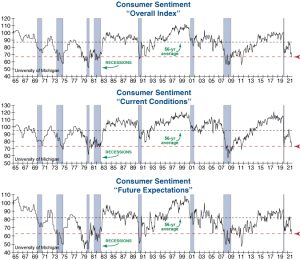

The November Final reading for the Consumer Sentiment Index came in at 61.3, down 3.9% from the October Final reading and its fourth consecutive decline.

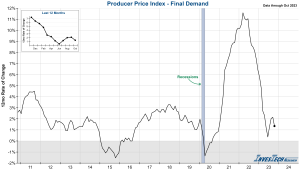

Read MoreProducer Price Index (PPI)

The latest Headline PPI FD for October came in at -0.5% month-over-month (MoM), down significantly from 0.4% in September. PPI is up 1.3% on a year-over-year (YoY) basis, its first deceleration in four months.

Read MoreLatest macroeconomic data reiterates the case for a hard landing ahead

Recent macroeconomic reports have shown broad-based weakness as the U.S. economy remains on a collision course with recession…

Subscribe To Read MorePremier small-cap index breaks to new bear market low!

The Russell 2000 Index has broken below its June 2022 bear market low as technical damage continues to accumulate…

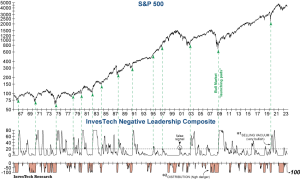

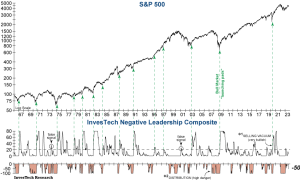

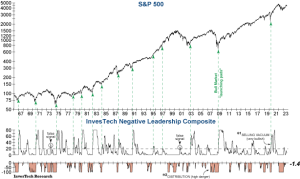

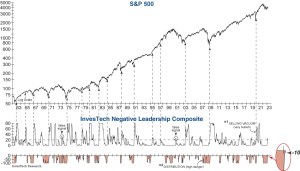

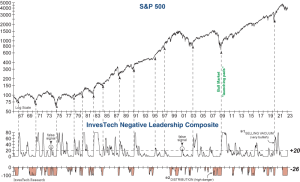

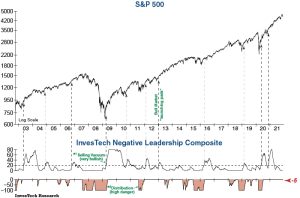

Subscribe To Read MoreDistribution in our Negative Leadership Composite falls to -100!

With Distribution falling to -100 in our Negative Leadership Composite, caution is warranted going forward…

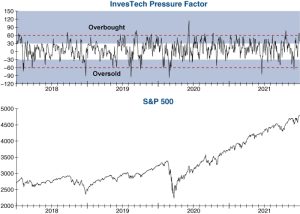

Subscribe To Read MoreInvesTech’s flagship indicator breaches a critical threshold

Our Negative Leadership Composite has registered an important warning flag in a sign of rising market risk…

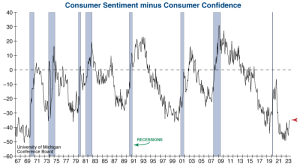

Subscribe To Read MoreThe consumer squeeze approaches a potential breaking point…

With U.S. consumers remaining under significant pressure, a key indicator is nearing a critical warning level…

Subscribe To Read MoreThe bear reawakens? NLC triggers bearish Distribution (again)

With Distribution reemerging within our Negative Leadership Composite, the bear market may be close to regaining control…

Subscribe To Read MoreInflationary pressures start to reaccelerate

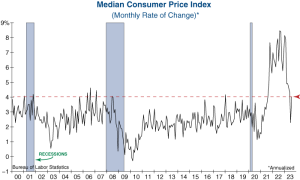

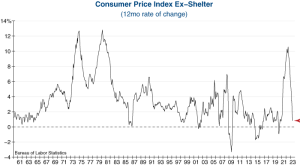

While inflation data has made positive progress over the past year, multiple indicators show that pricing pressures have started to reemerge...

Read MoreCash is Not Trash: How to make the most of your cash allocation

Cash plays a critical part of every “safety-first” investor’s portfolio, and it pays to know how to get the most out of this key holding…

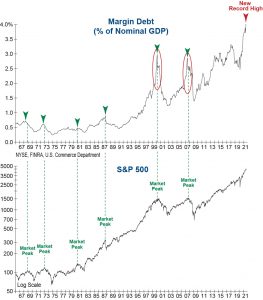

Subscribe To Read MoreIs air being let out of the speculative bubble… again?

Speculation reemerged in 2023, however there are early signs that the latest fervor may be fading…

Subscribe To Read MoreSmall business struggles persist…

The National Federation of Independent Business (NFIB) reported that their Small Business Optimism Index improved by 0.9 points in July, yet the Index remains at a historically depressed reading of 91.9...

Read MoreU.S. economy – soft landing or recession ahead?

While investors increasingly expect a soft landing for the U.S. economy, the economic data still paints a worrisome picture…

Subscribe To Read MoreAs consumer attitudes rebound, a different warning flag emerges…

While the recent rebound in Consumer Confidence is encouraging, other leading indicators paint a far less optimistic picture...

Read MoreThe Fed’s burden shifts from inflation to employment

With inflation pressures easing in recent months, the strong employment data has started to play a larger role in the Fed’s monetary policy decisions…

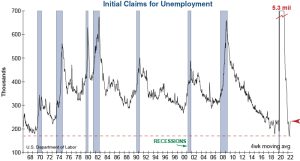

Subscribe To Read MoreJobless claims rise to a concerning level. Is the economy’s stronghold fading?

Initial claims for unemployment have risen significantly in recent months, signaling that labor market strength may be fading…

Subscribe To Read MoreS&P 500 enters overbought territory

Wall Street has celebrated the S&P 500 reaching “bull market” status by gaining +20% from its October low, however this rally has also led to overbought signals in multiple indicators…

Subscribe To Read MoreService & Manufacturing Sectors Show Signs of Slowing Demand

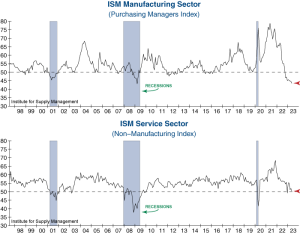

Both Institute for Supply Management (ISM) Purchasing Manager’s Index (PMI) for Manufacturing and Non-Manufacturing (Services) have shown general deterioration over the last 18 months.

Read MoreDebt Limit Showdown – Here’s What to Watch

Once again, all eyes on Wall Street are fixed on the debt limit showdown and there is a steady stream of headlines and news reports about the impending crisis that is quickly approaching.

Subscribe To Read MoreSmall business optimism sinks to decade low

The NFIB Small Business Optimism Index fell to the lowest level in a decade in April as small business owners prepare for tough times ahead…

Subscribe To Read MoreRegional Fed Manufacturing Surveys continue to spell trouble

Regional manufacturing surveys from the Federal Reserve continue to languish as economic challenges persist...

Read MoreLeading Economic Index continues to falter

The Conference Board’s Leading Economic Index has fallen for the 12th straight month as it further solidifies its recessionary warning signal…

Subscribe To Read MoreLatest Inflation Numbers Seem Hopeful, But Be Careful What You Wish For

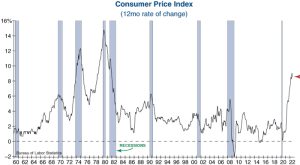

While falling inflation seems like a positive development, drops of this magnitude often occur when economic conditions are collapsing and there is little the Fed can do to save the day…

Subscribe To Read MoreSmall businesses remain under pressure

The NFIB Small Business Optimism Index declined in March to remain at a historically low reading…

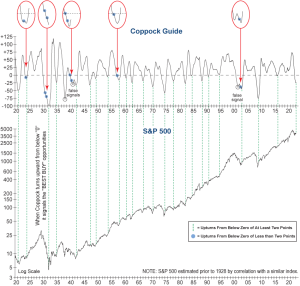

Subscribe To Read MoreCoppock Guide “ticks” upward… but is it a signal?

The Coppock Guide ticked higher in March, yet there are many important factors that can help put this positive signal into context…

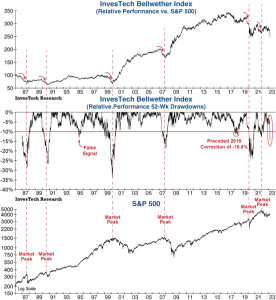

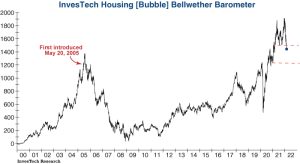

Subscribe To Read MoreBellwether Index registers a warning flag

The sudden underperformance of our Bellwether Index has triggered a warning flag that should not be ignored...

Read MoreThe Fed is stuck between a rock and a hard place

The FOMC finds itself in a tough position as inflationary forces persist while the banking system has started to show some vulnerabilities…

Subscribe To Read MoreBearish Distribution reemerges!

The reemergence of Distribution in our Negative Leadership Composite signals that the bears may have regained control of the stock market…

Subscribe To Read MoreMortgage applications sink to a 28-year low!

Homebuyer demand continues to deteriorate as mortgage rates remain near multi-decade highs...

Read MoreLatest inflation report points to further Fed rate hikes ahead

Persistent inflationary pressures continue to keep the Federal Reserve on a tightening path…

Subscribe To Read MoreSelling Vacuum signal emerges for first time since 2020

Our Negative Leadership Composite has started to generate a positive signal as the technical data continues to improve…

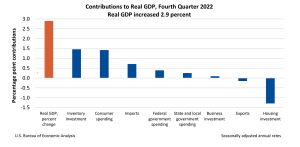

Subscribe To Read MoreWill the ‘real’ GDP please stand up?

The Advance Estimate for Q4 2022 Real GDP came in at 2.9%, down from 3.2% for Q3 but better than consensus. This may seem like a win against recessionary warning flags, but it doesn’t tell the whole story.

Read MoreLeading Economic Index continues its slide

The worsening decline in the Leading Economic Index means that a U.S. recession may have already arrived…

Subscribe To Read MoreDebt Limit Showdown! – Will the U.S. Government Default

The headlines are progressively warning of dire consequences if the U.S. Government defaults… We say: don’t panic!

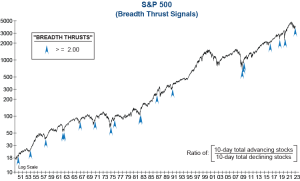

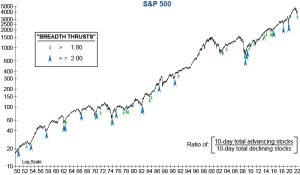

Read More[Potentially] bullish Breadth Thrust emerges from the bear market lows

A breadth thrust has emerged for the first time since June 2020, a technical development deserving of careful consideration...

Read MoreService Sector shockingly plunges into contraction

The ISM Services Index suffered its third largest drop in history in December and it is another indicator sending a decisive recession warning flag…

Subscribe To Read MoreLeading Economic Index points to hard times in 2023

The Leading Economic Index suffered its worst decline since the pandemic, as recession appears to be quickly approaching…

Subscribe To Read MoreCanary Index leads the break to new lows

Our Canary (in the coal mine) Index breaking to new lows could be a prelude to what lies ahead for the broader market...

Read MoreInflation eases, yet challenges for the Fed remain

The Consumer Price Index continued to ease in the latest report, yet one key measure shows that wages remain a persistent inflationary force…

Subscribe To Read MoreManufacturing falls into contraction for the first time since the pandemic

The ISM Manufacturing Index fell more than expected in November and is close to raising a recession warning flag…

Subscribe To Read MoreConsumers grow more pessimistic heading into the holidays

Consumer Sentiment remained at one of the worst readings in its 60+ year history in November as inflation expectations rebounded and labor market conditions start to deteriorate…

Subscribe To Read MoreLeading Economic Index suffers sharpest drop since pandemic-induced recession

The Conference Board's Leading Economic Index declined for the 8th straight month as it solidifies its recessionary warning flag.

Read MoreSmall business optimism remains downtrodden heading into year-end

Small business owners remain pessimistic as they contend with many challenges, including persistent inflation pressures and falling customer demand.

Subscribe To Read MoreStrong wage growth complicates the Fed’s inflation fight

The Employment Cost Index remained at a very high level in Q3, which adds further pressure on the Fed to remain on their tightening course.

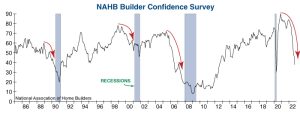

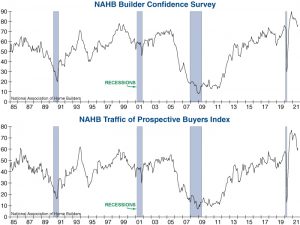

Subscribe To Read MoreHomebuilders warn of more pain ahead

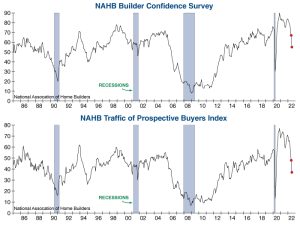

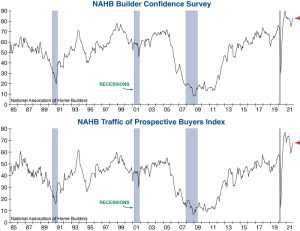

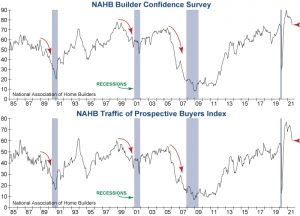

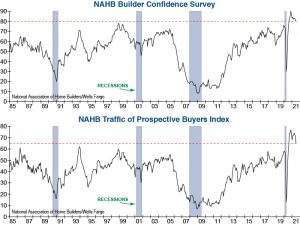

NAHB Builder Confidence declined for a record 10th month in a row in October as housing conditions continue to deteriorate...

Read MoreCore inflation reaches a new 40-yr high

The Core Consumer Price Index jumped to the highest level since 1982 in September, and broadening inflation pressures show that today’s inflation problem is far from over…

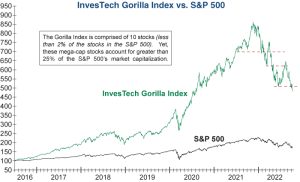

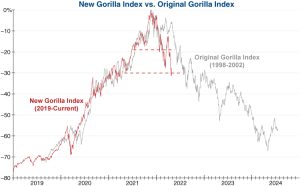

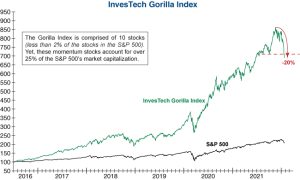

Subscribe To Read MoreGorilla Index’s breakdown is a bad omen

Our Gorilla Index has plunged through its lower support level and is making new lows, indicating that the broad market may be soon to follow…

Subscribe To Read MoreThe labor market weakens, but key data will keep the Fed on a tightening path…

There is growing evidence of weakness in the U.S. labor market, yet data which matters most to the Federal Reserve is keeping them on a tightening course…

Subscribe To Read MoreSoaring interest rates point toward further Fed tightening

Skyrocketing interest rates have pushed stocks to new lows and indicate that the Federal Reserve still has a ways to go before they can stop tightening monetary policy…

Subscribe To Read MoreLeading Economic Index solidifies its recession warning

With the Conference Board's Leading Economic Index declining for the sixth straight month, recession is looking increasingly inevitable...

Read MoreHas a pinhole been put into this housing bubble?

It is no secret that the housing market has gone ballistic over the past two years. Yet, there is now growing evidence that extremes in the housing market are coming unwound...

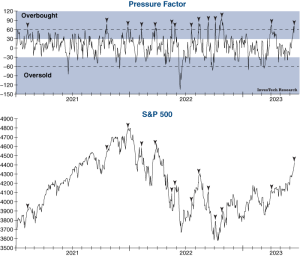

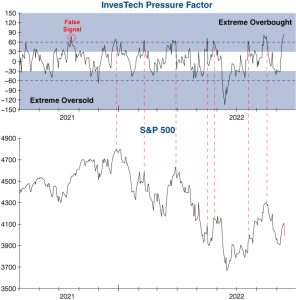

Read MorePressure Factor reaches a historically extreme level…

Our short-term Pressure Factor just reached the second most overbought level of the past decade – a big potential headwind for the market in the days or weeks ahead…

Subscribe To Read MoreLabor market expands but shows increasing weakness in August…

Headlines are cheering that 315K jobs were added in August, but the labor market looks a lot less stable when we look below the surface…

Subscribe To Read MoreLatest housing data – look out below!

New home sales continued to plunge in July as the faltering housing market represents a growing risk to the U.S. economy.

Read MoreBreadth Thrusts: What is this bullish confirmation tool telling us today?

Breadth thrusts have been one of the most reliable confirmations that a new bull market has begun, so is this tool validating the recent stock market rally?

Read MoreHousing risks continue to accumulate

Homebuyer traffic has continued to collapse in the midst of this affordability crisis, increasing the risk of a hard landing for housing…

Subscribe To Read MoreInflation declines, but investors shouldn’t celebrate just yet…

Equities rallied on the decline in inflation last month, but key data shows it may not be the bullish development many are hoping for…

Subscribe To Read MoreLatest employment data appears strong, but there’s a catch…

Today’s employment report was stronger than expected, but leading indicators suggest that this strength may not last for long…

Subscribe To Read MoreBroadening inflation keeps pressure on the Fed

A key measure shows that inflation broadened by the largest amount on record in June – increasing pressure on the Fed to regain control over inflation…

Read MoreForget the backward-looking recession debate – the worst likely lies ahead for the US economy…

Many are debating whether or not the U.S. is in recession after real GDP growth declined for the second straight quarter. More important to investors, however, are the concerning signals being sent by the leading economic data…

Subscribe To Read MoreLeading Economic Index verging on recessionary signals

The Conference Board’s Leading Economic Index has declined for the fourth straight month and is now on the brink of giving multiple recessionary warning flags…

Subscribe To Read MoreHomebuilder confidence posts second-largest plunge on record in July

Builder Confidence from the National Association of Home Builders (NAHB) cratered in July as unprecedented affordability challenges weigh on homebuyer demand…

Subscribe To Read MoreNFIB Small Business Survey – Just when you thought it couldn’t get any worse…

NFIB Small Business Optimism plunged further in June as recessionary warning flags continue to emerge...

Read MoreRecession risk rises as jobless claims reach worst level in eight months

Jobless claims have surged to an 8-month high as another recessionary warning flag emerges…

Subscribe To Read MoreManufacturing tumbles in June – confirming a likely U.S. recession

The ISM Manufacturing Index declined further in June, and an internal component suggests that the risk of recession is rising rapidly...

Read MoreConsumers’ outlook darkens as inflation expectations surge to new highs

Consumers’ outlook for the future continues to deteriorate as inflation expectations surge to new highs – is inflationary psychology is becoming ingrained in the minds of consumers?…

Subscribe To Read MoreLEI – On a collision course with recession?

The Conference Board’s Leading Economic Index (LEI) has fallen for the third straight month and is suggesting that an economic slowdown and possible recession may be in store for the U.S. economy.

Subscribe To Read MoreTraffic of prospective home buyers plunges as affordability challenges worsen

NAHB Traffic of Prospective Buyers collapsed further in June as soaring mortgage rates and deteriorating affordability have put the housing market in a vulnerable position...

Read MoreInflation unexpectedly jumps to a 40-yr high, sending Consumer Sentiment to a 70-yr low!

As inflation has proven to be stubbornly persistent, consumers have become the most pessimistic of any time since 1952 as recession risks start to mount...

Read MoreService sector slows to a two-year low

The ISM Services Index has fallen to the lowest level since May 2020, but the fact that it remains in expansion territory will pressure the Fed to continue tightening in the months ahead.

Subscribe To Read MoreConsumer Sentiment hits a new low in a sign of caution for the U.S. economy

As Consumer Sentiment becomes more and more depressed, the U.S. economy is in a vulnerable position with spending beginning to soften…

Subscribe To Read MoreLatest data flashing “RED” for the housing market!

Just released housing data reveals a sharp drop in new home sales and surging inventory – confirming a probable “hard landing” ahead for housing…

Read MoreTraffic of prospective buyers collapses – an early warning flag for the housing market

NAHB Traffic of Prospective Buyers fell by the second-largest amount on record in May, indicating that the housing market is now skating on thin ice…

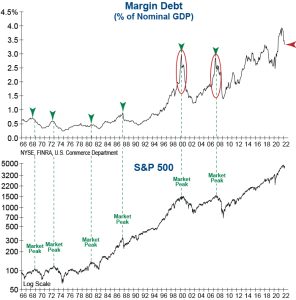

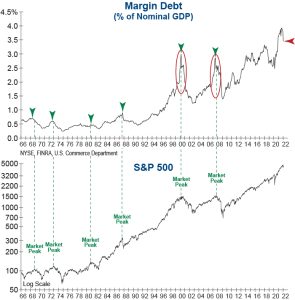

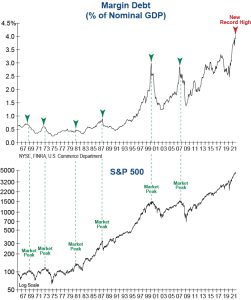

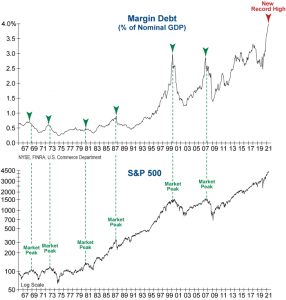

Subscribe To Read MoreMargin Debt solidifies our ‘red flag’ warning

Margin debt continued to decline in April and is confirming that a longer-term stock market peak is likely in place...

Read MoreInflation cools slightly, but its persistence will keep the Fed on a tightening path

Inflation ticked lower in April, but its persistence surprised many and is likely to keep the Fed tightening monetary policy in the months ahead.

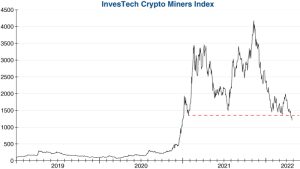

Subscribe To Read MoreCrypto miners break critical support. Could Bitcoin be next?

[Updated May 9] Earlier this year, we began tracking 10 of the leading crypto mining stocks to warn of a potential loss of exuberance surrounding the crypto-mania…

Subscribe To Read MoreResilient ISM Surveys show signs of initial weakness

While the ISM surveys remain at historically strong levels, the combination of high prices and falling demand could weigh on companies in the months to come…

Subscribe To Read MoreThe battle between consumer confidence and inflation “heats” up

Consumer Sentiment rebounded in April after suffering its second worst 11-month skid in history… however, one important component has reached its most worrisome level in over 40 years.

Subscribe To Read MoreGorilla Index tests another critical support level

Following the pandemic-induced crash of 2020, we developed our new Gorilla Index as we recognized that just 10 mega-cap momentum stocks accounted for a disproportionately large 27% weight in the S&P 500 Index...

Read MoreThe Leading Economic Index advances but it’s not all good news…

The Conference Board’s Leading Economic Index (LEI) gained 0.3% in March, indicating that economic growth is likely to continue in the months ahead…

Subscribe To Read MoreSoaring mortgage rates hit the brakes on home buyer traffic

Traffic of Prospective Buyers from the National Association of Home Builders (NAHB) fell for the fourth straight month after this month’s six point decline.

Subscribe To Read MoreMargin debt craters in March!

Margin debt has joined the ranks of emerging warning flags after falling significantly in March.

Subscribe To Read MoreInflation surges higher, taking small business optimism to new lows

The Consumer Price Index (CPI) surged to 8.5% on a year-over-year basis in March, the highest reading since 1981.

Read MoreService sector shows resilience despite record inflation challenges

The ISM Services Index increased by 1.8 points to a reading of 58.3 in March, its first gain in four months.

Subscribe To Read MoreManufacturing slows as prices remain hot

The ISM Manufacturing Index fell to an 18-month low in March, due largely to new orders falling by the fastest clip since the COVID-19 induced recession in early 2020.

Subscribe To Read MoreInflation sets (another) record

Personal Consumption Expenditures (PCE) climbed to +6.4% in February, its 15th straight monthly gain which ties the prior record set in 1980.

Subscribe To Read MoreConsumer Sentiment craters as inflation expectations hit a 41-year high

The Consumer Sentiment survey from the University of Michigan plunged further below its pandemic lows in March as inflation expectations surged to the highest level since 1981.

Read MoreLEI nudges higher in February but risks to growth remain

The Leading Economic Index (LEI) from the Conference Board edged higher by 0.2% in February, yet the gain was not enough to offset half of the prior month’s -0.5% loss.

Subscribe To Read MoreInflation surges to a new high ahead of next week’s Fed meeting

The overall Consumer Price Index (CPI) jumped +0.4% to +7.9% in February, the highest reading since January 1982.

Subscribe To Read MoreSmall Business Optimism sinks as price hikes hit a record high

The Small Business Optimism Index from the National Federation of Independent Business unexpectedly fell to the lowest level in over a year as surging inflation and labor shortages continue to be headwinds.

Subscribe To Read MoreService sector unexpectedly slows to a 12-month low

The ISM Services Index dropped to a reading of 56.5 in February versus economists’ expectations for an increase to 60.9.

Subscribe To Read MoreManufacturing improves after a three-month skid

The ISM Manufacturing Index jumped by one point and remains at an historically strong reading of 58.6 after having contracted for the previous three months.

Subscribe To Read MoreInflation surges to a 40-year high

Personal Consumption Expenditures (PCE) rose to +6.1% in January, the highest reading in 40 years.

Read MoreOur leading housing index breaks below initial support

Our Housing [Bubble] Bellwether Barometer has broken under its initial support level as mortgage rates have spiked to 3.9%.

Subscribe To Read MoreLeading economic indicators slow unexpectedly to start the year

The Leading Economic Index (LEI) from the Conference Board fell by -0.3% in January, notably lower than economists’ expectations for a +0.3% increase.

Subscribe To Read MoreMargin debt plunges in January

Margin debt has joined the list of bear market warning flags as it cratered to start the year.

Read MoreInflation takes a big hit on Sentiment!

Consumer Sentiment from the University of Michigan unexpectedly cratered to an 11-year low in February as inflation continues to weigh heavily on the consumer.

Subscribe To Read MoreSmall Business Optimism falls further as inflation soars

Small Business Optimism from the National Federation of Independent Business fell to an 11-month low in January as inflation continues to be challenging

Read MoreService Sector loses some steam, but increases pressure for rate hikes ahead

The ISM Services Index declined to start 2022, as persistent labor and supply chain shortages weighed on the measure.

Subscribe To Read MoreManufacturing softens for the third straight month

The ISM Manufacturing Index continued to moderate in January, as its third consecutive decline brought it down to a 16-month low.

Subscribe To Read MoreConsumer Sentiment hits new lows on inflation concerns

Consumer Sentiment from the University of Michigan fell further below its pandemic lows this month as inflation concerns continue to mount.

Subscribe To Read MoreThe InvesTech Gorilla Index loses technical support

During the final years of the 1990s Tech Bubble, we observed an interesting dynamic where a relatively small number of mega-cap stocks became responsible for the majority of the stock market’s advance.

Read MoreNew highs in the Leading Economic Index come with a warning from the Conference Board…

The Conference Board’s Leading Economic Index (LEI) improved by 0.8% in the final reading of 2021, with only one of its ten components contributing negatively…

Subscribe To Read MoreHomebuilder confidence dips – has it peaked for this cycle?

NAHB Builder Confidence declined by one point to a reading of 83, yet the measure is still at a very strong historical level.

Subscribe To Read MoreInflation continues to hit consumer attitudes

The University of Michigan’s measure of Consumer Sentiment declined slightly in January’s preliminary reading to reach the second lowest level of the past decade.

Subscribe To Read MoreConsumer prices rise at fastest pace since 1982

Inflation as measured by the Consumer Price Index (CPI) climbed to +7.0% in December, the highest reading in nearly 40 years and a far cry from last December’s print of +1.4%.

Subscribe To Read MoreSmall business optimism inches higher but inflation continues to weigh

NFIB Small Business Optimism gained just 0.5 points in December to remain at a relatively depressed reading of 98.9.

Subscribe To Read MoreCanary Index plunges below critical support

Our InvesTech Canary (in the coal mine) Index has been testing its critical support level for the last few weeks. On Wednesday, the Index -7% loss definitively broke support.

Read MoreService sector is hampered by Omicron

The services sector finished 2021 on a significantly weaker note, as the ISM Services Index fell to a reading of 62.0 versus expectations of 67.0.

Read MoreManufacturing disruptions start to moderate

The ISM Manufacturing Index moved lower by 2.4 points in December, yet the Index remains at a historically strong reading of 58.7, as many of the supply/demand imbalances in the manufacturing sector began to normalize last month.

Subscribe To Read MorePressure Factor reaches overbought extreme

Our InvesTech Pressure Factor, a technical tool that indicates how overbought or oversold the market is in the short term, reached an extreme overbought reading of + 69 earlier this week.

Read MoreConsumers find a little bit of holiday cheer

Consumer Sentiment from the University of Michigan improved by 3.2 points in the final reading of 2021, primarily because the outlook of low-income households jumped as they begin to realize the benefits of the ongoing labor shortage in the form of wage growth.

Subscribe To Read MoreMore strong inflationary data coming down the chimney

Personal Consumption Expenditures (PCE) rose to 5.7% in November, the highest reading in nearly 40 years.

Subscribe To Read MoreLeading economic indicators continue to advance

The Conference Board’s Leading Economic Index (LEI) continued to move higher in November on broad strength.

Subscribe To Read MoreCanary Index testing critical support level

Our InvesTech Canary (in the coal mine) Index recently plunged below initial support and proceeded to close below its critical support level for the first time yesterday.

Read MoreProducers continue to get squeezed

The Producer Price Index (PPI) for Finished Goods continued to surge in November and has now increased by +13.6% from a year ago.

Subscribe To Read MoreInflation soars to a 40-year high

The Consumer Price Index surged to 6.8% in December, the highest level in nearly 40 years.

Subscribe To Read MoreInvesTech Negative Leadership Composite Triggers Distribution

For the first time since the 2020 COVID-19 Crash, our Negative Leadership Composite (NLC) has started showing bearish Distribution.

Subscribe To Read MoreManufacturers show strength despite persistent challenges

The ISM Manufacturing Index ticked higher to a reading of 61.1 in November, keeping it at a historically strong reading.

Subscribe To Read MoreSurging prices weigh on the minds of consumers heading into the holiday season

Core Personal Consumption Expenditures (PCE), which excludes volatile food and energy prices, climbed even further beyond the Federal Reserve’s 2.0% inflation target in October.

Subscribe To Read MoreBorrowing on Margin Soars as Speculation Re-engages

Margin debt surged to new highs in October in a clear indication that speculation remains alive and well in the stock market.

Subscribe To Read MoreLeading economic indicators keep on rolling – what does it mean for the equity market?

The Conference Board’s Leading Economic Index (LEI) reached a record high for the seventh straight month in this morning’s release, suggesting that economic strength will continue into 2022.

Read MoreHomebuilder optimism regains its footing

After sliding for much of this year, NAHB Builder Confidence continues to rebound and remains above its pre-pandemic highs.

Subscribe To Read MoreConsumer Sentiment falls to the lowest level in a decade

November’s preliminary reading of Consumer Sentiment fell further below its pandemic lows due to intensifying inflation fears.

Subscribe To Read MoreInflation accelerates and broadens at an alarming pace

The Core Consumer Price Index (CPI) -which excludes food and energy prices- soared to another 30-year high in October as pricing pressures continue to mount.

Subscribe To Read MoreInflation insights from the corporate trenches…

As the inflation debate rages on, we explore what CEOs and corporate executives of Fortune 500 companies are seeing on the ground floor.

Read MoreA record high for the services sector, but not as strong as it appears…

The ISM Service Sector surged to the highest level in its 24-year history last month due to the combination of strong consumer demand and supply chain disruptions.

Subscribe To Read MoreA tug of war between manufacturing demand and supply chain challenges

The ISM Manufacturing Index ticked down by 0.3 points in October to remain near one of the highest readings of the past 50 years.

Subscribe To Read MoreInflation puts the Fed further behind the eight-ball

Core Personal Consumption Expenditures (PCE), the preferred inflation measure of the Federal Reserve, climbed to 3.64% last month to remain at the highest level in over 30 years.

Subscribe To Read MoreConsumer Sentiment gets hit hard by inflation psychology

The University of Michigan’s measure of Consumer Sentiment declined in October as inflationary fears pushed consumers’ attitudes back below pandemic levels of a year ago.

Read MoreNew home sales jump in spite of record price increases

New home sales of 800,000 in September was notably higher than economists’ expectations and was the largest month-over-month increase since July of 2020.

Subscribe To Read MoreConsumer Confidence stabilizes yet inflation expectations become even more extreme

Consumer Confidence rose modestly in October after having fallen for the four months prior, bolstered primarily by declining COVID-19 cases.

Subscribe To Read MoreLeading economic indicators rise, but at a much slower pace…

The Conference Board’s Leading Economic Index (LEI) increased to another record high in September, yet last month’s growth of 0.2% missed economists’ expectations and was the second slowest reading since last year’s COVID-induced recession.

Subscribe To Read MoreProducers feel the pinch

The Producer Price Index (PPI) for Finished Goods climbed from 10.2% to 11.7% in September, the highest reading since November of 1980.

Subscribe To Read MoreInflation just won’t quit

The Core Consumer Price Index (CPI), which excludes food and energy prices, moved slightly higher to 4.0% on an annual basis in September to remain near a 30-year high.

Read MoreThe service sector remains robust

The ISM Services Index exceeded economists’ expectations by ticking higher to a reading of 61.9 in September.

Subscribe To Read MoreThe Fed has an inflation conundrum

Core Personal Consumption Expenditures (PCE) –the Federal Reserve’s preferred inflation measure– edged up slightly to 3.62% from 3.60% for the month prior.

Subscribe To Read MoreConfidence continues to tumble in September

Consumer Confidence from the Conference Board continued to worsen in September as fears over inflation and the COVID-19 Delta variant persist.

Read MoreSpeculative Borrowing Re-engages

The latest margin debt reading showed that speculation regained momentum last month as it surged to yet another record high.

Read MoreThe Leading Economic Index continues to advance

The Conference Board’s Leading Economic Index (LEI) exceeded economists’ expectations by jumping +0.9% in August.

Subscribe To Read MoreHomebuilder confidence stabilizes… for now

NAHB Builder Confidence registered a warning flag last month after it fell sharply to a 13-month low, yet it managed to rebound by one point in September.

Subscribe To Read MoreInflation stays high as sticky prices are poised to pick up the slack

The Consumer Price Index ticked down to 5.3% from 5.4% last month and remained at one of the highest readings of the past twenty years.

Read MoreInflation continues to weigh on small business optimism

The NFIB Small Business Optimism Index increased by a meager 0.4 points in August (top graph) as small business owners continue to contend with both rising input costs and labor challenges.

Subscribe To Read MoreIs speculation starting to fade?

The speculative frenzy that was ignited by the trillions of dollars in monetary and fiscal stimulus since the pandemic began may be starting to dissipate, according to our InvesTech Investor Psychology Barometer (IIPB).

Read MoreProducer prices surge to record levels

The Producer Price Index (PPI) surged to an all-time high of 8.3% in its most recent reading, showing that supply/demand imbalances are persisting.

Subscribe To Read MoreManufacturing remains strong, but challenges remain…

The ISM Manufacturing Index moved higher to a reading of 59.9% in August to remain near one of the highest levels of the past two decades.

Subscribe To Read MoreConsumer confidence craters in August

Consumers became significantly more pessimistic in August due to a combination of persistent inflation pressures and fears over the Delta variant.

Subscribe To Read MoreThe Fed’s preferred inflation measure still running hot

Core Personal Consumption Expenditures (PCE), which excludes volatile food and energy prices, rose for the fifth straight month to 3.62% versus the prior month’s unrevised reading of 3.5%.

Subscribe To Read MoreLeading economic indicators show strength

The Leading Economic Index (LEI) from the Conference Board improved once again in July, taking the Index to another record high.

Subscribe To Read MoreLeading housing indicator raises a warning flag

NAHB Builder Confidence (top graph below) sank to a 13-month low in August after suffering its fourth largest drop of the past decade.

Subscribe To Read MoreSmall businesses voice concern about the future

NFIB Small Business Optimism Index unexpectedly declined by -2.8 points to a reading of 99.7 as economic expectations retreated in July.

Subscribe To Read MoreManufacturing remains strong but moderates

The ISM Manufacturing Index declined by -1.1% to 59.5% in July, yet it remains at one of the highest levels of the past 30 years.

Subscribe To Read MoreThe Fed’s preferred inflation measure continues to rise

Core Personal Consumption Expenditures (PCE) –the preferred inflation measure of the Federal Reserve– climbed further beyond the central bank’s 2% inflation target to 3.5% last month.

Subscribe To Read MoreConsumer Confidence Steady Despite Inflation Concerns

Consumer attitudes were virtually unchanged in July...

Read MoreLEI continues to climb

The Leading Economic Index (LEI) from the Conference Board gained 0.7% last month on positive contributions from eight of its ten leading components.

Subscribe To Read MoreMargin debt stays the course

Margin debt climbed in June for the eighth straight month as investors continue to borrow on margin to buy stocks.

Subscribe To Read MoreHomebuilders remain optimistic

Homebuilders became slightly less optimistic this month according to the National Association of Home Builders, yet their confidence remains higher than at any point prior to the COVID-19 pandemic.

Subscribe To Read MoreCOVID-19 recession declared shortest on record

The National Bureau of Economic Research (NBER) has officially announced that the pandemic-induced recession has ended.

Subscribe To Read MoreSmall business optimism improves

Small businesses became more optimistic last month as the economic recovery continued to gain momentum.

Subscribe To Read MoreInflation surges in June

The core Consumer Price Index (CPI), which excludes volatile food and energy prices, continued to surge in June.

Subscribe To Read MoreServices remains on solid ground

The ISM Services Index fell to a reading of 60.1% in June, still firmly in expansion territory and just 3.9% below its record high from the month before.

Subscribe To Read MoreManufacturing remains red hot

The manufacturing sector stayed soundly in expansion territory in June, as the ISM Manufacturing Index registered a strong reading of 60.6.

Subscribe To Read MoreConsumer confidence rebounds, but…

Consumer Confidence from the Conference Board increased for the fifth consecutive month as pandemic woes continued to fade.

Subscribe To Read MoreLeading inflation indicator points higher

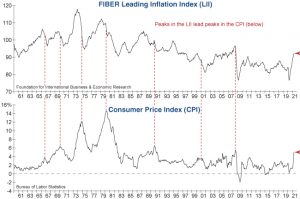

Inflation has emerged with a vengeance in recent months, and the FIBER Leading Inflation Index (LII) suggests that that pricing pressures are continuing to mount.

Subscribe To Read MoreConsumer optimism emerges, yet inflation lurks

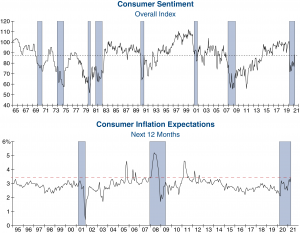

Consumer optimism has been held down by the pandemic over the past year, but attitudes have started to improve as COVID-19 disruptions begin to fade.

Subscribe To Read More