InvesTech Research: A Proven Track Record for Over 40 Years

Based in scenic Whitefish, Montana, InvesTech Research offers a unique “safety-first” conservative investing strategy to our readers located throughout the United States as well as 43 countries around the world. Through our proven proprietary models and objective analysis, InvesTech has over a 40-year history of accurately assessing market risk – telling investors when to be most bullish and when to become cautious.

InvesTech Research is over 2,200 miles away from Wall Street and we see this distance from mainstream financial industries as a core component of our philosophy and objective methodologies. We love our mountain view and are proud to be “Far From the Madding Crowd,” able to offer our newsletter readers the clear, researched, objective market analysis you rely on to inform your investment decisions.

A Philosophy Based on Experience

Formerly a Project Manager for IBM Research with a number of domestic and international patents to his credit, founder and president Jim Stack has a B.S. in Mechanical Engineering, with post-graduate study in business. After launching InvesTech Research in 1979, Jim began national circulation of his investment newsletter, InvesTech Research, in December 1982.

Today, InvesTech Research publishes the InvesTech Research newsletter, which has earned widespread recognition for its time-proven risk allocation and conservative investing strategy, as well as its in-depth analysis of the Federal Reserve.

Meet the InvesTech Research Team

As a Subscriber, You Will Receive:

InvesTech Issues

The monthly InvesTech Research newsletter contains monetary and technical analysis and unique research to aid your investment decisions. Request a FREE SAMPLE!

Market Insights &

Economic Trends

Keep up with timely economic news and data releases and how these may affect your investing.

InvesTech Indicators

Follow InvesTech’s proprietary technical indicators daily to watch for important breakouts or warning flags.

Model Fund Portfolio

Track the current investment allocation and sector recommendations in the InvesTech Research Model Fund Portfolio and access the latest trades as they happen.

Daily Data

Daily access to a wide range of stock market metrics, including market indexes, breadth/volume data, and short-term indicators. Including updates within 45 minutes of market close.

Subscriber Library

Explore our library of Special Reports and past issues on important topics of a timeless and historically significant nature.

Why Subscribe to InvesTech Research?

InvesTech Research is governed by a “Safety-First” investment strategy which is committed to helping you preserve capital, build resilient wealth, and identify tremendous buying opportunities.

- We have a proven track record. For 40 years, we have successfully navigated volatile markets with our “Safety-First” risk allocation and conservative investing strategy, providing valuable insights to our newsletter subscribers. View full Track Record here.

- Over 120 years of data inform our publications. InvesTech has developed one of the largest private databases in the industry including technical, monetary, and macroeconomic data. Through this wealth of market information, we’re able to spot trends and detect patterns that most other research firms miss.

- Time-proven proprietary indicators and tools. We are unique in our ability to analyze both the monetary policy of the Federal Reserve as well as the technical health of the stock market, and what it means for your portfolio.

- InvesTech provides 100% independent, objective analysis. We sell no investment products. We provide fiercely independent research and analysis that you will not get from brokers, mutual fund advisors, and even many investment newsletters.

Kiplinger

Rated Best Source of Investment Advice by Kiplinger Personal Finance Magazine.

Best Stock Market Letter

InvesTech Research, which promises ‘safety-first profits,’ has bested the overall stock market over the long haul with less risk. Publisher James Stack analyzes economic, monetary and market data (some going back more than 100 years) to make market calls and recommend allocations. – Kiplinger Personal Finance

InvesTech Research is Frequently Quoted in the Following:

Visit our In The News to read more.

Become a subscriber today for full access to our latest issues, proprietary indicators, market insights, and other tools. Call our office at (406) 862-7777 (Monday-Friday, 8:30 am-5:00 pm Mountain Time) with any questions. We are here to assist you!

Request a free sample

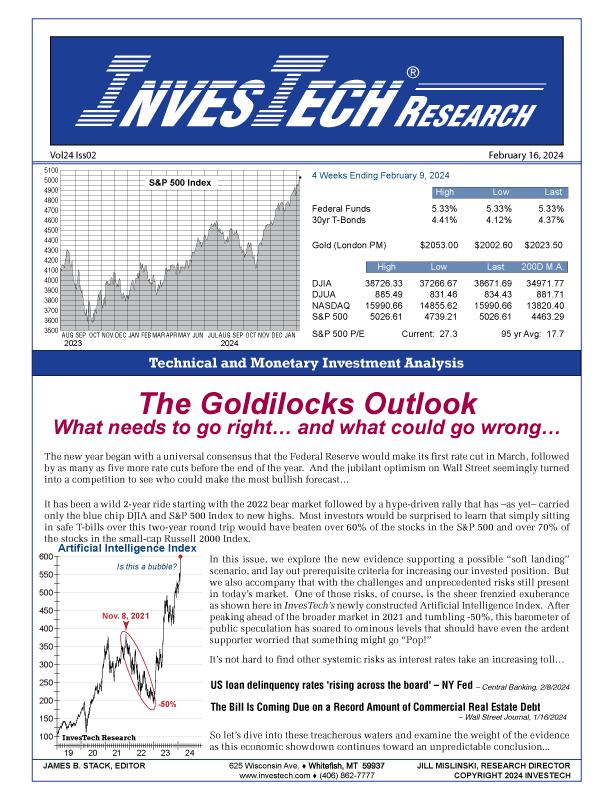

The Goldilocks Outlook

What needs to go right… and what could go wrong…

Eager anticipation of rate cuts from the Federal Reserve and a potential economic soft landing have consumers and investors hopeful. While we watch for continued evidence of this Goldilocks scenario, we also monitor the challenges and unprecedented risks that are still present in today’s market. In this issue, we explore the possibility of Fed success and lay out prerequisite criteria for increasing our invested position.