Read the February Issue of the InvesTech Research Newsletter!

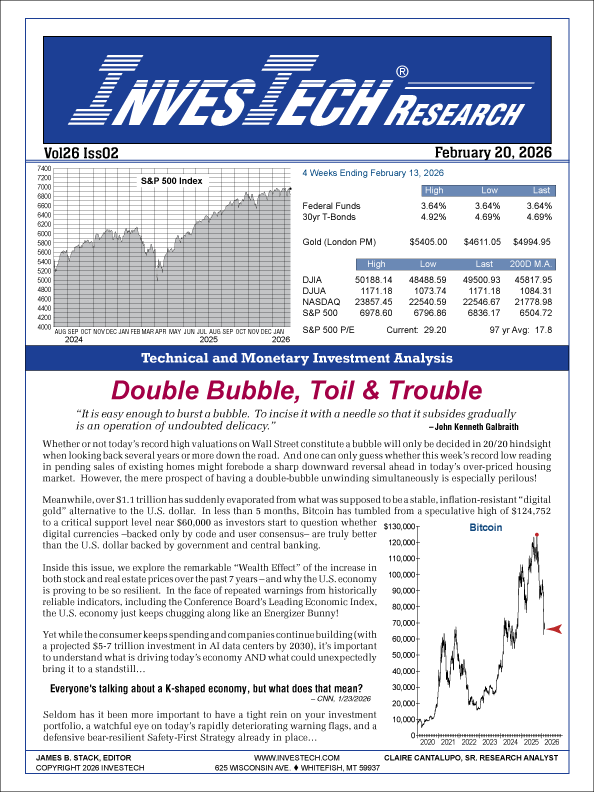

Double Bubble, Toil & Trouble

The U.S. is riding on the “wealth effect” of a K-Shaped economy fueled by a massive $52 trillion increase in stock prices and home values since COVID – compared to just a $1.5 trillion average annual increase in GDP. What does this mean for investors and the stock market outlook as the S&P 500 struggles to stay positive in 2026 and the Mag-7 have already lost more than -10% from their high?

Inside this issue of InvesTech Research, we dive into…

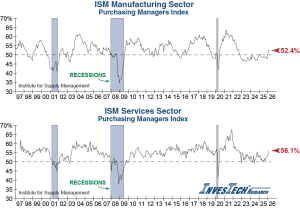

- Why major indicators like the U.S. Leading Economic Index have been wrong.

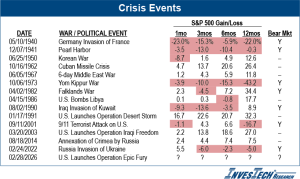

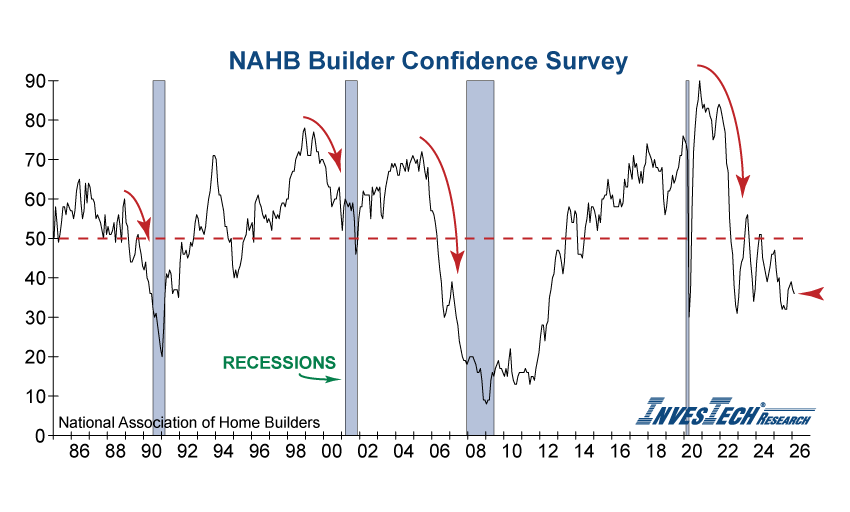

- Where recession warning flags are STILL increasing.

- NEW breakdowns in InvesTech’s AI Index and Gorilla Index.

- And how our Model Fund Portfolio is up +6.4% year-to-date.

You won’t want miss this critical issue. Click below to read!

Exclusive Subscriber Resources & Tools

InvesTech Issues

The monthly InvesTech Research newsletter contains both monetary and technical analysis and unique research.

Market Insights

Keep up with timely economic news and data releases and how these may affect your investing.

InvesTech Hotlines

Updated each Friday to provide a summary of the week’s important data releases, technical updates, and any changes to the Model Fund Portfolio.

Model Fund Portfolio

View the current investment allocation in our Model Fund Portfolio and access the latest trades as they happen.

InvesTech Indicators

Follow InvesTech’s proprietary technical indicators daily to watch for important breakouts or warning flags.

Daily Data

Daily access to a wide range of stock market metrics, including market indexes, breadth/volume data, and short-term indicators.

Recent Market Insights

InvesTech Research: A Proven Track Record for Over 40 Years

InvesTech Research offers a unique “safety-first” investing strategy to our readers located throughout the United States and 43 countries around the world. We use proven proprietary models and objective analysis to provide clear, researched market analysis you can rely on.

Kiplinger

Rated Best Source of Investment Advice by Kiplinger Personal Finance Magazine.

Best Stock Market Letter

InvesTech Research, which promises ‘safety-first profits,’ has bested the overall stock market over the long haul with less risk. Publisher James Stack analyzes economic, monetary and market data (some going back more than 100 years) to make market calls and recommend allocations.

InvesTech Research is frequently quoted in the following:

Visit our In The News to read more.