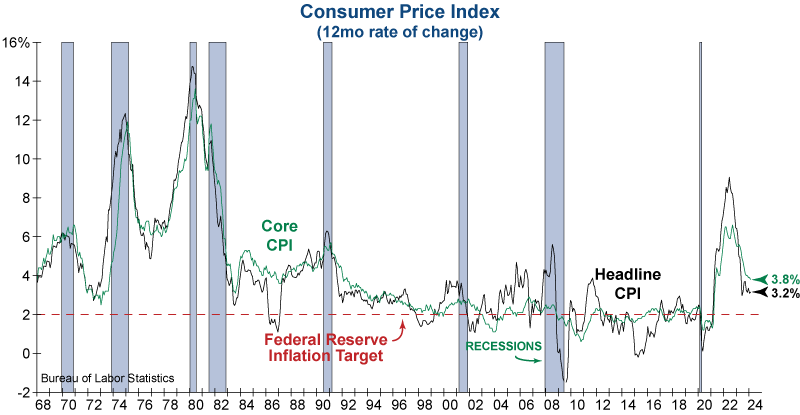

This morning’s Headline CPI print came in hotter than expected, going from 3.1% to 3.2% year-over-year (YoY) while Core CPI ticked down from 3.9% to 3.8% YoY but was still higher than consensus. On a month-over-month basis (MoM), both Headline and Core CPI were up 0.4%, with shelter and gasoline contributing most to the increase for Headline. Interestingly, headline CPI minus shelter was up 0.5% MoM, indicating the monthly increase was fairly broad-based.

While both Headline and Core CPI have fallen from their highs in 2022, the slowing of inflation has not matched the rapid acceleration seen following the pandemic. Even with the more transitory aspects of inflation related to supply chain dysfunction having fully resolved, the Fed’s battle to rein in inflation is proving difficult and is not yet over.

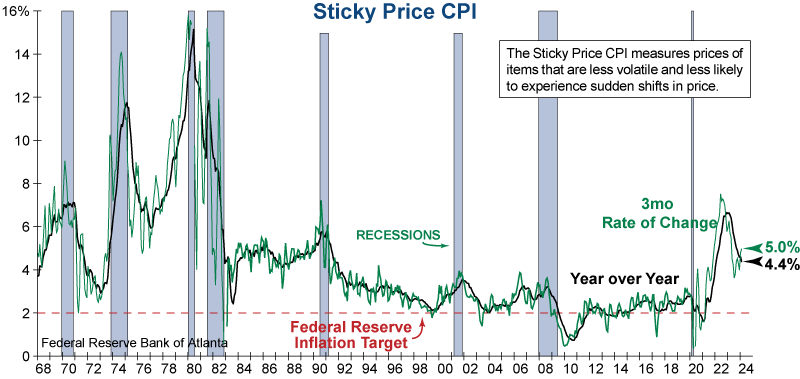

Another measure of inflation we track frequently was released this morning as well – Sticky CPI from the Federal Reserve Bank of Atlanta. Sticky CPI, which measures a weighted basket of items that change in price relatively slowly, increased 4.4% in February YoY. When looking at the 3-month annualized value, it has jumped from 4% to 5% to start 2024, illustrating the recent underlying increases in inflation pressures. If inflation continues to prove stickier than expected, the Fed will likely hold rates higher for longer and push their plans to cut even further out.