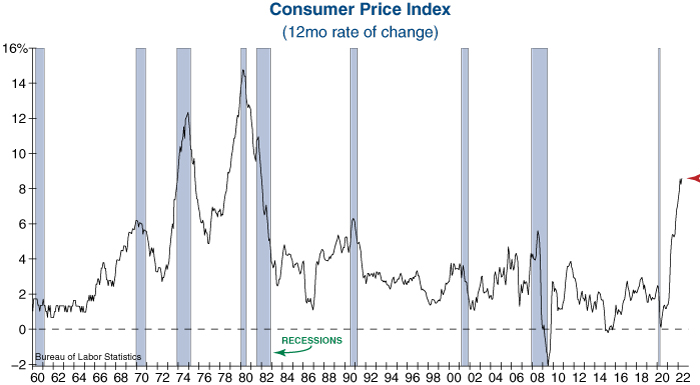

The Consumer Price Index (CPI) jumped to a four-decade high of 8.6% in May, catching economists off-guard as they expected a decline to 8.2%. While rising energy prices contributed to last month’s rise in inflation, most other items continued to increase as well, showing that inflation pressures have remained persistent. One factor keeping CPI at a stubbornly high level is Owners’ Equivalent Rent (OER) which measures housing costs and is the single largest component of CPI with a 24% weighting. Last year we warned that soaring housing prices would lead to an inevitable jump in the OER, and this major component of the CPI has now risen from 2.0% to 5.1% – its highest reading in over 30 years.

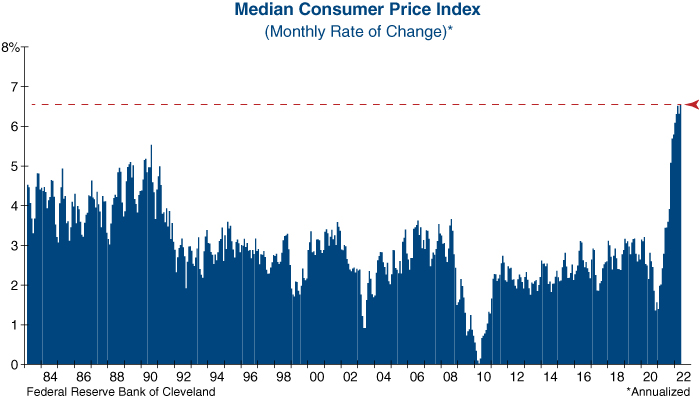

Another way to measure the stickiness of inflation is the Median Consumer Price Index. Tracked by the Cleveland Federal Reserve, the Median CPI is a useful gauge of the broadness of underlying inflation pressures, as it is not skewed by large components or extreme moves in a handful of items. Last month’s Median CPI reading hit the highest level since its data set began in 1983 (see graph below), further highlighting that inflation pressures have become firmly entrenched.

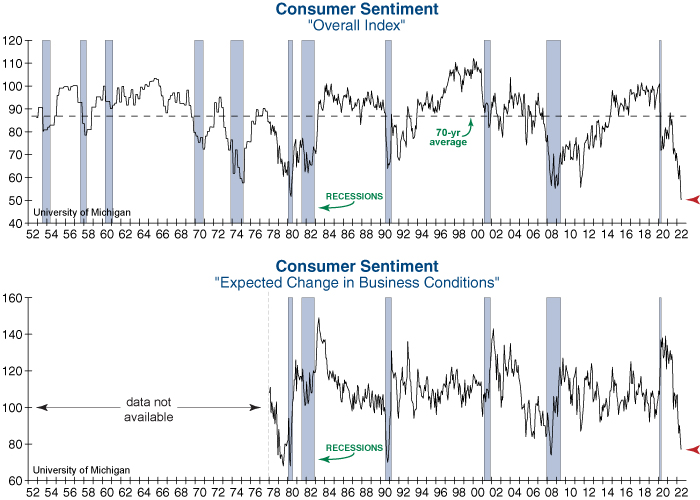

While the jump in CPI was unexpected, the plunge in Consumer Sentiment to the worst reading in its 70-yr history was even more shocking. Inflation has played a big part in Consumer Sentiment’s downward spiral, but a fearful economic outlook has contributed significantly to the decline: As shown in the bottom graph below, the Expected Change in Business Conditions for the year ahead has plunged to one of the lowest levels since the depths of the 2008 Financial Crisis!

The combination of these reports means that the Federal Reserve will have to aggressively tighten monetary policy even as consumers are feeling extremely downtrodden, which significantly increase the risk of an economic hard landing ahead.