Inflation dominated the headlines this week as recent reports show a resumption of inflationary pressures. The Consumer Price Index (CPI) surprised to the upside at 3.7% on a year-over-year (YoY) basis, its second consecutive increase. While rising gas prices were partially responsible for the CPI’s jump, other measures indicate that inflation is rebounding across a broad range of industries.

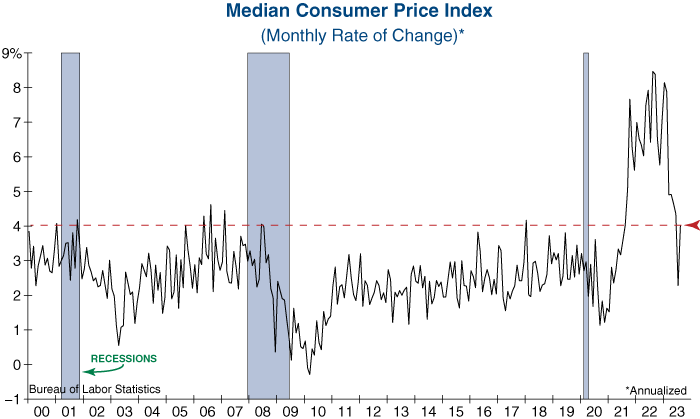

Perhaps the most concerning inflationary development is the surge in the Median Consumer Price Index. The Median CPI is a useful tool for gauging the broadness of underlying pricing pressures, as it is not skewed by heavily weighted items or outliers. While this indicator has declined rapidly over the past year, it suddenly rebounded last month. If this measure remains at its current level, it will confirm that this inflationary episode is far from over.

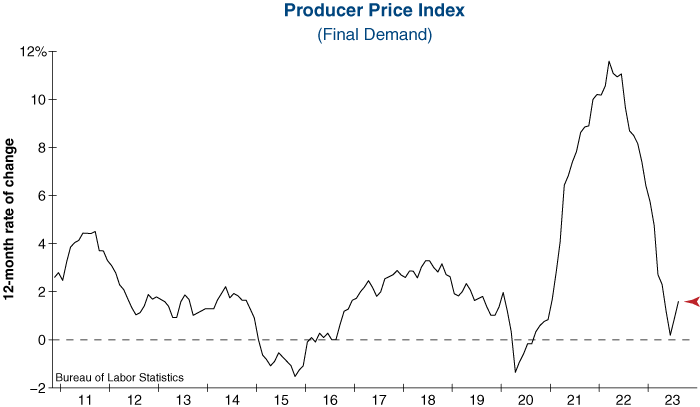

The Producer Price Index (PPI) for Final Demand also surprised to the upside in its latest report. The PPI is a measure of wholesale inflation and tracks many key input costs for businesses. After nearly falling into negative territory on a year-over-year basis, the PPI has moved higher for the past two months. This rebound has been driven by surging goods prices and helped by services inflation stabilizing above 2%. Rising input costs will likely impact future earnings, as corporations have become less able to pass on cost increases to their customers.

Price plans of small businesses also remain stubbornly high. As reported by the National Federation of Independent Business (NFIB), a net 30% of small businesses are planning to raise prices over the next three months. This is a historically high reading and suggests that inflationary pressures have not adequately subsided on Main Street. Small business price plans have been a good leading indicator of inflation over the past few years and are worth paying close attention to in the months ahead.

We expected that inflation would come down over the past year, however we also expected that sticky pricing pressures would keep inflation uncomfortably elevated above the Federal Reserve’s 2% target rate. While the CPI has declined from 9% to about 4%, the move from 4% to 2% is proving to be more difficult.

At the July FOMC meeting Chairman Powell indicated that the Fed intended to be data dependent heading into the September meeting (no August meeting). Since then, inflation data has accelerated for two straight months. Given this, we think the possibility of further rate hikes this year cannot be ruled out, and the Fed will need to keep interest rates “higher for longer” in their bid to restore price stability.