The Institute for Supply Management (ISM) Services report, released on the third business day of each month for the previous month, surveys purchasing and supply executives around the country in over 20 service industries like legal services, entertainment, real estate, professional, and finance & insurance. Levels above 50 indicate expansion while below 50 imply contraction. The index includes the following components: Business Activity, New Orders, Employment, Supplier Deliveries, Inventories, Prices Paid, Backlog of Orders, New Export Orders, Imports, and Inventory Sentiment.

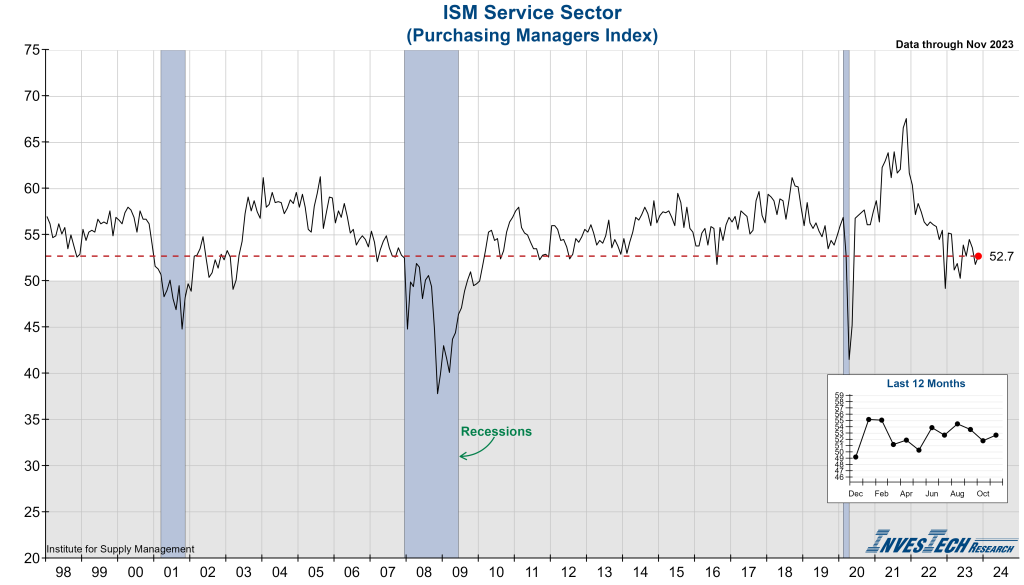

The latest ISM Services Index for November came in at 52.7%, slightly above expectations and 0.9 percentage points above the October reading of 51.8%. The ISM Services Index now sits at the mid-point of this year’s readings, which have ranged from 50.3 to 55.2

Overall, the index grew (defined as over a value of 50.0), and at a slightly faster pace. Fifteen of eighteen industries reported growth in November while three contracted (<50.0). The three industries that saw decreases include: Information; Mining; and Professional, Scientific & Technical Services.

Of the ten components of the index, six increased, three decreased, and one was unchanged. The three components which decreased were Imports, Prices, and Backlog of Orders. The important New Orders component was unchanged at an expansionary reading of 55.5.

Here is an excerpt from today’s report (emphasis ours):

“The services sector had a slight uptick in growth in November, attributed to the increase in business activity and slight employment growth. Respondents’ comments vary by both company and industry. There is continuing concern about inflation, interest rates and geopolitical events. Rising labor costs and labor constraints remain employment-related challenges.”

– Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee

Here are a few interesting excerpts from survey respondents:

“Customers are conservative in spending, so competition to maintain market share is tight.” [Management of Companies & Support Services]

“Candidate expectations during the hiring process have made staffing up more difficult.” [Retail Trade]

“There are fewer new projects in comparison to last month and November 2022. Customers are not requesting quotes for new services.” [Information]