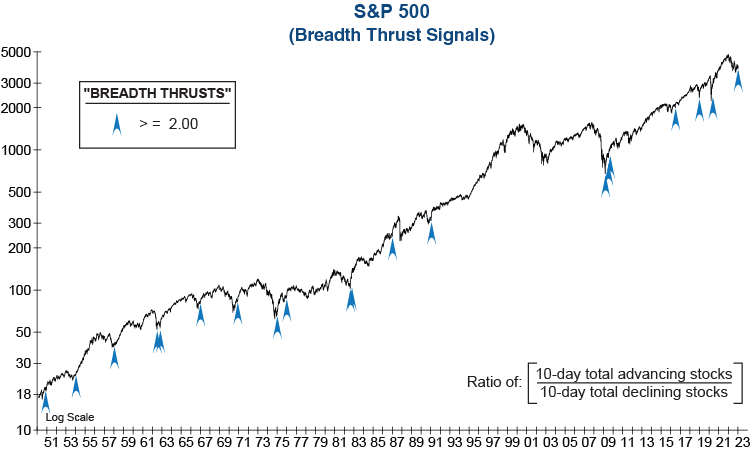

The early warning from our technical indicators over a year ago, followed by their guidance throughout the year, helped us to sidestep the majority of bear market losses in 2022. As we enter 2023, we have a new development with the emergence of a bullish Breadth Thrust that could signal a bear market rally (or a potential new bull market – although color us skeptical on that for now).

While there are differing technical interpretations for what constitutes a “breadth thrust,” our historical research has led us to define it as any time the 10-day total of advancing stocks on the NYSE exceeds declining stocks by a ratio of 2.0 or greater. In general, it shows broad, strengthening participation in the equity market.

As shown below, returns following these signals have historically been quite strong. Using a “weight of the evidence” approach this development deserves careful consideration, even as other technical and leading macroeconomic data remains negative.