The Producer Price Index for Final Demand (PPI FD) is yet another inflation indicator from the Federal Government, but instead of focusing on the consumer, it measures the average change over time in prices received by producers for domestically produced goods, services, and construction. In other words, PPI measures price changes from the perspective of the seller, whereas CPI measures changes from the perspective of the consumer.

PPI FD represents the final stage of production and is important for investors as it’s a reflection on company profit margins.

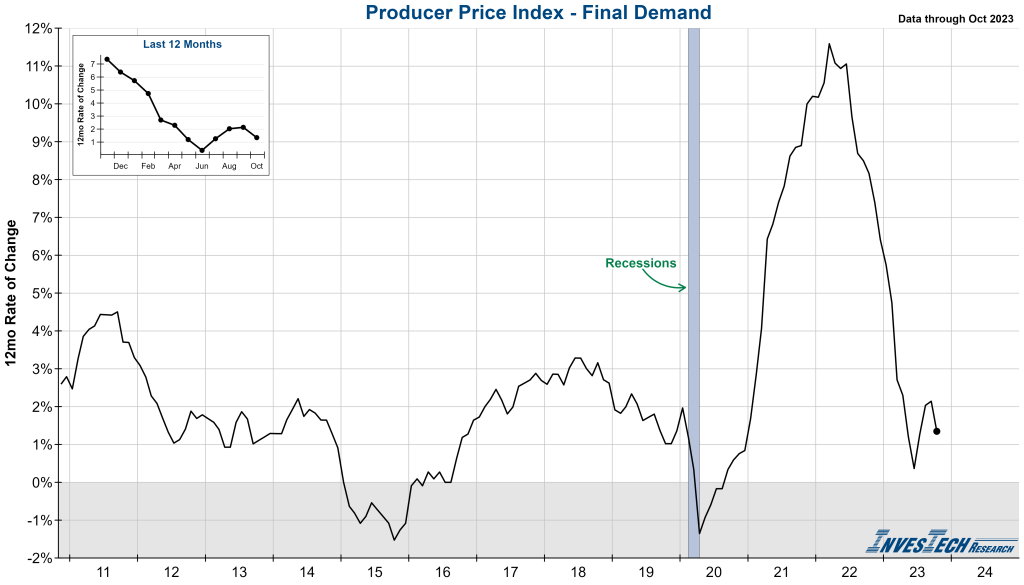

The latest Headline PPI FD for October came in at -0.5% month-over-month (MoM), down significantly from 0.4% in September. PPI is up 1.3% on a year-over-year (YoY) basis, its first deceleration in four months.

Core PPI FD –which excludes food, energy, and trade services– was unchanged MoM and up 2.4% YoY in October. Both of these measures were lower than expected.

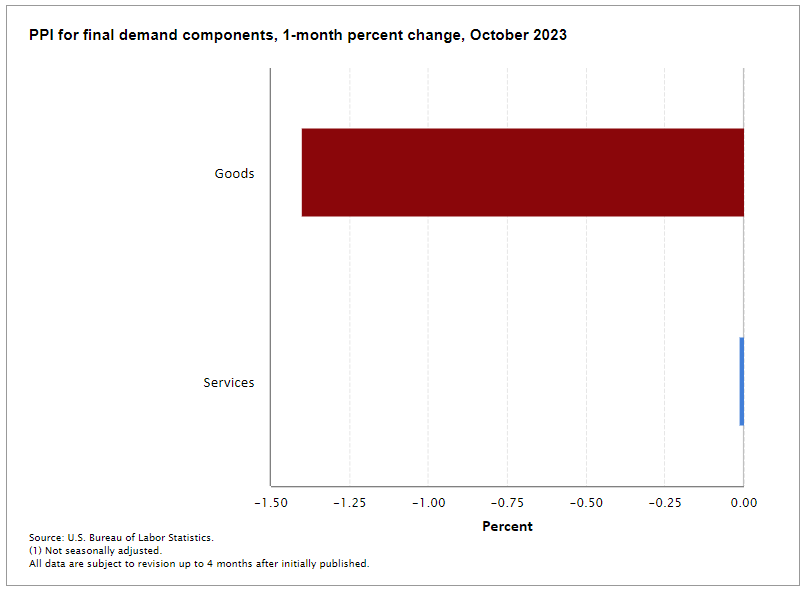

Headline PPI FD is made up of both Goods and Services. The Goods component was down -1.4% and the Services component was unchanged on a MoM basis in October. The majority of the decline in goods came from a -6.5% drop in energy prices.

While the PPI had previously reaccelerated for three straight months on a YoY basis, falling crude oil prices kept the producer prices inflation in check last month. Price pressures eased to a lesser degree in other areas as well, as food prices fell and services inflation was the weakest in seven months. This will be a key indicator to watch as all eyes remain on the Federal Reserve and their fight to restore price stability.