The S&P CoreLogic Case-Shiller Home Price Index (HPI) claims to be a leading measure of U.S. home prices by using a more precise calculation than other home price measures of home price changes over time. What makes the S&P/Case-Shiller HPI stand out is its repeat sales method and creation of sales pairs – i.e. “When a home is resold, months or years later, the new sale price is matched to its first sale price.” It also weights the sales pairs to control for quality change in the measured homes and uses a three-month moving average. The report has a two-month lag.

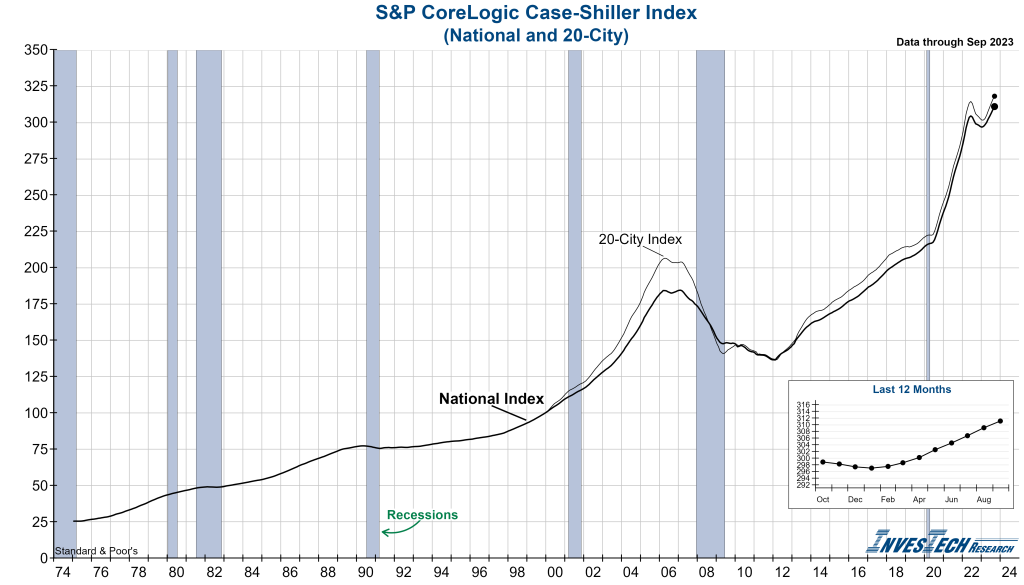

The latest S&P CoreLogic Case-Shiller National Home Price Index (not seasonally adjusted – NSA) for September saw a 3.9% increase year-over-year (YoY), up from a 2.5% YoY change the previous month. 10- and 20-city Indexes both saw increases YoY. All three indexes are at their non-inflation adjusted record highs. On an NSA month-over-month basis (MoM), all three indexes were up 0.3% from September. The top three performing cities in September on a YoY-basis were Detroit, San Diego, and New York, while the three worst performers were Las Vegas, Phoenix, and Portland.

Home prices have continued to rise due to the severe lack of inventory despite decades-high mortgage rates. These trends will likely continue until housing sales come to a halt and economic conditions (namely employment) deteriorate enough to force meaningful price reductions. As of last month, all-cash sales made up almost 30% of transactions in existing home sales.

Here’s an excerpt from S&P Global’s latest press release:

“On a year-to-date basis, the National Composite has risen 6.1%, which is well above the median full calendar year increase in more than 35 years of data. Although this year’s increase in mortgage rates has surely suppressed the quantity of homes sold, the relative shortage of inventory for sale has been a solid support for prices. Unless higher rates or exogenous events lead to general economic weakness, the breadth and strength of this month’s report are consistent with an optimistic view of future results.”

Interested in reading more? Access a select few publicly available Market Insights here.