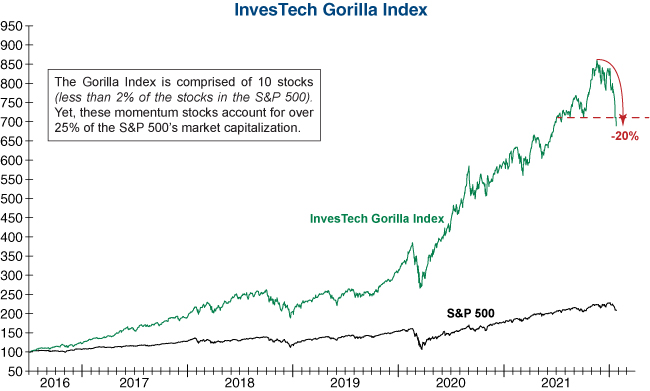

During the final years of the 1990s Tech Bubble, we observed an interesting dynamic where a relatively small number of mega-cap stocks became responsible for the majority of the stock market’s advance. Recognizing the importance of this extreme, we tracked 17 of these dominant stocks in our original Gorilla Index, which accounted for over 25% of the S&P 500’s market capitalization at that time. This original Gorilla Index proved to be an important technical tool, as its breakdown signaled a sequential loss of confidence that was permeating the broader market during the unwinding of the Tech Bubble.

Following the rebound out of the COVID-19 Crash, we created the InvesTech Gorilla Index 2.0 to track what we once again recognized as an extremely narrow basket of mega-cap momentum stocks which had become a disproportionately large percentage of the S&P 500. Today’s Gorilla Index contains only ten stocks but accounts for an even greater share of the S&P 500 (28%) than the original. After peaking last November and moving modestly lower over the balance of 2021, our Gorilla Index has accelerated its downward slide to start the year. The Index fell below its technical support level today, indicating that the loss of investor confidence that began in our Canary (in the coal mine) Index is spreading to the broader market. The Gorilla Index is now -20% below its high, and if it does not regain technical support, the S&P 500 will almost assuredly remain under pressure.