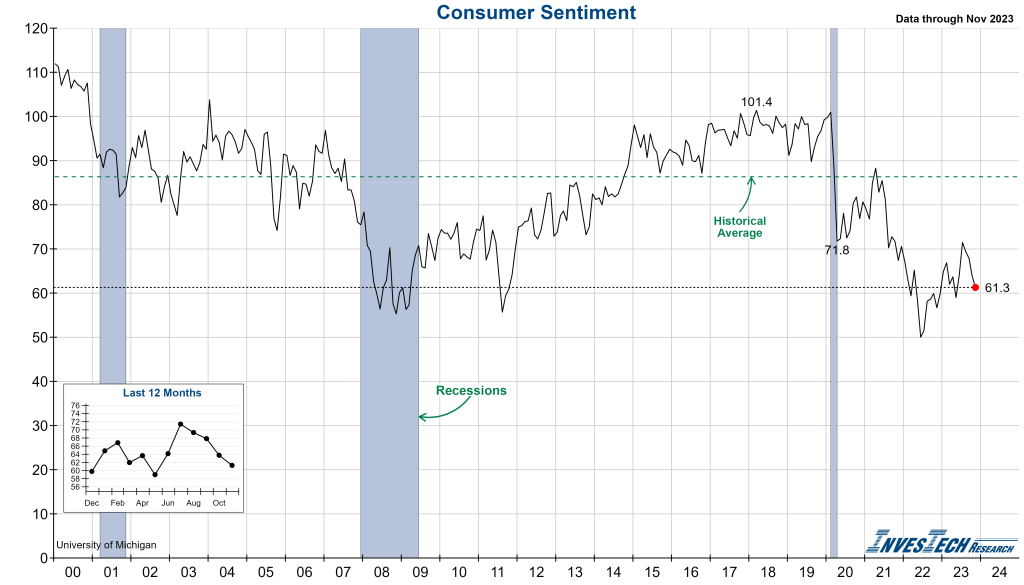

The Consumer Sentiment Index surveys consumers monthly using about 50 questions that track different aspects of their attitudes and expectations around personal finances, business conditions, and buying conditions. In addition to this index, the group also publishes the Index of Consumer Expectations and the Index of Current Economic Conditions.

Published twice a month – one Preliminary and one Final reading – this is an important indicator to watch as consumer attitudes greatly impact consumer spending which makes up over 70% of GDP.

The November Final reading for the Consumer Sentiment Index came in at 61.3, down 3.9% from the October Final reading and its fourth consecutive decline. The Current Economic Conditions figure fell 3.3% to 68.3 and the Index of Consumer Expectations declined by 4.2% to 56.8.

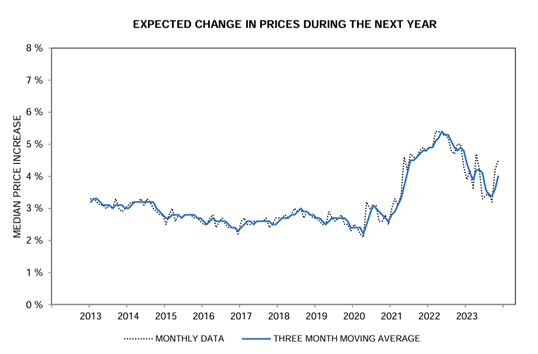

November’s overall decline featured both improving and worsening conditions. Current sentiment and expectations on personal finances improved slightly while expectations of future business conditions deteriorated by 15%. Younger and middle-aged groups saw decreasing confidence in the economy while consumers 55 and older saw improving sentiment. Inflation expectations continue to climb despite improvement in slowing inflation (see graph below).

Here’s an excerpt from the latest report:

Year-ahead inflation expectations rose to 4.5% this month, up from 4.2% in October, reaching its highest reading since April 2023. Long-run inflation expectations rose from 3.0% last month to 3.2% this month, a reading last seen in 2011. These expectations have risen in spite of the fact that consumers have taken note of the continued slowdown in inflation; consumers appear worried that the softening of inflation could reverse in the months and years ahead.