Recent reports from the Conference Board highlight the unique dichotomy investors are experiencing. On the one hand, consumers are becoming more optimistic, while on the other hand leading economic data continues to deteriorate.

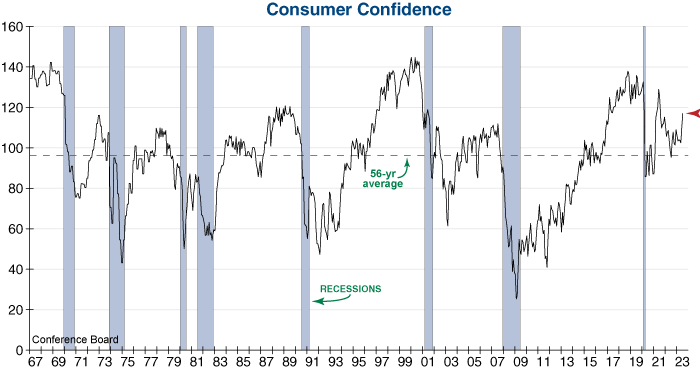

Starting with the positive, the Conference Board reported that Consumer Confidence climbed to a reading of 117.0 this month, far exceeding economist expectations of 111.8. The Present Situation component jumped to a post-pandemic high of 160.0, while the Future Expectations component also improved to its best level since January 2022. Recent optimism has been driven by expectations for lower inflation and for better business conditions over the next six months. Even so, as highlighted in the Economic Trends section of our website, the share of consumers who expect a recession over the next 12 months actually increased from 69.9% to 70.6%.

Despite the improvement in Consumer Confidence, other indicators from the Conference Board paint a more concerning picture. Most notably, the Leading Economic Index (LEI) has continued to solidify its warning flag by falling for the 15th straight month in June. Additionally, the Conference Board’s Employment Trends Index (ETI) reached a new cycle low in its latest reading.

The Employment Trends Index is a composite of eight different leading employment indicators, including job openings, temporary help payrolls, NFIB small business data, jobless claims, and more. The ETI has fallen by more than 4% from its cyclical peak, which historically has indicated that recession has arrived.

Clearly, the weight of the evidence still points to a hard landing ahead for the U.S. economy. The Conference Board has reached a similar conclusion, stating: “Although consumers are less convinced of a recession ahead, we still anticipate one likely before yearend.”