The ABCs of MLPs…

What you don’t know can hurt you.

In this era of ultra-low interest rates, investors are inevitably drawn to investments with attractive yields, and Master Limited Partnerships (MLPs) are among the most popular income-generating investments on the market today. These appear to be safe and secure places to invest as MLPs derive their income from revenue generating properties and infrastructure, but there’s more to the story.

What are Master Limited Partnerships (MLPs)?

As the name states, MLPs are limited partnerships which trade on major exchanges like common stock. They consist of a general partner (a sponsoring company in the same industry, which retains control of the business) and limited partners. When investors buy shares or units of the MLP, they become a limited partner in the business.

As partnerships, MLPs are eligible for special tax treatment and avoid “double taxation.” With common stock, dividends are essentially taxed twice – once at the corporate level before dividends are paid and again at the shareholder level, after the dividend is received. Partnerships –including MLPs– are treated as “pass-through” entities where the income and deductions are passed directly to the partners (investors) who pay the taxes. Thus, MLPs are taxed only once at the investor level.

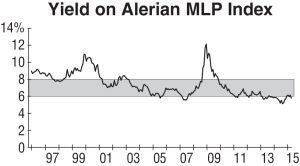

Due to this favorable tax treatment, the level of distribution or yield for MLPs is generally high and can be very attractive to potential investors. One of the primary benchmarks used to track these publicly traded partnerships is the Alerian MLP Index, which includes 50 of the most prominent MLPs. The yield for this Index over the past 20 years is shown in the graph at right. Note that the yield has generally been in the 6-8% range, and has occasionally jumped to over 10%.

With yields like this, it’s no surprise that many investors consider MLPs to be a great source of potential income. But they aren’t as safe as commonly perceived, and there are important facts to consider before making an investment decision…

Fact #1: Sector diversification options are limited.

Today, the majority of MLPs are in the energy sector and most are engaged in energy-related transportation, processing, and storage. This makes sector diversification problematic. Current tax regulations require that a publicly traded partnership must receive 90% of its income from specified sources, most of which pertain to natural resources. Thus, there are only a few MLP options outside of energy, and those are mostly in real estate and finance.

Fact #2: Yields can be high, but distributions are not guaranteed.

Most MLPs manage to maintain distributions even in a weak economy. However, they need to have profits to make payouts. In recent downturns, it’s become apparent that distributions can decline or even disappear altogether. Several 2007 members of the Alerian MLP Index were forced to cut distributions significantly in the last recession (and it’s interesting to note that they have since been dropped from the Index).

Atlas Pipeline Partners LP (symbol: APL) is a prime example of the risk in MLP investing. Over the course of the last recession, the price of APL shares dropped more than 90% and distributions ceased. No distributions were made from May 2009 to November 2010.

Fact #3: MLPs mean more work at tax time.

When you invest in an MLP, you become a limited partner, so the tax picture is more complicated than when you simply own common stock. With stocks, investors pay taxes on dividends received. With MLPs, much of the tax on distribution income is deferred until you sell your shares. Briefly, this is how taxes work with an MLP…

At year-end you receive a “K1” report from the partnership showing your portion of partnership income minus deductions for depreciation, depletion, etc. Due to these offsetting deductions, the net taxable income for the year is usually much less than the distributions paid out. The difference between the distribution and taxable income is treated as “return of capital” and reduces your cost basis. When you sell the shares, you will be required to pay income taxes on the “return of capital” portion, along with any capital gains above your initial investment. Bottom line, MLP investing requires extra work and forms at tax time, and it can lead to delays in filing as you wait for K1s to be issued.

Fact #4: MLPs are generally not suitable investments for IRAs or pension plans.

There are no restrictions on buying MLPs in qualified retirement plans, but they may not be a good investment option. One benefit of owning an MLP is that most taxes are deferred until sale, and that benefit is wasted in a tax deferred IRA. Also, although your retirement plan is tax exempt, it could end up owing taxes on MLP income. The reason is that any tax-exempt entity (like an IRA) that earns income from an outside business is subject to the “Unrelated Business Income Tax” (UBIT) after the first $1,000 of net income. As a partner in an MLP, your retirement plan could be considered to earn this sort of income.

Fact #5: MLPs carry unknown risks.

It’s important to remember that these investments are not like bonds or preferred stocks which have a set par value. The price of MLP shares fluctuates like common stock. MLPs tend to be especially vulnerable to rising interest rates as they face increased competition from other income investments such as bonds or CDs. Higher interest rates also increase the cost of capital used for maintenance or expansion of MLP assets. In addition, economic swings can have a negative impact since most MLPs derive income from oil and gas properties, and utilization of these assets typically declines in a recession.

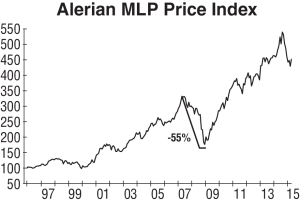

This variability in MLP performance is evident in the Alerian MLP Price Index shown at right. Although this Index has generally moved higher over the past 20 years, it hit a major peak in 2007 and again in 2014. Over the course of the last bear market, this MLP Index dropped more than 55% and it took over three years to surpass the 2007 peak.

The trajectory in this Index is also particularly worrisome. As investors have flocked to these popular investments, this Index has soared and valuations have climbed. Even with the sell-off in energy stocks, the average P/E ratio of the Alerian Index constituents is now 30x compared to an average P/E of 20.7x for the S&P 500.

Also, although MLPs currently enjoy tax favored status, be aware that tax rules can change at the stroke of a legislative pen.

This has happened before. In the early 1980s, the first MLPs were a far more diverse group than they are today. Under the tax laws at the time, firms in a variety of energy and consumer industries were able to take advantage of this tax favored status including restaurants, hotels and cable TV. Even the Boston Celtics traded as an MLP at one time. In 1987 the tax code tightened, and under the new rules many of these partnerships no longer qualified for the tax advantages.

Also, in a more recent example, Canada’s 2006 Tax Fairness Plan implemented a new tax eventually amounting to more than 30% on most Canadian Income Trusts, which are similar tax-advantaged entities. The intention, of course, was to capture more tax revenue and make this form of business less attractive to existing corporations. Keep in mind that the U.S. government is seeking ways to generate more tax revenue right now and MLPs are currently exempt from paying corporate taxes.

Strategy

Though MLPs offer an attractive yield, they do carry risks and can lose value. It’s important to recognize these are not simply safe, dividend paying alternatives to stocks or bonds. The risks in these MLPs are particularly acute today with continued demand for high-yield instruments, volatility in oil prices, and the likelihood of rising interest rates in the future.

At this point in time, we do not view MLPs as a “safety-first” alternative, and advise following these guidelines if investing in MLPs today:

- Limit allocation to no more than 10% of the portfolio.

- Diversify among MLPs so you are not invested in just a single partnership.

- Generally avoid buying MLPs in IRAs or other tax-exempt accounts.

- Do your research, just as you would in selecting stocks. Study the partnership before investing and look for strong financial position (including stability of the general partner) and any hidden liabilities, as well as growth potential.

InvesTech Research Special Report published March 11, 2011 – updated May 27, 2015.

Also available in PDF format