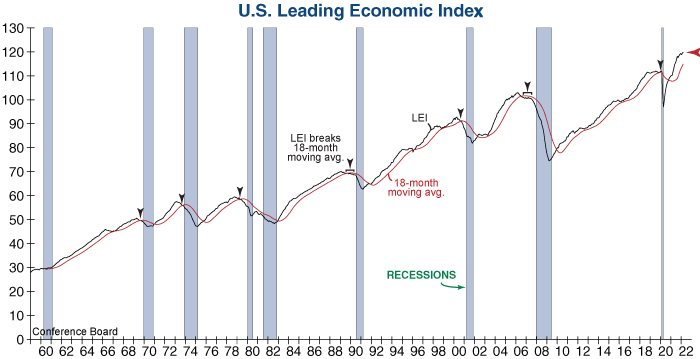

The Conference Board’s Leading Economic Index (LEI) gained 0.3% in March, indicating that economic growth is likely to continue in the months ahead. However, the Conference Board noted that there are significant economic risks on the horizon by stating: “downside risks to the growth outlook remain, associated with intensification of supply chain disruptions and inflation linked to lingering pandemic shutdowns and the war, as well as with tightening monetary policy and persistent labor shortages.”

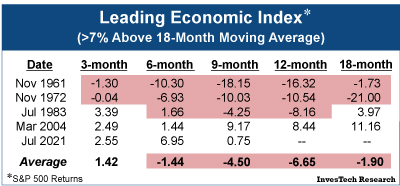

However, the stock market is not the economy, and equity market returns have historically been relatively weak following breakaway LEI readings. The table below shows S&P 500 Index forward returns when the LEI rises more than 7% above its 18-month moving average. This threshold was surpassed in July of last year, and the S&P 500 has gained just +0.75% over the last nine months. So, while the LEI suggests that a recession is not imminent, it is important to remember that when it comes to economic growth there can be too much of a good thing – at least as it pertains to inflation and Fed policy.