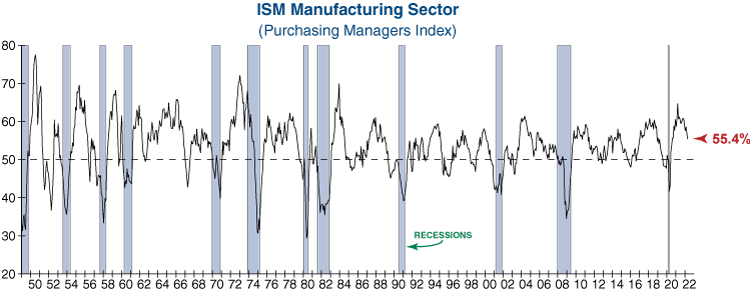

The ISM Manufacturing Index unexpectedly declined in April and has now fallen for five of the last six months. It currently stands at the lowest level since July 2020. Last month’s decline was driven by a confluence of factors as high prices, a lack of qualified labor, and supply-chain disruptions all remain headwinds. While a reading of 55.4% is a historically strong level for the ISM Manufacturing Index, the report clearly reveals signs of stagflation as new orders fall while input prices remain high.

The ISM Services Index also remained at a historically strong level, yet it ticked lower last month and new orders (not shown) fell to a 14-month low. The decline in new orders was due in part to customers starting to balk at higher prices, which will limit the ability of some companies to continue passing on inflationary costs to their customers. This could prove to be problematic, as the Prices Paid Index (bottom chart below) is at the highest level on record. Therefore, unless these stagflationary conditions change in the coming months, companies may be forced to choose between absorbing inflation costs or raising prices at the expense of lower demand.