While many are focused on whether or not the U.S. economy is in a recession after today’s data release showed a second consecutive quarter of negative real GDP growth, what matters for the stock market is what lies ahead. When we turn to the leading economic data, we see growing evidence suggesting that the U.S. economy is headed for further slowdown – indicating a recession may be inevitable regardless of timing.

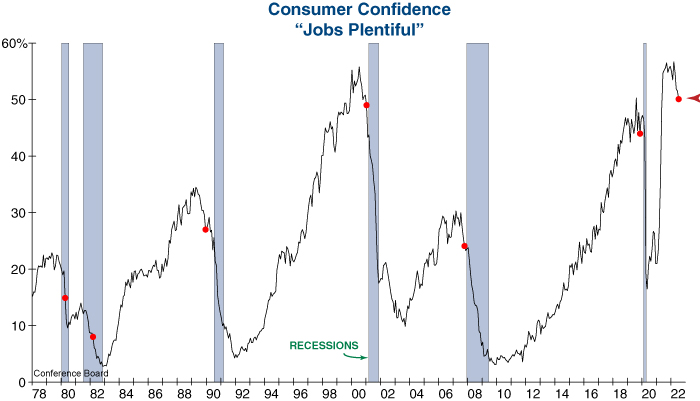

The labor market has been the most resilient part of the economy this year, yet this stronghold is fading fast. The Conference Board’s Consumer Confidence survey recently revealed that the share of consumers that see jobs as “plentiful” fell to 50.1% this month, which is down 6.6% points from its record-high reading of 56.7% reached in March. Historically, each time this measure has dropped by at least six points from a cyclical high, a recession has ensued without fail (red dots on graph).

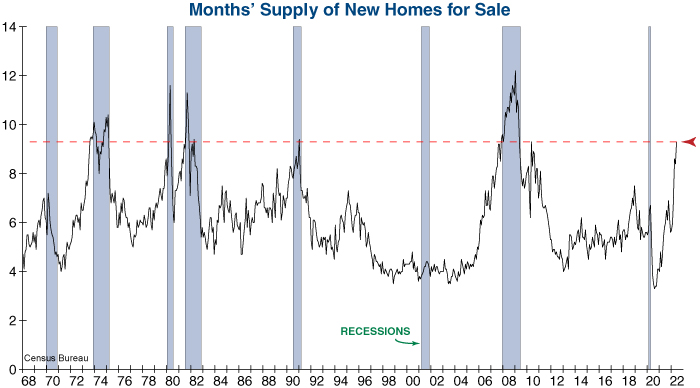

The housing market was also red-hot coming into 2022, but soaring mortgage rates have led to a worrisome reversal in the housing data. Most recently, sales of new homes cratered to the lowest level since the pandemic lockdowns, while the average sales price for new homes fell to $457K versus $569K in April. Additionally, new home inventory continued to pile up builders as struggle to adjust to lower homebuyer demand. As a result, the months’ supply of new homes for sale jumped to a level which has historically been associated with recession, with the lone exception of one month in 2010 (see graph below).

Regardless of whether the first half of 2022 is ultimately declared a recession or not, the data is indicating that the U.S. economy is on a downward trajectory that is likely to get worse before it gets better. This carries significant implications for the stock market and indicates that this remains a high-risk investment environment moving forward.

Eli Petropoulos, CFA – Sr. Market Analyst