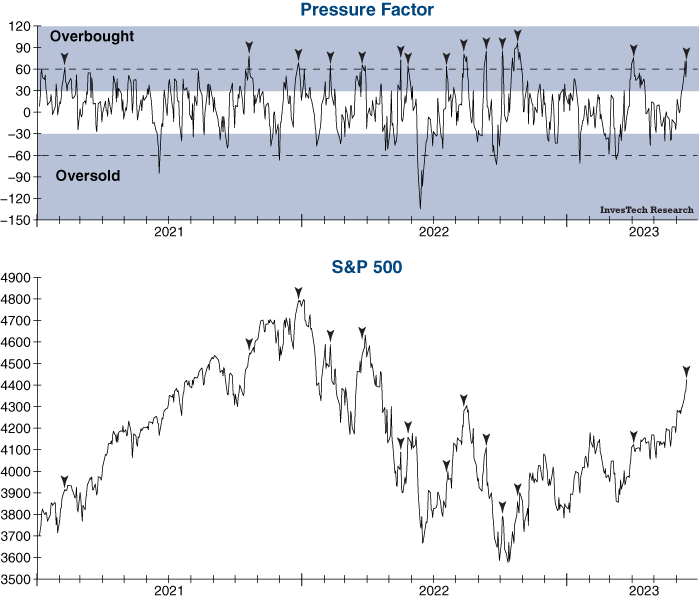

Wall Street has celebrated the S&P 500 reaching “bull market” status by gaining +20% from its October low, however this rally has also led to overbought conditions in the Index. Specifically, our short-term Pressure Factor has surged to an extreme overbought reading of +71. These readings typically precede corrections or consolidations in the market (black arrows on graph below), although the size and duration of these sell-offs varies.

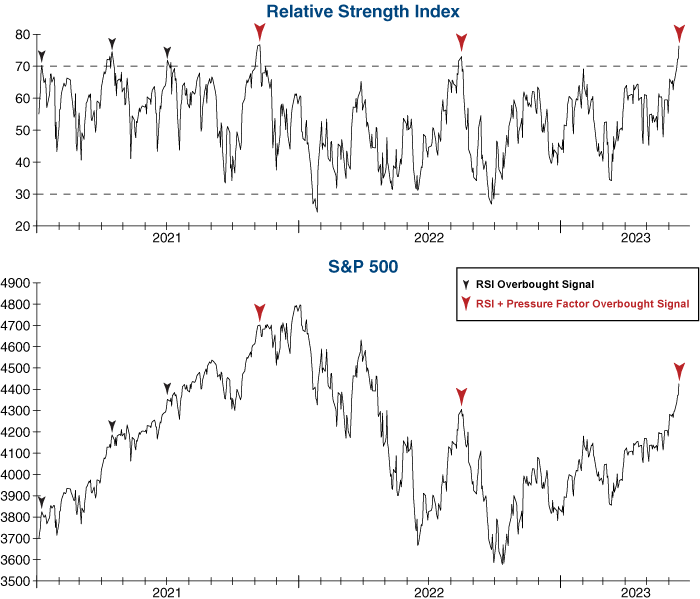

Another indicator which shows that the market has become overbought is the Relative Strength Index (RSI). Today, the RSI is at its highest reading since November 2021 – not long before the start of the 2022 bear market. Equity market corrections that follow overbought RSI readings tend to be most severe when they occur within two weeks of an overbought Pressure Factor reading (red arrows on graph). With both indicators showing overbought readings today, this market rally is due to go through a cooling-off period soon.