In 2020 and 2021, we began to track a number of indicators related to the speculative bubble brewing in the stock market. It did not take long for these indicators to display weakness, and they registered prescient warning signals ahead of the 2022 bear market.

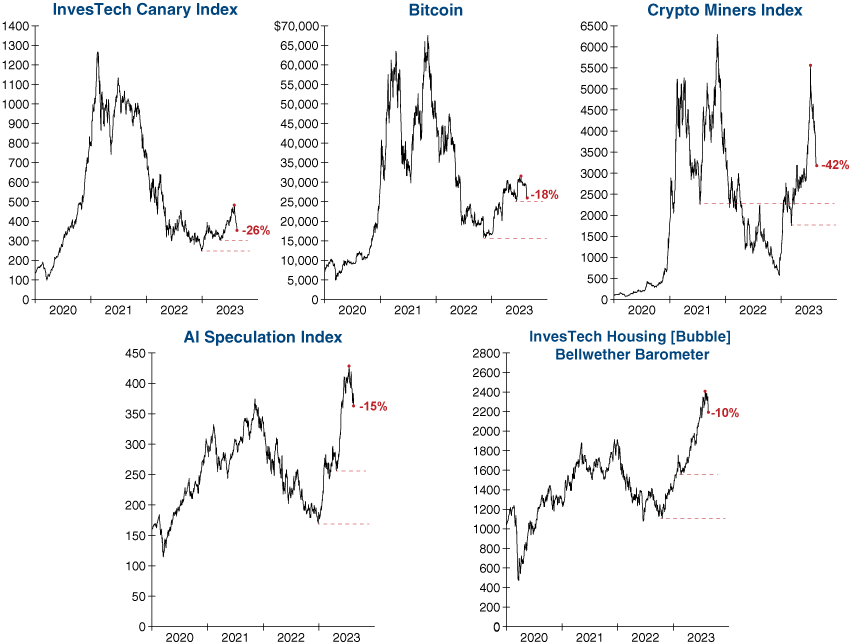

However, beginning in 2023, the fear of missing out (FOMO) returned and many speculative darlings began to rally once again. The most notable rallies have occurred in high-risk areas such as artificial intelligence (AI), cryptocurrencies, homebuilders, our Canary (in the coal mine) Index, and more. This has resembled what is historically known as an ‘echo bubble’ – or a short-lived period of speculation that follows a larger and more extended asset bubble. Yet with most speculative indexes having fallen by double digits in recent weeks (see graphs below), it looks like this echo bubble may already be deflating.

Currently, we are watching for these indexes to break below their major support levels (red lines on graphs) to confirm that the speculative peak is once again in place. This would carry negative implications for the broader stock market, similar to the early warnings given by these high-risk issues prior to the 2022 market top…