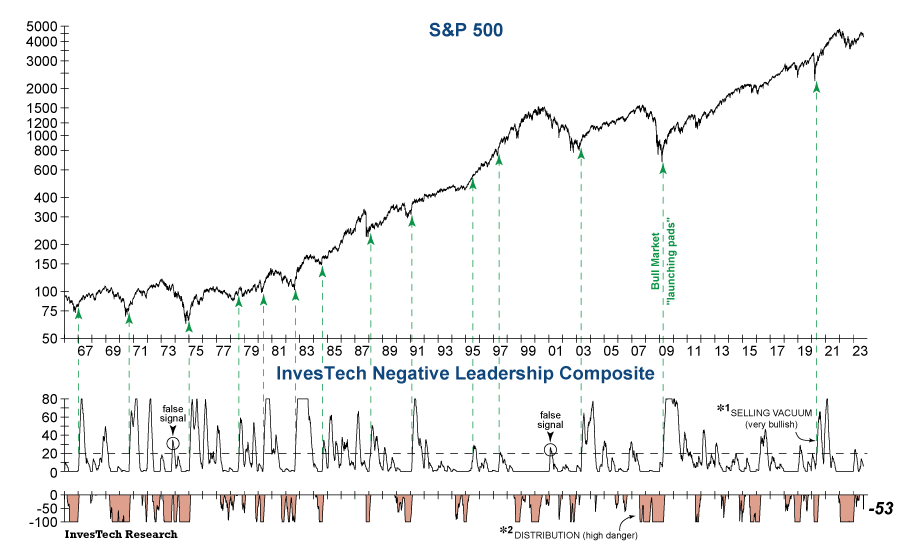

We recently raised concern that bearish Distribution had started to reemerge in our Negative Leadership Composite (NLC). We specifically noted that Distribution would raise a warning flag if it fell below the -50 threshold, which happened today as stock market internals remain notably weak.

When the NLC signals significant Distribution (-50 or below), it’s important to ask three questions:

- How fast is the gauge falling?

- A quicker descent usually indicates more pervasive selling pressure, and Distribution is likely to last longer. This increases the probability of a bear market versus a short-term correction.

- Are there external influences causing Distribution?

- There can be event-driven sell-offs that produce Distribution readings below -50. While this undoubtedly means that the equity market is technically vulnerable, these instances most often tend to result in a correction, and Distribution reverses more quickly.

- How persistent and extreme is Distribution?

- The initial bearish trigger is at -50. However, Distribution that hits -100 and lasts for weeks is a major concern. That’s when investors have reached the “bite-the-bullet” stage and are anxious to sell stocks no matter the cost. When that occurs in concert with other warning flags, it increases the likelihood that we are close to, or have already passed, the final bull market peak.

Today’s signal reached the -50 threshold in only 12 days, which is notably faster than the 21 days that is typically required. Furthermore, due to the many macroeconomic risks present in today’s environment, it is unlikely that Distribution will quickly and easily reverse as you would expect if it were due to a one-time, external event. While Distribution has built up quickly, we are watching for it to drop to -100 to confirm that the bear market has indeed awakened from its slumber.

In light of the worrisome message being sent by our NLC, we have further reduced the invested allocation of the Model Fund Portfolio (see today’s Special Hotline Update for details).