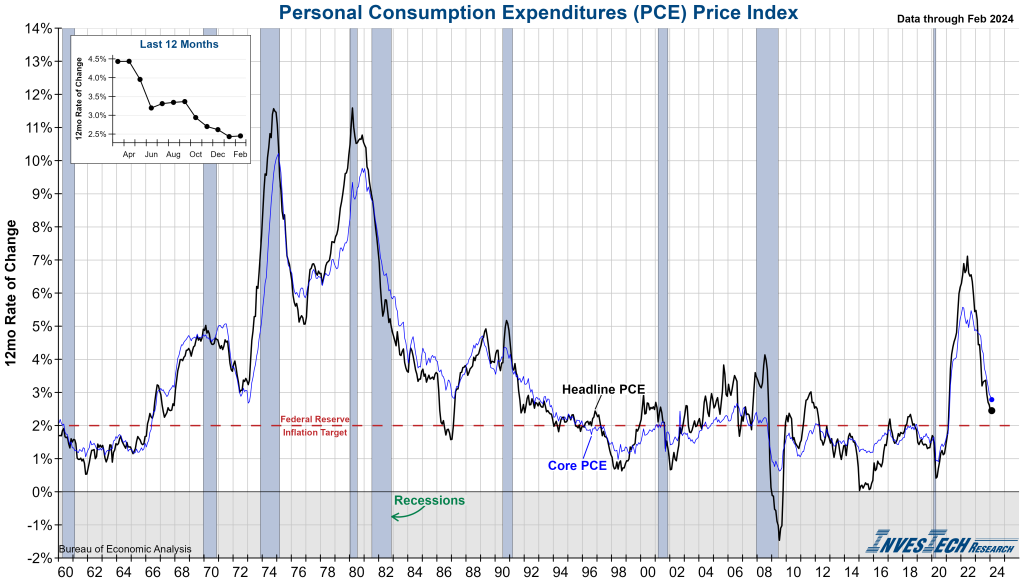

This morning’s Personal Consumption Expenditures (PCE) for the month of February was released and both headline and core came in as expected. Headline PCE ticked up from 2.4% to 2.5% and Core PCE, the Fed’s preferred measure of inflation, came in at 2.8%, which was a slight decline from 2.9% in January but still remains 0.8 percentage points above target.

Other information within the report shed some light on the current health of the consumer. Personal income increased, as did consumer spending, while personal saving as a percentage of disposable income went down. This suggests that consumers are dipping into savings in order to maintain a high level of spending. We question how long this relationship can last as the personal savings rate has fallen to its lowest level in over 14 months and stress is building in consumer debt.

Core PCE continues to fall much more slowly than the Fed would like, and both FOMC Governor Waller and Chairman Powell stressed patience this week with respect to cutting interest rates. The challenge for the Fed is twofold – ensure rates remain high enough to maintain downward pressure on inflation but not wait too long and cause significant harm to the economy. Our view is that in the absence of significantly higher inflation numbers going forward, the Fed’s focus could quickly switch to whether deteriorating employment will raise the odds of a recession.

This leaves the door open to surprises in either direction!