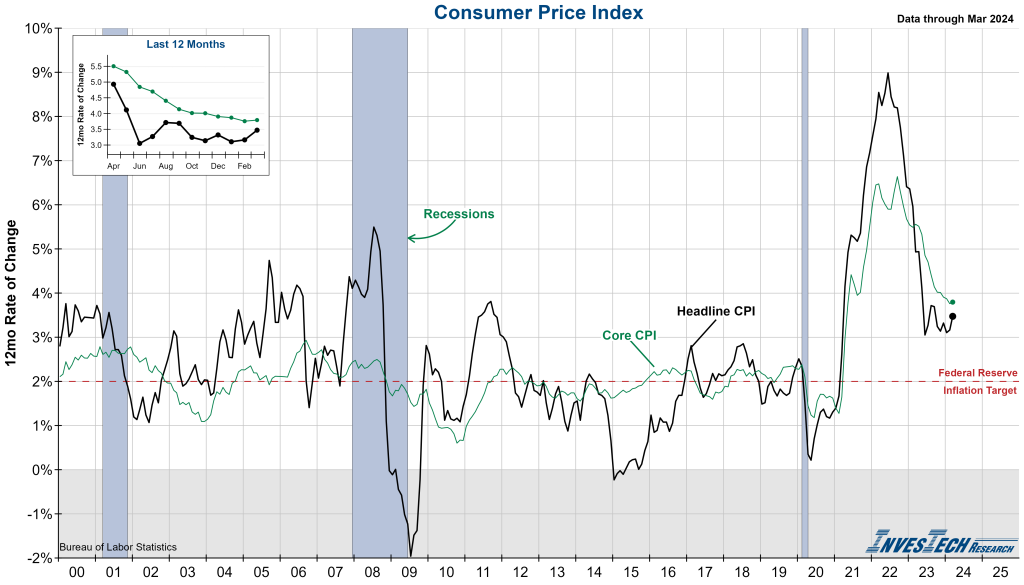

The S&P 500 is experiencing a selloff and long-term bond yields are jumping as investors digest a hotter than expected CPI report. This morning’s CPI report for March came in above expectations and was an increase from the February reading. Headline CPI came in above consensus at 3.5%, up from 3.2% the previous month, while Core CPI remained unchanged at 3.8% and was also higher than forecast.

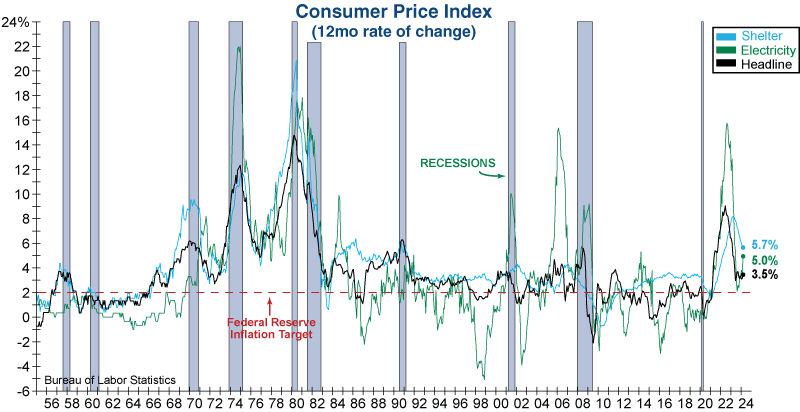

Shelter and gasoline components of the CPI were the greatest contributors to the overall increase, reinforcing current challenges surrounding consumer sentiment and still-rising prices. Record-high home prices and rising energy costs suggest these pressures are unlikely to subside rapidly.

Combined with February’s PCE print, inflation is proving much stickier than many hoped and will likely stall any potential rate cuts in the near term. Wall Street is continuing to price this in, as Fed Funds futures are now suggesting the first rate cut will not come until the September meeting.

The Fed’s battle with inflation isn’t over yet. With a still tight labor market and resurgent energy prices, today’s seemingly strong economy is giving the Fed more headaches than it would prefer.