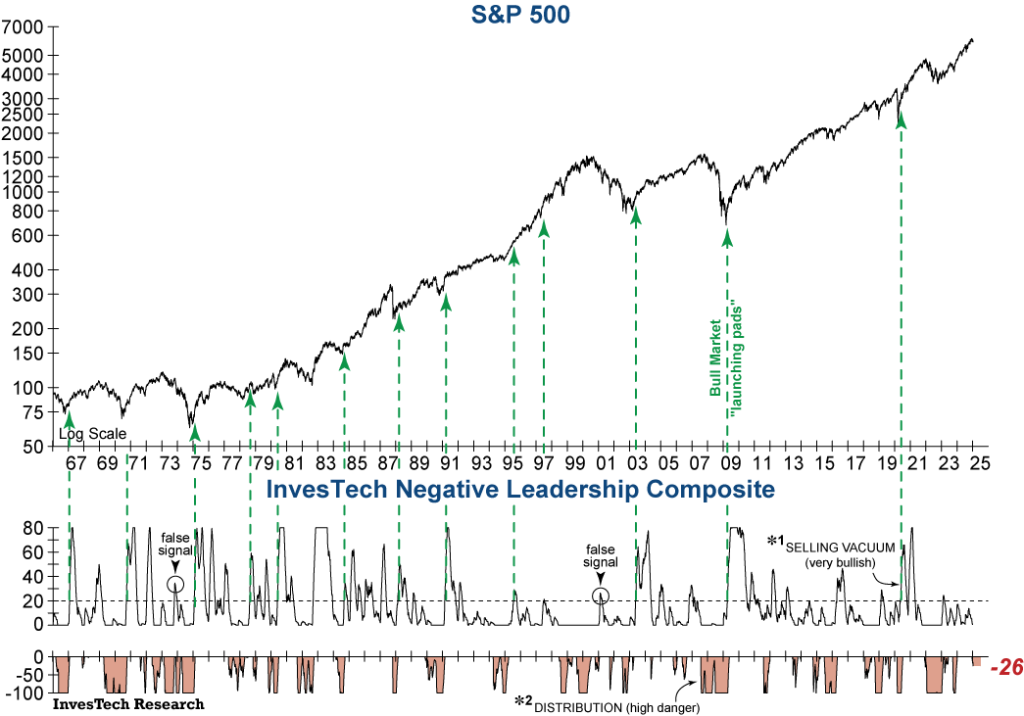

Bearish Distribution in InvesTech’s time-tested key indicator, the Negative Leadership Composite (NLC) has broken through -20. Distribution first emerged on December 20th at -5 and is now at -26. The NLC has steered us toward increased defensiveness in the past by moving decisively through -100 prior to the 1987 Crash, the peak in the 1990s Tech Bubble, the 2007 Financial Crisis, and the latest market peak in January 2022. While -20 is not a definitive bear market confirmation, it warrants caution, and a continued move through -50 and then -100 would be a severe warning flag. Given this early cautionary development, we made an incremental defensive adjustment to the Model Fund Portfolio.

Additional technical warning flags are appearing along with Distribution:

- Our Housing [Bubble] Bellwether has tumbled 26% from its peak and breaking its first support level appears imminent.

- Our Artificial Intelligence Index has fallen over 13% from its peak.

- Our Gorilla Index has started to decline (down 7%) and indicates the big cap momentum stocks could also be headed for trouble.

In our December issue of InvesTech Research, we noted that these “Critical 4” indicators would be important to watch going into 2025, and they are beginning to paint a concerning picture. These indicators will be essential in guiding our path forward over the coming weeks, and additional bearish developments will warrant further defensive measures in the Model Fund Portfolio.