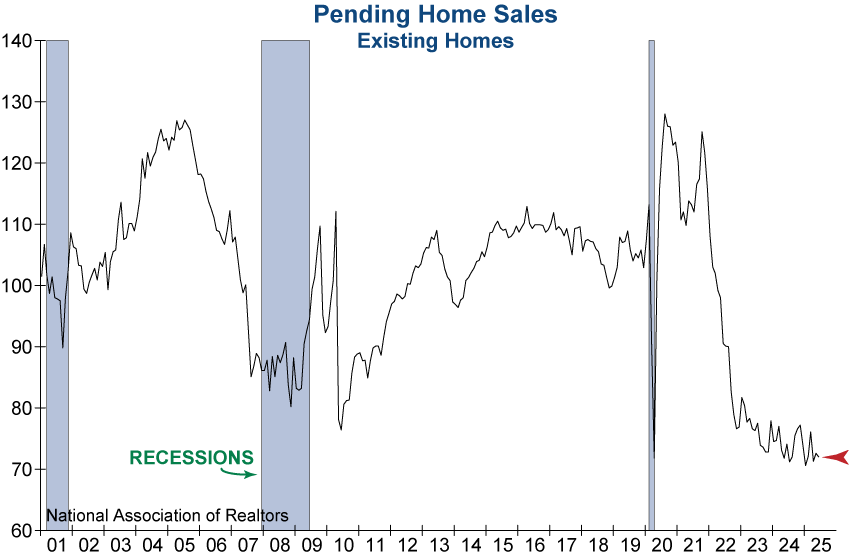

July 30, 2025 Update: Pending Home Sales for existing homes fell in June, dropping -0.8% and down -2.8% from one year ago. With pending sales near all-time lows, this is a concerning sign that the housing market will continue to stall, and actual home sales are not likely to recover in the coming months.

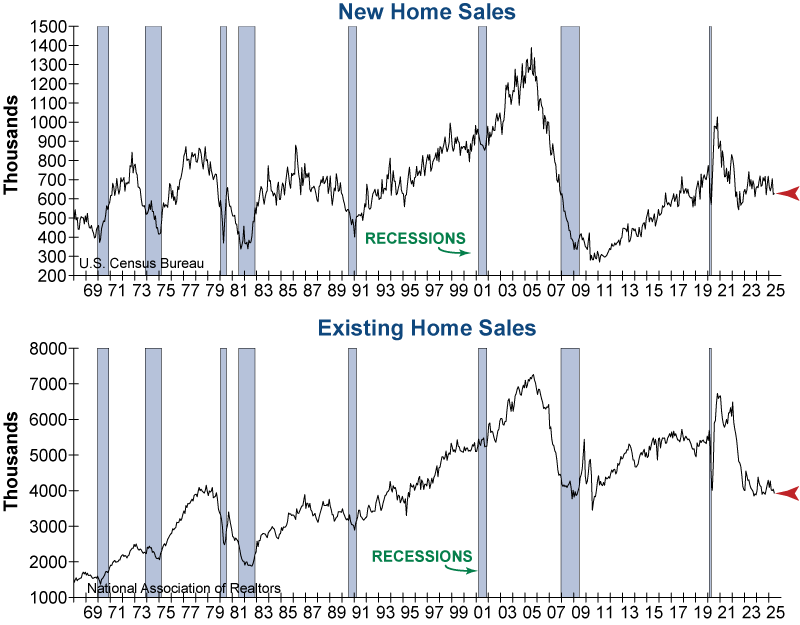

July 24, 2025: Both New and Existing Home sales data came out this week, revealing growing cracks in the housing market. Existing Home Sales fell – 2.7%, while New Home Sales ticked up +0.6%. New Home Sales are near their lowest level in around 3 years, while sales for existing homes are virtually at decade lows.

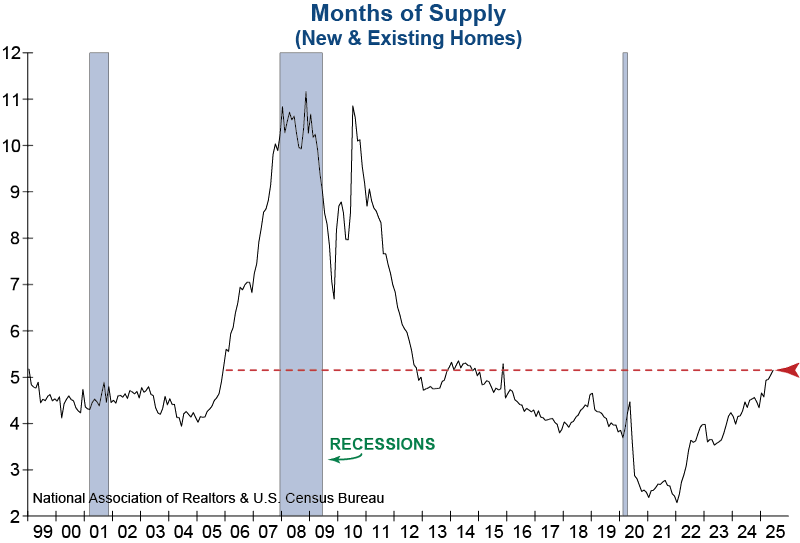

New Home Inventory continued to rise, pushing the months of supply at the current sales rate up to 9.8 – a severely elevated level. This is especially troublesome for the market at a time when homebuilder incentives are widely prominent. In fact, according to the National Association of Home Builders, 38% of builders report cutting prices and 62% use sales incentives.

The months of supply for the entire housing market (new & existing) rose to 5.1 – the same level as when housing prices peaked in 2005… This is especially problematic given the upward trend, with the months of supply nearly doubling in the last 3 years. A rapid increase in months of supply preceded the Great Financial Crisis, and if the current path continues it would be extremely dangerous for today’s housing market.

Rising inventories are already flowing through to price weakness with the Median New Home Price down -12.7% (Seasonally Adjusted) from its high in July 2022 and the Median Existing Home Price down -1.0% (Seasonally Adjusted) from its high in December 2024.

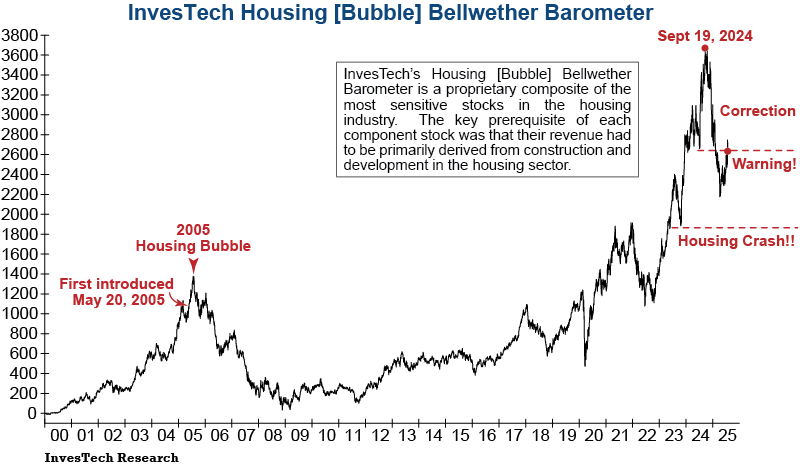

InvesTech’s Housing [Bubble] Bellwether Barometer continues to be a critical tool in assessing the economic wild card. As shown in the graph below, it briefly moved out of warning territory earlier this week in a short (but sizeable) one-day rally. Major single day bounces are not uncommon in this indicator, and they occurred on multiple occasions during the unwinding of the 2005 Housing Bubble. Despite this short-lived bounce, the Housing [Bubble] Bellwether Barometer has already fallen back into warning territory. The prolonged trend of the barometer will be essential in monitoring the housing market over the next few weeks, and the level of risk it brings to the U.S. economy and stock market.