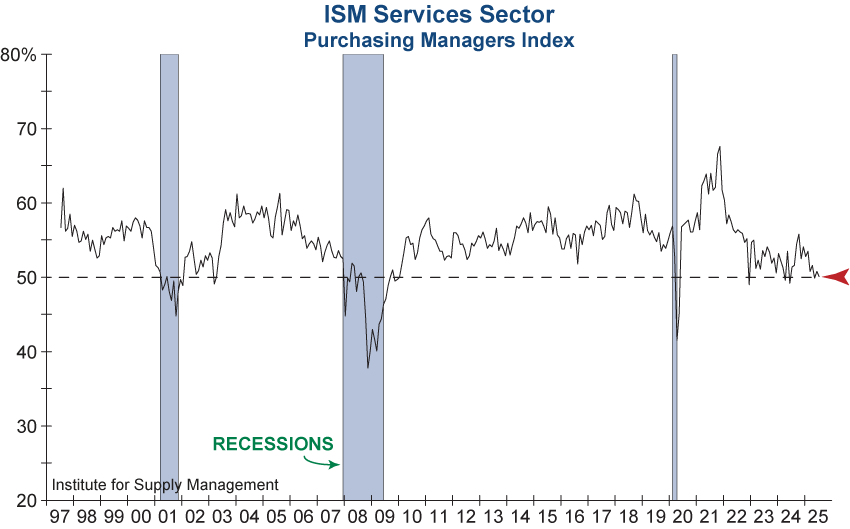

The Service Sector stumbled in July with the Institute for Supply Management (ISM) Services Purchasing Managers Index (PMI) coming in well below expectations at 50.1%. This reading is just slightly above the contraction threshold (<50%) and indicates significantly slowing growth. Services, which makes up approximately 70% of the US economy, has generally been a source of resilience over the past couple of years, making this latest release all the more concerning.

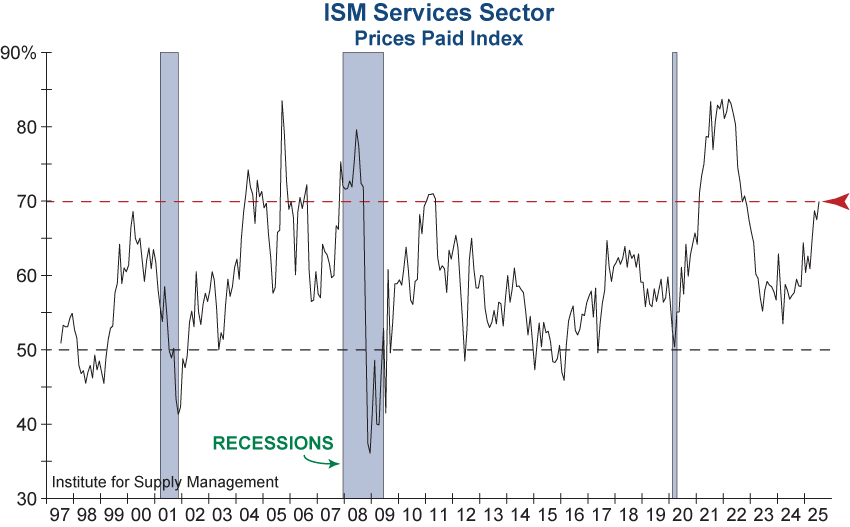

Slowing growth in the Service Sector is problematic for the economy. However, that’s not the only economic red flag that came from this morning’s report. The Prices Paid Index rose to 69.9%, its highest reading since October 2022. This indicates accelerating cost pressures for organizations. If these price increases are passed on to consumers, it would exacerbate today’s stubborn inflation.

The combination of sluggish growth and rapid price increases in the Service Sector is a warning flag that should not be ignored.