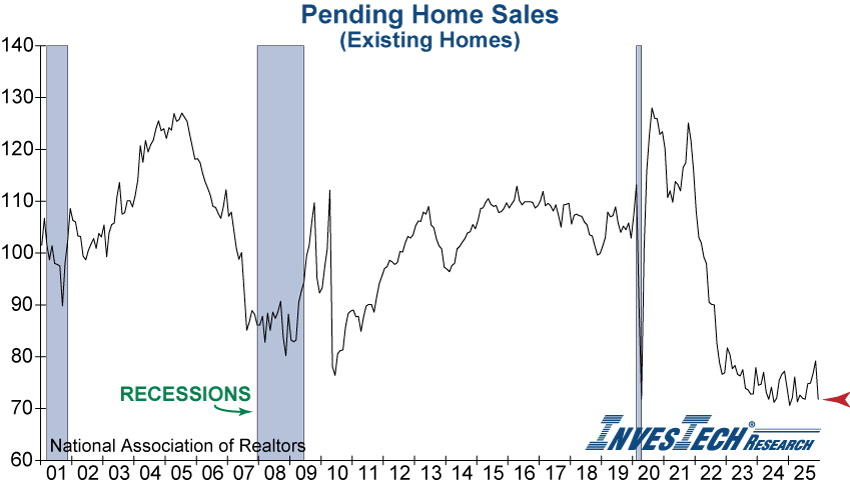

Pending Home Sales tumbled in the latest release, falling to the lowest level in 5 months.

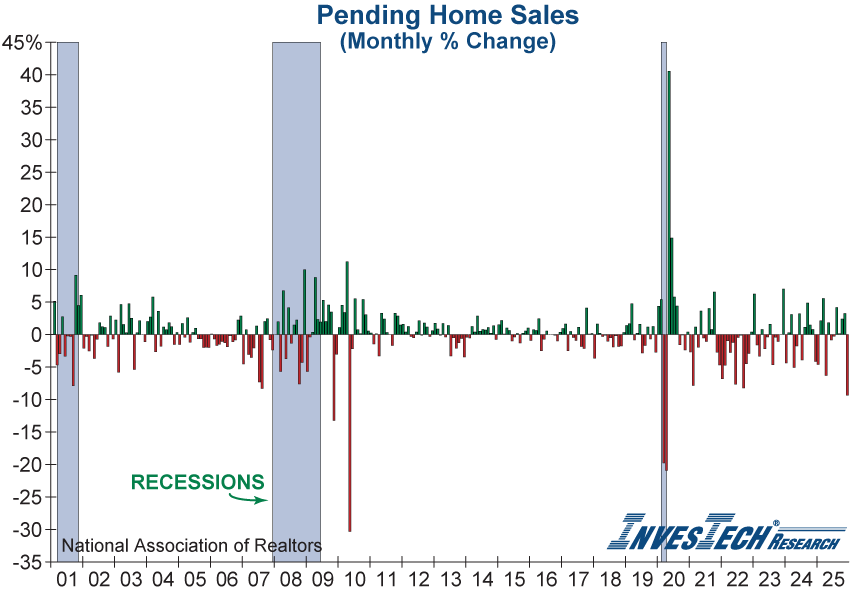

This was the largest one-month drop in the Index since the economy was shut down due to the COVID-19 pandemic in April 2020.

The report was far worse than expected as analysts were anticipating a slight increase. It was especially surprising as the Index had shown signs of recovery in the last few months. This plummet in Pending Home Sales will likely translate into lower sales for existing homes in the early months of 2026.

In addition, the report noted that homes sat on the market for a median of 39 days, up from 36 days the month before. This slowdown is a concerning development depicting a stagnating housing market.

The housing industry is critical to the economy and investor psychology. Should this weakness in Pending Home Sales spread to a larger breakdown in other housing related measures, it could have a significant impact on broader financial markets.