Read the February Issue of the InvesTech Research Newsletter!

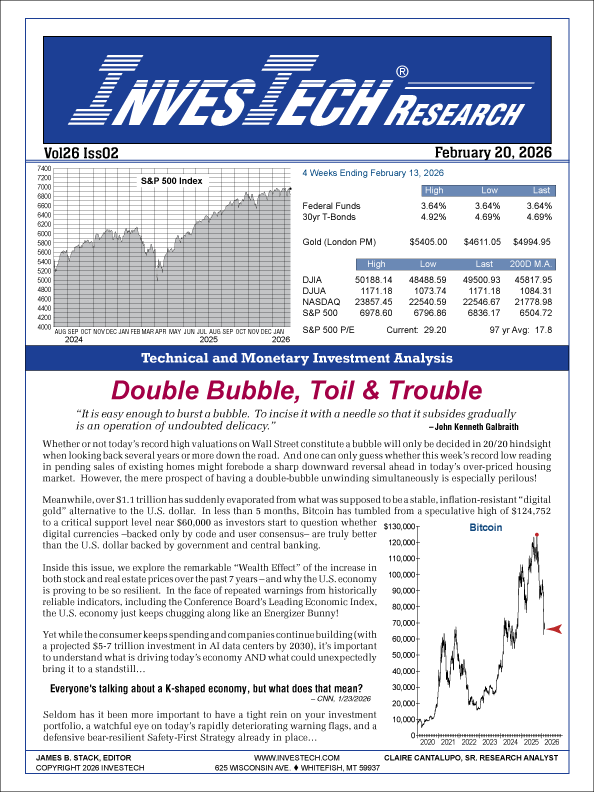

Double Bubble, Toil & Trouble

The U.S. is riding on the “wealth effect” of a K-Shaped economy fueled by a massive $52 trillion increase in stock prices and home values since COVID – compared to just a $1.5 trillion average annual increase in GDP. What does this mean for investors and the stock market outlook as the S&P 500 struggles to stay positive in 2026 and the Mag-7 have already lost more than -10% from their high?

Inside this issue of InvesTech Research, we dive into…

- Why major indicators like the U.S. Leading Economic Index have been wrong.

- Where recession warning flags are STILL increasing.

- NEW breakdowns in InvesTech’s AI Index and Gorilla Index.

- And how our Model Fund Portfolio is up +6.4% year-to-date.

Don’t miss this critical issue of InvesTech Research, fill out the form below to read more!

To receive this issue of the InvesTech Research newsletter FREE, complete the following information. We will email you a link to read the issue immediately; and additionally, you may request a physical copy be sent by U.S. mail.