Managing risk in the final stages of a market cycle

Managing risk in the final stages of a market cycle is vitally important for preserving capital and generating superior long-term investment returns. With a safety-first investment strategy, the first line of defense for protecting assets is to selectively take profits off the table and hold the proceeds in cash. Adjusting stock and sector weightings toward more resilient areas of the market can also fortify a portfolio. When bear market warning flags begin to wave, adding a bear fund can further reduce exposure to downside market movements and lower portfolio volatility.

A bear fund is a mutual fund or exchange-traded fund (ETF) designed to increase in value as the market drops. Conversely, the fund will lose value when the market rises. The original bear market mutual funds have been around since the mid-1990s, and several inverse index ETFs following the same principles were created in the decades that followed. At InvesTech Research, the primary reason for using a bear fund is as an “insurance policy” to offset potential losses in core holdings of the portfolio during market declines. Below are some of the most frequently asked questions –some simple, some more complex– we receive about bear funds.

Why use a bear fund instead of selling positions and raising cash?

Increasing cash in the portfolio is an important part of a defensive strategy, but there are several reasons for maintaining select long positions and partially offsetting them with the “insurance policy” of a bear market fund:

- Diversification: Bear funds allow you to hold onto more stocks in a portfolio, maintaining

greater diversification while counteracting the impact of a stock or sector that doesn’t perform as anticipated. - Lower portfolio volatility: Market volatility usually increases as risks rise. A strategy that manages risk

is inherently less volatile, and by “neutralizing” a portion of the portfolio, volatility is reduced. - Dividends: Dividend payments continue for the positions that are maintained in a portfolio.

- Reduce capital gains tax: In taxable accounts, selling stocks can create sizeable realized gains. Limiting

sales can lessen the tax bite. - Prepare for the next bull market: When risks begin to resolve and the time is right to increase market

allocation, new additions for the portfolio must be properly vetted prior to purchase. In the meantime,

exposure can be quickly increased by removing the bear fund, which “de-neutralizes” a portion of the

portfolio to participate in the market recovery without delay.

What do we mean by a “net” long position?

To demonstrate, let’s look at a hypothetical portfolio (chart at right) that is allocated 60% to long funds (blue), 5% to a bear fund (red), and 35% to cash or Treasurys (yellow).

The bear fund effectively “neutralizes” or offsets the impact of an equivalent position of long holdings (shaded blue area). In other words, if the long position moves down, the bear fund moves up and the return on that combination should be negligible for the day. Therefore, the net long position, or overall exposure to the equity market, is the 60% long position minus the 5% short position which is equal to a 55% “net” long position.

Why is an S&P 500 inverse index ETF a good choice for the Model Fund Portfolio?

Our portfolio holdings are based on S&P 500 sectors, so it’s appropriate to select an inverse index fund correlated to this broad market Index. We like some of the advantages ETFs have over mutual funds such as lower expense ratios and the ability to trade throughout the day.

We also prefer a fund that is passively managed to inversely correlate to the Index’s daily returns. Actively managed funds typically focus on profiting from shorting individual stocks, frequently use resource holdings, and may concentrate on attempts to time the market. Performance can vary depending on the manager’s ability to pick the right stocks to short. Thus, for a safety-first strategy, a more predictable passive fund is the best choice for our purposes.

Can you provide a list of bear fund options?

We’ve assembled a list of some of the larger funds that have longer track records, including both ETFs and mutual funds. Before purchasing any on the list, you should perform your own due diligence to determine the suitability for your portfolio. Reasons for providing these additional choices include:

- Some retirement accounts are limited to mutual fund investments only.

- When using a passively managed fund, it’s best to choose one based on an index that most closely matches your portfolio holdings.

- If you are willing to accept the added risk that comes with an actively managed fund, you may want to consider one of the total return or capital appreciation alternatives.

If a passive bear fund offsets the market on a daily basis, what happens over a longer period?

Due to the compounding of daily returns, performance over periods longer than one day will likely differ from the inverse of the target index. To demonstrate, let’s look at an exaggerated example of how compounding affects returns.

Assume that both an S&P 500 inverse index (bear) fund and the S&P 500 start with a value of $100. On Day 1, the S&P 500 loses 10% causing the bear fund to gain 10%. The S&P 500, therefore, ends Day 1 with a price of $90, while the bear fund has grown to $110. If on Day 2 the S&P 500 loses 10% again, its price drops to $81 and the bear fund increases to $121. While achieving perfect correlation on a daily basis, after two days the S&P 500 is down 19% and the bear fund is up 21%.

If the stock market continues to decline after purchasing a bear fund, gains can be much more than you might expect due to progressively larger dollar changes based on the increasing value of the investment. On the other hand, if the stock market rises persistently after a bear fund is purchased, the daily percentage changes result in progressively smaller dollar changes as the value of the investment decreases. Hence, investors lose less than they might expect when the fund’s return over the course of the rally is calculated.

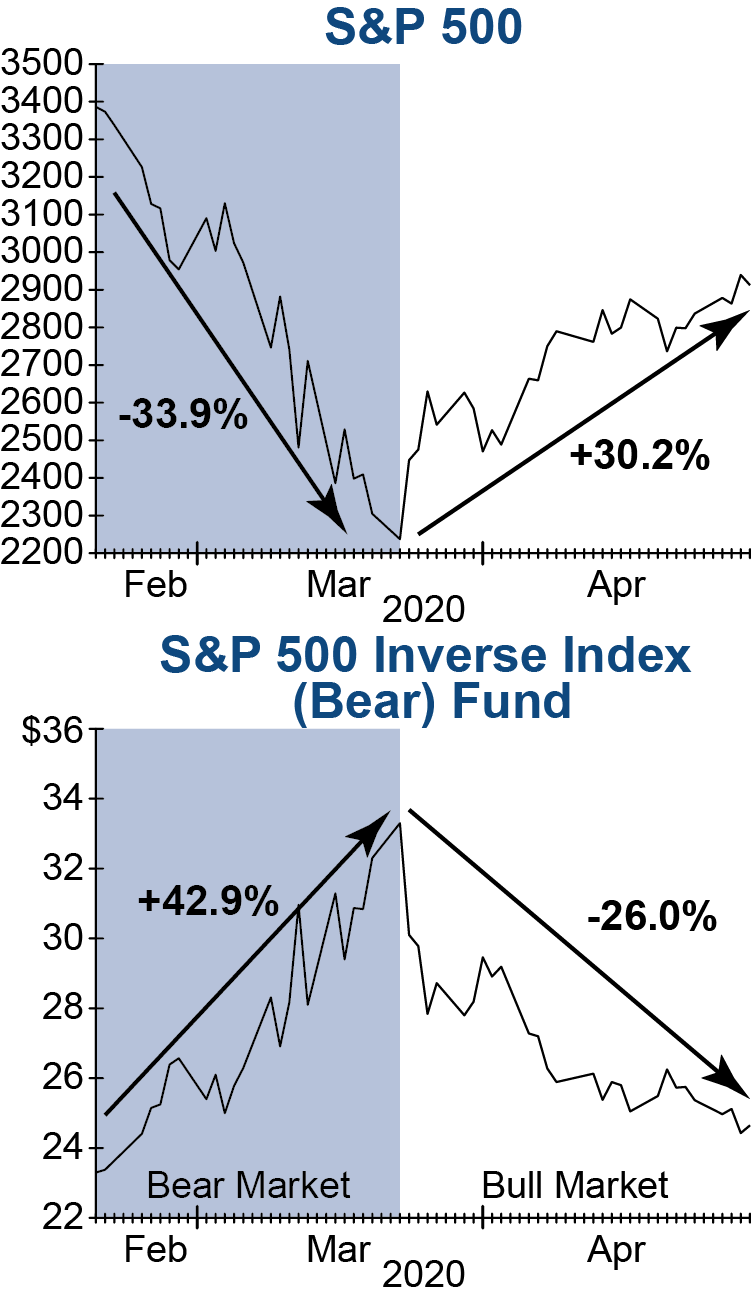

This point is illustrated in the graphs at left, which show the S&P 500 and the bear fund after the stock market peak in February 2020. Clearly, bear funds can serve as valuable “insurance” in a declining market, even if the position is held past the market bottom. One important note: bear fund performance in trendless, volatile markets is less predictable than in markets persistently trending up or down. In fact, due to compounding effects, an inverse index fund may even decline as the market remains flat.

Why don’t you use a leveraged bear fund?

A leveraged bear fund is designed to go up two or three times as much as its benchmark goes down on a daily basis. “More” might sound better to the average investor; however, trying to time bear markets or corrections rarely works, and one can easily get burned with leveraged funds if the market doesn’t move as anticipated and the compounding effect is magnified. With this in mind, we’d avoid the leveraged bear market funds due to the increased volatility and risk.

Summary: A Safety-first Approach

Bear market funds should be used to neutralize portfolio risk and help you sleep at night – not as a tool for speculative short-term trading. Some brokerages provide warnings before purchasing these funds or require a signature acknowledging risk because they can be used as risky “short bets” on the market. However, when utilized as part of a safety-first strategy, inverse index funds can serve as an effective, low cost insurance offering an efficient way to offset rising market risk and reduce portfolio volatility. When considering a bear fund, the following guidelines should be helpful:

- Use bear funds as an insurance to offset a portion of your portfolio investments.

- Stay with the passively managed bear funds that inversely correlate with the broader indexes.

- Choose the larger more liquid funds with longer track records.

- Gradually implement a bear fund position as a bear market becomes more likely.

- Do not use leveraged funds.

If bear funds are not an option for your portfolio, the alternative is to reduce your long positions to reach the target “net” allocation and hold the balance in cash.

Also available to read in PDF form