Holland, 1636

One would suppose that there must have been some great virtue in this flower to have made it so valuable in the eyes of so prudent a people as the Dutch; but it has neither the beauty nor the perfume of the rose – hardly the beauty of the ‘sweet, sweet-pea;’ neither is it as enduring as either…”

“At last, however, the more prudent began to see that this folly could not last for ever… It was seen that somebody must lose fearfully in the end. As this conviction spread, prices fell, and never rose again. Confidence was destroyed, and a universal panic seized upon the dealers.”

– Tulipomania, Holland, 1636, excerpted from Extraordinary Popular Delusions & the Madness of Crowds, written by Charles Mackay 1841

The quotes above referring to the Tulipomania of the 1600s may seem bizarre and distant to many. However, we see striking similarities between the investor psychology that once surrounded those antiquated tulip bulbs and that which is driving the current mania in cryptocurrencies, particularly Bitcoin:

Wealth Managers Are Being Inundated With Calls About Bitcoin

Bloomberg, 11/21/17

Someone in 2010 bought 2 pizzas with 10,000 bitcoins – which today would be worth $100 million

Business Insider, 11/28/17

Owning bitcoin is so much damn fun

Yahoo! Finance, 11/30/17

Bitcoin swings from bull to bear and back in a day

Financial Times, 11/30/17

Bitcoin’s Wildest Ride: Up 40% in 40 Hours

Wall Street Journal, 12/7/17

Bitcoin Futures Debut With 26% Rally, Trigger CBOE Trading Halts

Bloomberg, 12/11/17

Bitcoin is the most widely-recognized and largest cryptocurrency by market capitalization. Specifically, a cryptocurrency is a digital currency which has no central issuing or regulating authority, but instead uses a decentralized system of computers to record transactions and manage the issuance of new units. The digital asset relies on cryptography to prevent counterfeiting and fraudulent transactions. While over 1,000 unique cryptocurrencies exist today, they all share a common purpose: to enable and serve decentralized applications – a way to create a self-supporting service that no single entity operates or regulates.

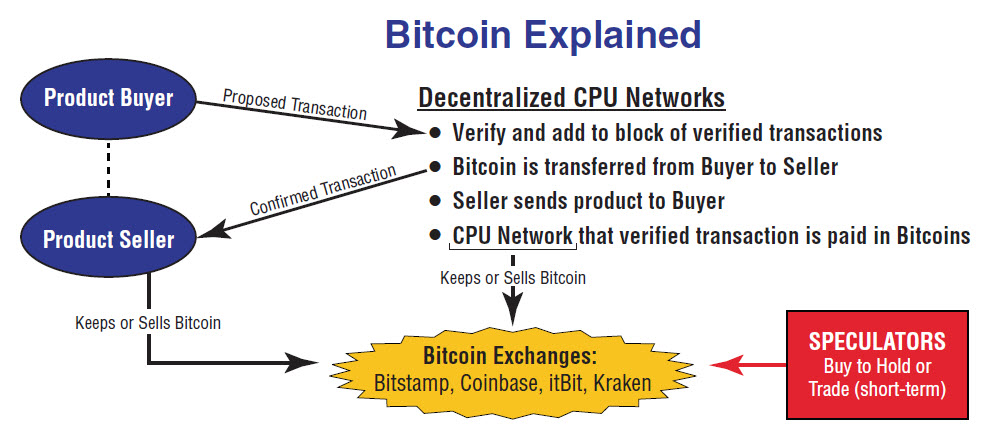

Cryptocurrencies may sound like the way of the future, but they are incredibly complex and difficult to understand. To illustrate, let’s take a high-level look at a theoretical transaction paid for in Bitcoin, as depicted by the flow chart below. Once the transaction is proposed, independent entities (called “miners”) compete on the open network to time stamp and verify the transaction by performing computationally difficult calculations. The reward for winning the elaborate race to verify and add the transaction to the public digital ledger (the blockchain) is a fraction of the transaction’s value, plus a processing fee, both denominated in Bitcoin. The integrity of the ledger is upheld by the economic self-interest of the miners – pure, unadulterated capitalism.

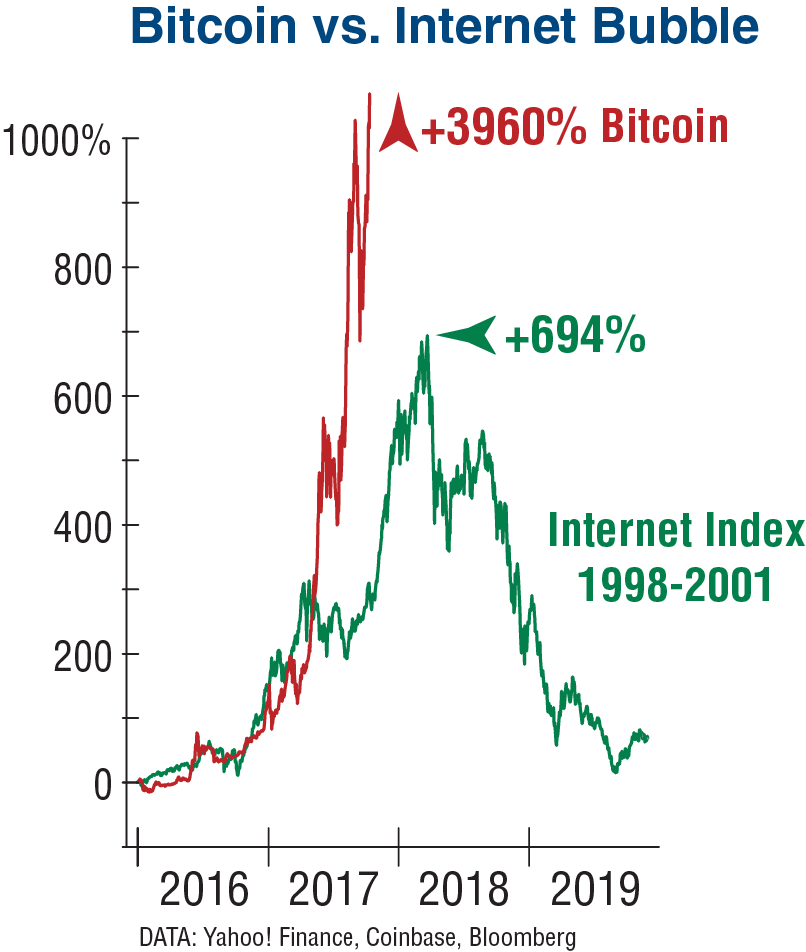

Bitcoin vs. Internet Bubble

Although Bitcoin has been in existence since 2009, its ascension to mainstream relevance is far more recent. Originally beloved by a very small group of passionate believers, Bitcoin saw relatively steady price appreciation in its early years while remaining virtually unknown to the general public. Over time, public enthusiasm surrounding Bitcoin has crescendoed, with the price of the digital currency rising exponentially, attracting hordes of amateur “investors” and speculators. As a result, the price of one Bitcoin has exploded by an absurd +3960% since the beginning of 2016! The ride has been volatile, including five drawdowns of at least -25% (daily close) during that period. Bitcoin’s meteoric rise dwarfs even the gains seen in the Internet Index at the peak of the notorious Tech Bubble. ➞

Why has the world seemingly become enamored with the concept of cryptocurrencies? The following are some of the advantages being widely touted by Bitcoin advocates:

- Freedom – It is possible to send and receive Bitcoin payments anywhere in the world at any time, without scrutiny. Users don’t have to worry about third party delays or approvals, banking holidays, transfer limits, or any other laws due to lack of central authority.

- Anonymity – Anyone, of any age, from anywhere in the world, with access to the Internet can transact with Bitcoins without providing any paperwork or proof of identification. Since personal information is not being tied to transactions, the risk of identity theft is eliminated.

- Low Fees – Transaction fees for processing Bitcoin payments are relatively low. Additionally, digital currency exchanges (e.g., Coinbase) can help merchants process transactions by converting Bitcoins into fiat currency for a fee that is generally lower than most credit card processing fees.

- Less Risk for Merchants – Because Bitcoin transactions cannot be reversed and do not carry any personal information with them, merchants are protected from potential losses that could occur from credit card fraud.

Despite the increasing hype and number of new Bitcoin advocates, doubters and skeptics abound – and you can count us among them. An asset’s value does not go parabolic without carrying extreme risk. In addition, there are numerous pitfalls and uncertainties associated with cryptocurrencies:

- Price Volatility – It is impossible for Bitcoin to be a good store of value and a legitimate tool for transacting business when prices change so rapidly. Imagine trying to buy a car with Bitcoin when its value is gyrating by hundreds, or even thousands of dollars over a short period of time.

- Intangible – Many skeptics take issue with the fact that a Bitcoin is represented by a unique string of numbers stored on a hard drive – there is no physical coin.

- Moral Dilemma – The anonymity provided by Bitcoin is a double-edged sword, as it makes the digital currency inherently ideal for black market dealings.

- Regulation – The IRS has begun taxing digital currency gains and payments. Furthermore, there is the potential that certain countries could attempt to ban cryptocurrencies altogether, particularly if terrorist activities are funded by Bitcoin.

- Cybersecurity and Fraud – Digital currency assets can be stolen by hackers. Additionally, as the demand for cryptocurrencies has grown, scammers and poseurs have created their own bogus digital assets.

- Scalability – Major digital currency exchanges (e.g., Coinbase) have had difficulty handling traffic, which causes scalability and liquidity issues.

Our Perspective

Throughout history, there have been numerous examples of revolutionary ideas or innovations that turned into dangerous bubbles due to feverish speculation and Wall Street hype ─ regardless of how well-intentioned the underlying concept. In our opinion, cryptocurrencies like Bitcoin are among them. Any dispute regarding the practical applications of Bitcoin matters not to the crazed speculators driving today’s rampant price gains.

Many will argue that cryptocurrencies are isolated from other aspects of the economy and financial markets. However, we are concerned that the potential impact of a violent collapse in cryptocurrency prices could be bigger and more far-reaching than anticipated. And we are not alone:

Why Bitcoin’s Bubble Matters

If there’s a price crash in the cryptocurrency, it could hit the tech sector–and more

Wall Street Journal – 10/8/17

Deutsche Bank Economist Says a Bitcoin Crash Would Endanger Global Markets

Fortune – 12/10/17

Whether speculation is in tulip bulbs, real estate, stocks, sub-prime mortgages, or cryptocurrencies, the pattern is usually the same. For investors, emotions run the gamut from greed, to defiance, to fear at any hint of a disruption in the system. Unless you have a voracious appetite for risk and a high tolerance for loss, today’s cryptocurrency bubble is best left to the speculators.

Excerpt from InvesTech Research – December 15, 2017

This report is also available to read in PDF format.