In the “safety-first” investment strategy employed at InvesTech Research, cash plays a dynamic and critical role. Those familiar with our philosophy know that the cash allocation in our Model Fund Portfolio is adjusted relative to the measurable risk in the market. When risk is elevated, we advise holding a higher cash position. Not only has carrying a cash buffer in our Model Fund Portfolio been key to limiting bear market losses over our 40+ year history, but it has helped us to take full advantage of low-risk buying opportunities when they emerge.

Many investors don’t realize that they may be earning next to nothing in brokerage bank sweep cash, and they should take diligent care to make the most out of this portion of their portfolio, especially now that interest rates are exceeding 5%.

Best Practices

Before getting into specific cash investment options, it’s important to establish best practices for cash management. The point of maintaining a cash buffer is to preserve capital until an attractive buying opportunity arrives, therefore investors should look for the optimal combination of safety, yield, and liquidity. Here are three best practices that should be maintained:

- Cash investments should be safe. Ideally, this includes investments that are either backed by the full faith and credit of the U.S. government or FDIC insured.

- Cash investments should have maturities no longer than 12 months.

- Cash investments should have an active secondary market or should be redeemable with minimal penalties.

With these guidelines in mind, we will explore the three primary cash options that meet the above criteria…

Treasury Bills

Treasury Bills (T-bills) are debt obligations of the U.S. Treasury with maturities of 12 months or less. Rather than paying a coupon, T-bills are issued to investors at a discount and then pay their full value when they mature. They are generally considered to be risk-free as they are backed by the U.S. Treasury and are one of the most widely traded assets in the world, both of which are desirable qualities for a cash investment. The two main T-bill options are: 1) buying T-bills directly or 2) purchasing a T-bill exchange traded fund (ETF).

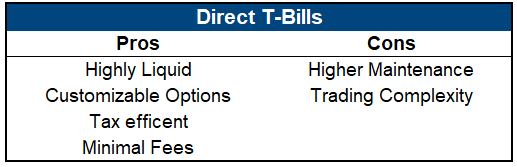

Investing directly in T-bills has many benefits, including a high degree of customization and minimal fees. Additionally, T-bill interest is exempt from state and local income tax. Investors have the option to either shorten or extend their T-bill maturities, which can be greatly beneficial at certain times. For instance, investors can structure maturities to fit their personal liquidity needs or to take advantage of a changing interest rate environment. However, investing in T-bills directly takes some extra effort, as they need to be reinvested as they mature. T-bills are available on most brokerage platforms or can be purchased from the U.S. Treasury through the TreasuryDirect website.

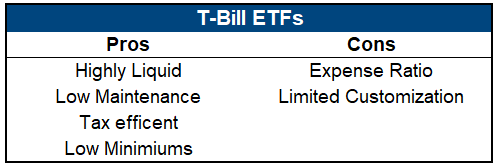

T-bill ETFs are another good option that require less effort. Unlike investing directly in T-Bills, there is minimal ongoing maintenance required by holding these funds. However, investors will have less customization and higher fees in exchange for the convenience provided by these ETFs.

Popular T-bill ETF options include: US Treasury 3 Month Bill ETF (TBIL), SPDR Bloomberg 1-3 T-Bill ETF (BIL), and iShares 0-3 Month Treasury Bond ETF (SGOV). Note that price charts for these funds may look odd as a result of their distribution schedule. However, the size of these fluctuations is minimal in percentage terms.

In summary, direct T-bills are a great option for investors who value customization and are comfortable trading fixed-income investments. Conversely, T-bill ETFs can be good for investors who are seeking a low maintenance option.

Money Market Funds

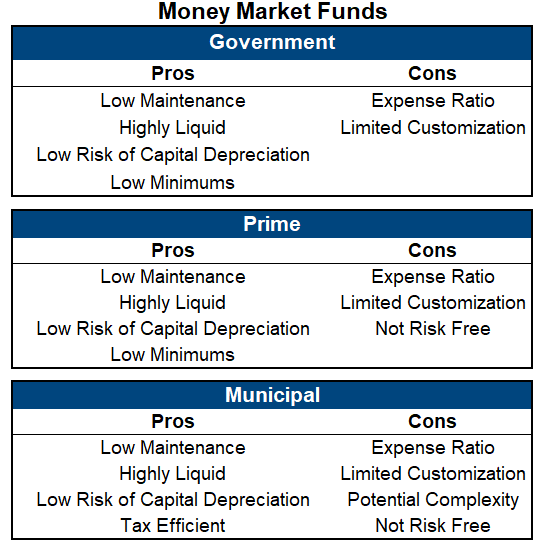

Money market funds are another widely available cash option. These funds are highly liquid and have very little risk of capital depreciation. Because money market funds seek to maintain a stable net asset value (NAV) of $1.00 per share, investors can usually expect to get back their full investment regardless of when they sell. Yield is distributed to shareholders through dividends in an amount equal to the fund’s net income for the period (usually monthly). However, investors should be aware that during periods of extraordinary stress money market funds could be subject to credit risk and may charge redeeming shareholders liquidity fees or gate redemptions to temporarily halt withdrawals.

The three main types of money market funds are government, prime, and municipal.

Government money market funds:

- Hold short-term U.S. government debt and repurchase agreements (repos) that are fully backed by Treasurys and cash.

- Are the safest type of money market fund and are our most preferred alternative.

- Popular options include: Schwab U.S. Treasury Money Fund (SNSXX), Fidelity Treasury Money Market Fund (FZFXX), and Vanguard Treasury Money Market Fund (VUSXX).

Prime money market funds:

- Invest in non-Treasury debt and commercial paper of banks, large corporations, and U.S. governmental agencies.

- Have holdings that are low in risk, however they are not considered to be risk free.

- Yield slightly more than other money market options due to the higher relative risk.

- Popular options include: Schwab Value Advantage Money Fund (SWVXX) and Fidelity Money Market Fund (SPRXX).

Municipal money market funds:

- Invest in the short-term debt of U.S. municipalities, typically agencies of local and state governments (this debt is relatively low in risk but is not considered risk-free).

- Have the primary benefit of being tax-exempt.

- Pay lower before-tax yields, but after-tax yields are comparable to other money market funds.

- Are only beneficial in taxable accounts for high-income investors and those living in high-tax areas.

- Popular options include: Schwab Municipal Money Fund (SWTXX), Fidelity Municipal Money Market Fund (FTEXX), and Vanguard Municipal Money Fund (VMSXX).

Certificates of Deposit

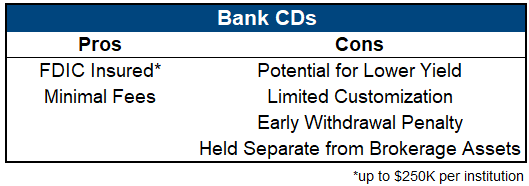

Investing in certificates of deposit (CDs) is also a suitable way for investors to make the most of their cash allocation. There are two major types of CDs – bank CDs and brokered CDs. They share many similarities such as being FDIC insured up to $250K per institution, but key differences are highlighted below.

Bank CDs are traditionally purchased through a local bank. Their benefits include being relatively easy to purchase and having little or no fees; however, they have numerous drawbacks as well. First, the yields offered at an investor’s bank of choice may be significantly lower than prevailing short-term interest rates. Next, banks will charge an “early redemption fee” if investors choose to redeem their CD prior to maturity. And finally, these CDs have to be held in a separate account from other brokerage assets, which makes it more difficult to quickly put cash to work if a buying opportunity emerges in the market.

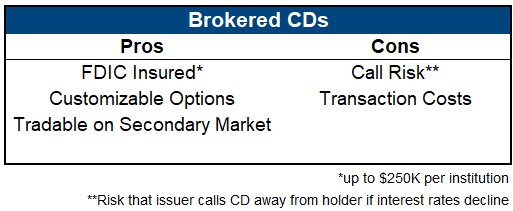

Brokered CDs, like bank CDs, are issued by banks but are traded through brokerage firms. This gives investors a wide range of options to choose from, both regarding the issuing bank and the terms of the CD. Thus, yields of brokered CDs tend to be higher and they offer a greater degree of customization. There is also an active secondary market for these CDs, although selling prior to maturity may result in taking a loss or paying transaction fees. Investors can get more than $250K in FDIC protection in a single brokerage account by purchasing CDs from multiple issuers. One potential downside with brokered CDs is that they may be callable by the issuing bank prior to maturity.

Conclusion

In summary, all of the options discussed above offer attractive yields compared to checking, savings, or bank sweep cash in a brokerage account, and still have little risk of capital depreciation. The option that is right for you largely depends on your personal circumstances, liquidity needs, and the available offerings at your preferred custodian.

The cash allocation of the Model Fund Portfolio is not intended to be fixed or permanent, but rather it is a critical and dynamic component of our “safety-first” investment strategy. Actively managing cash will help to lower portfolio risk while also earning an attractive yield. And in today’s high-risk market environment, that means being able to comfortably sleep at night while you remain ready for the next low-risk buying opportunity.