Consumer spending has been the backbone of this economic expansion, however recent developments suggest that the consumer may be priming for a pullback. Both Consumer Confidence from the Conference Board and Consumer Sentiment from the University of Michigan came in significantly lower than expected for February and are telling a similar (and concerning) story.

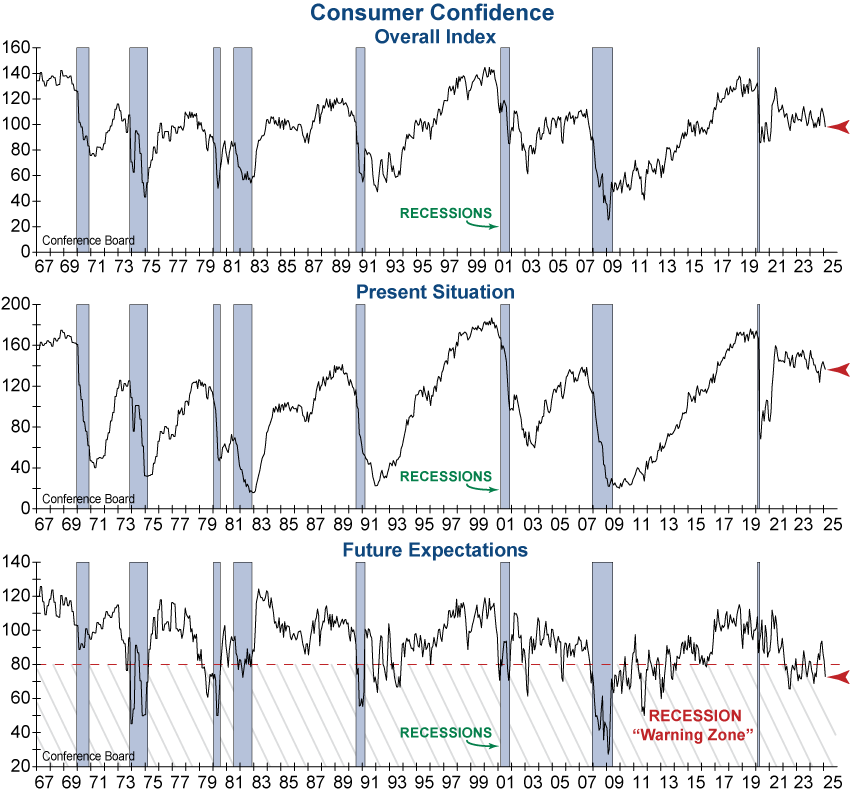

Last week’s Consumer Sentiment report showed meaningful declines in all three measures in February – especially Future Expectations (see this Market Insight for more). Today’s Consumer Confidence report followed the same pattern as both the Present Situation (middle graph below) and Future Expectations Indexes (bottom graph below) fell in February. The Present Situation Index declined by a few points, while the Expectations Index plunged 9.3 points and fell below the critical 80 threshold that typically signals recession ahead. As a result, the Overall Index (top graph below) saw its largest monthly decline since August 2021 and is now near the bottom of the range it’s been in since 2022.

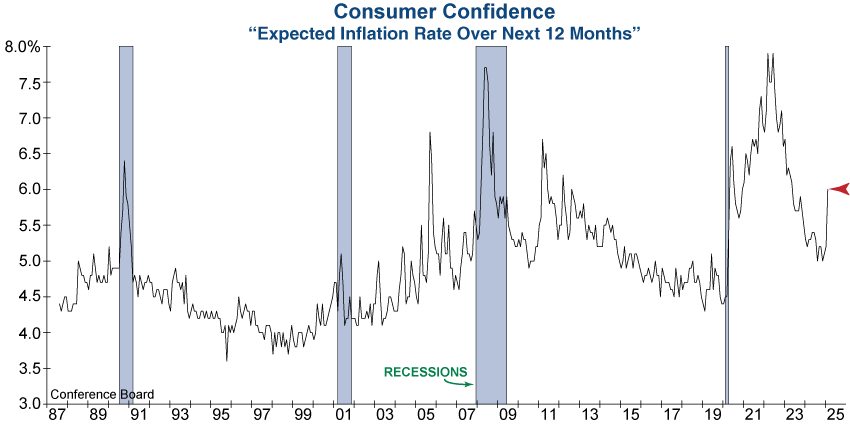

In addition, inflation expectations surged in February, suggesting the Fed’s path toward their 2% inflation goal remains uncertain and unfinished.

Consumers have been unable to sustain their post-election optimism, reflecting growing fears over inflation, tariffs, a weakening labor market, and future business conditions. Consumer spending accounts for roughly 70% of Gross Domestic Product (GDP), and if this pessimism continues, a cautious consumer could lead to an economic slowdown.