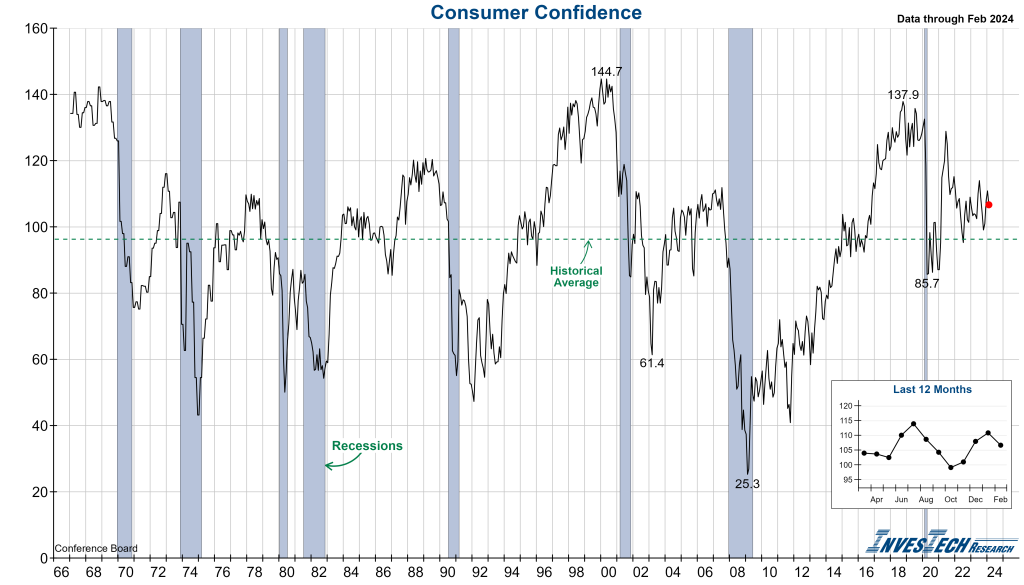

The Conference Board’s Consumer Confidence Index fell to 106.7 in February from a downwardly revised 110.9 (from 114.8) in January. This downward revision to January’s figure was significant and suggests that “there was not a material breakout to the upside in confidence at the start of 2024,” according to the Conference Board’s press release.

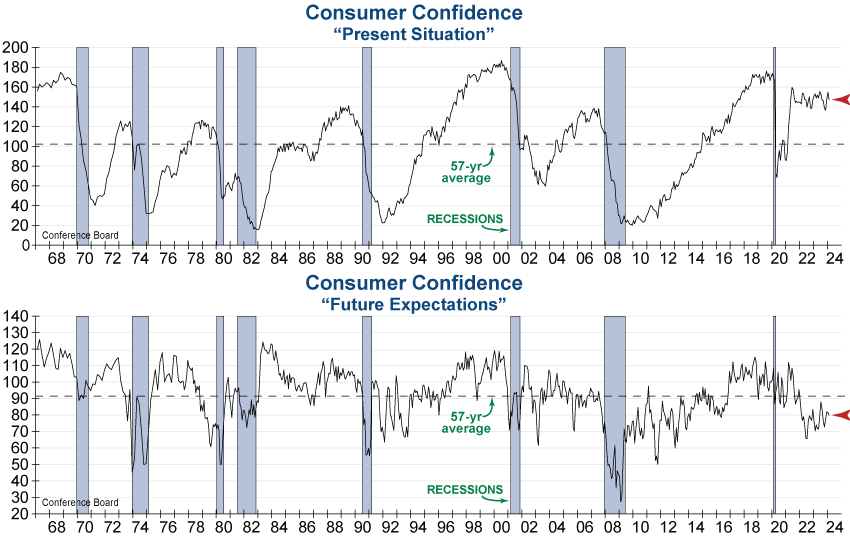

The Present Situation Index fell 7.7 points to 147.2 (top graph below) and the Expectations Index fell 1.7 points to 79.8 (bottom graph below). The Present Situation Index has fluctuated within a roughly 20 point range since mid-2021 and has not reached its pre-pandemic levels. It is worth noting, however, that when the Expectations Index has seen a reading below 80.0, it has often signaled recession ahead.

In terms of details from the report, consumers are still concerned about inflation, but they are less worried about food and gas prices which have both eased recently. However, they are more concerned today about deteriorating business conditions and both the current and future employment situation. Assessments of personal and family financial situations has retreated as have buying plans for more expensive items and vacations. Lastly, expectations of a recession over the next 12 months ticked back up above December 2023 levels, indicating renewed uncertainty.

As we mentioned in last month’s issue of InvesTech Research, where consumer optimism goes, so does the economy… We will continue to keep an eye on Consumer Confidence and Consumer Sentiment, as a halting in the recovery of consumer attitudes would jeopardize the Fed’s attempt at an elusive soft landing.