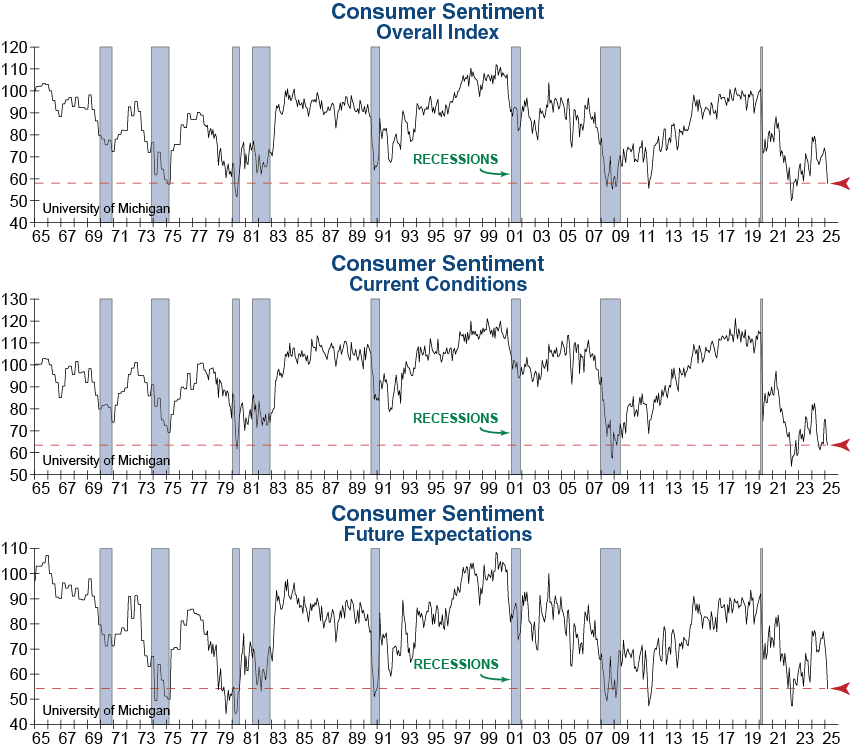

Interim Consumer Sentiment for March was far worse than expected with declines across the board, highlighting a stark reversal from the exuberance that has been driving the stock market and economy for the past few years. The Overall Index fell 6.8 points to 57.9, the Current Conditions Index slid to 63.5 and most concerningly, the Future Expectations Index tumbled 9.8 pts to 54.2, its lowest level since July 2022. All three indexes are now at historically low levels rarely seen outside of recessions. The rapid decline in Consumer Sentiment reflects increased uncertainty about individuals’ perceptions of their financial situation. Uncertainty regarding the future can quickly materialize into a slowdown if consumers cut back on spending or delay big purchases.

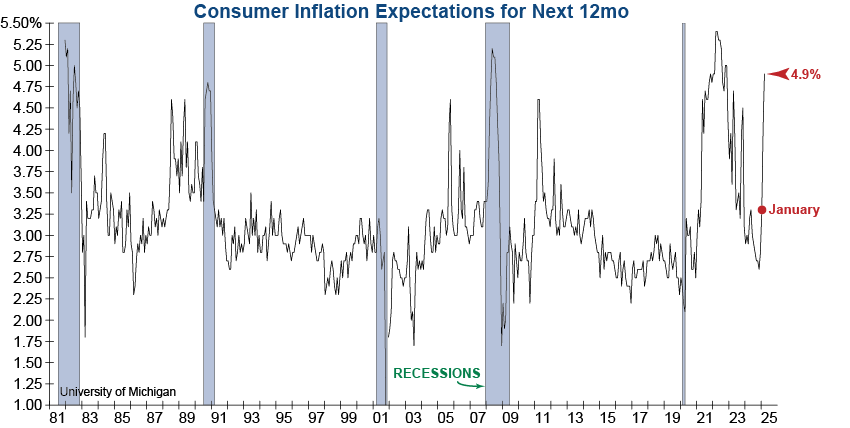

One reason for the increasingly dismal outlook is skyrocketing inflation concerns. Inflation expectations have risen dramatically over the past few months, increasing 1.6 percentage points since January, the largest 2-month increase since 1980! High inflation expectations can be a hindrance to the Fed’s inflation battle because if everyone is expecting prices to increase, then businesses will want to raise prices and consumers are more likely to be willing to continue to pay higher prices, leading to a self-fulfilling prophecy.

This morning’s Consumer Sentiment report sent an ominous message for consumers, markets, and the economy as consumer spending accounts for roughly 70% of Gross Domestic Product (GDP), and an increasingly cautious consumer could lead to an economic slowdown.