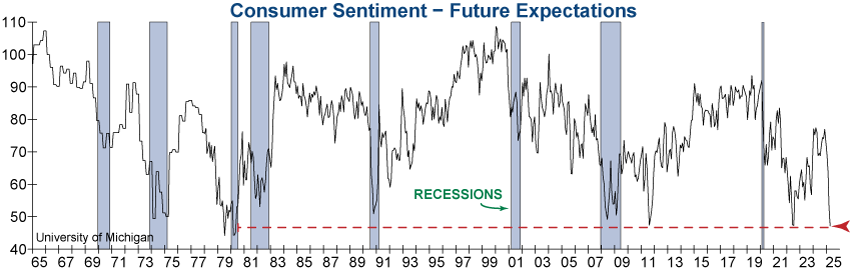

The preliminary Consumer Sentiment report for April showed a broad decline in optimism across age, income, education, geographic region, and political affiliation. The leading Future Expectations Component dropped below its 2022 low. It now sits at 47.2, the lowest level since 1980. The Index has plummeted -39% since its interim high in November of last year, the largest 5 month fall in the 74-year history of the series.

According to the survey Director Joanne Hsu, “Consumers report multiple warning signs that raise the risk of recession: expectations for business conditions, personal finances, incomes, inflation, and labor markets all continued to deteriorate this month.”

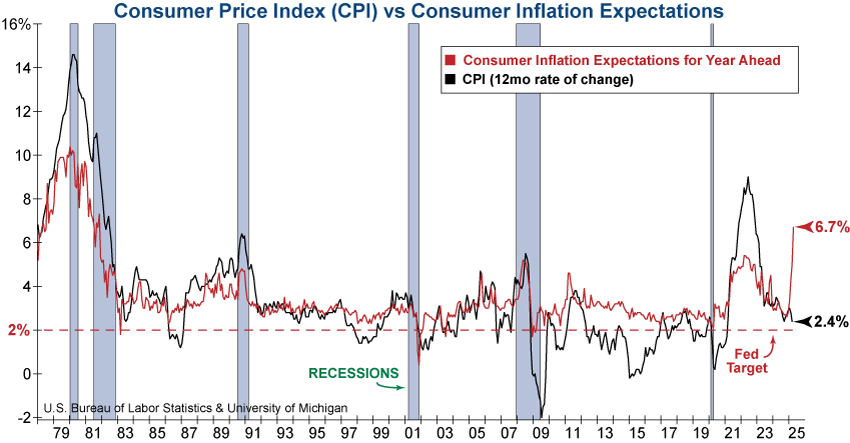

Concerns over inflation continue to prevail as year-ahead inflation expectations surged from 5.0% to 6.7% in the fourth consecutive month of unusually large increases, mostly attributed to concerns regarding tariffs. Today’s level is the highest since November 1981 when the Consumer Price Index (CPI) increased 9.6% year-over-year, and the U.S. economy was in the depths of one of its longest recessions. In stark contrast, CPI is currently 2.4% year-over-year. This marks the largest discrepancy between actual inflation and expected inflation in history, a troublesome hindrance to the Fed’s inflation battle, as high inflation expectations can easily become a self-fulfilling prophecy.

The rapid deterioration in Consumer Future Expectations, combined with skyrocketing inflation expectations, paints a worrisome picture for the US economy, reiterating that safety-first investors should approach this market cautiously.