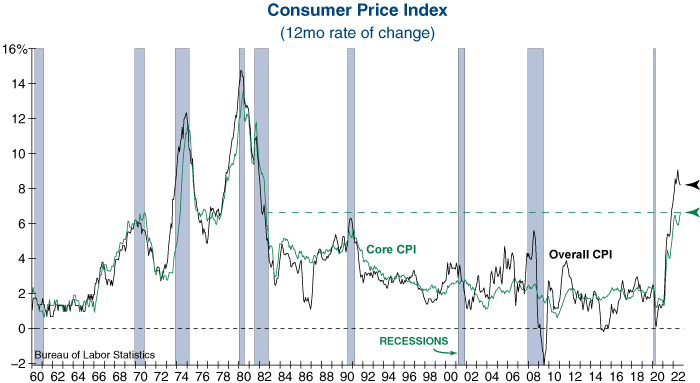

September’s inflation report once again came in hotter-than-expected, most notably with the Core Consumer Price Index (CPI) surpassing its March peak to reach a new 40-year high (see graph below). The report revealed that while goods inflation continued to ease, services inflation rose to the highest level since 1982. Additionally, the primary measure of shelter costs and largest overall CPI component, owners’ equivalent rent, surged to an all-time high of 6.7%.

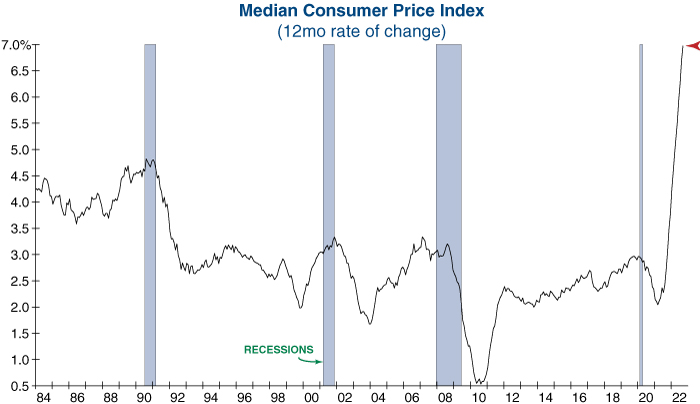

The most alarming aspect of the CPI report was that inflation continues to broaden out at an unprecedented rate, as shown by the parabolic rise in the Median CPI. This is a clear sign that inflation is becoming structurally entrenched, and history suggests that a recession will ultimately be required to relieve these pressures. This inflation report has all but solidified another sizeable rate hike at the FOMC’s November meeting and indicates that the Fed may have to tighten further (and for longer) than expected.

Eli Petropoulos, CFA – Sr. Market Analyst