The Consumer Price Index (CPI) report this morning came in cooler than expected, paving the way for a Fed rate cut at their meeting next week.

The CPI was originally scheduled to be released last week on October 15th. However, it was delayed due to the government shutdown. Although the shutdown is still in effect, CPI is a requirement for calculating the Social Security Administration’s annual cost-of-living adjustment (COLA). Because of this legal requirement, government staff responsible for compiling and releasing the CPI were called back to work for this report. As a result, the CPI is one of the few pieces of Federal economic data to be released during the government shutdown.

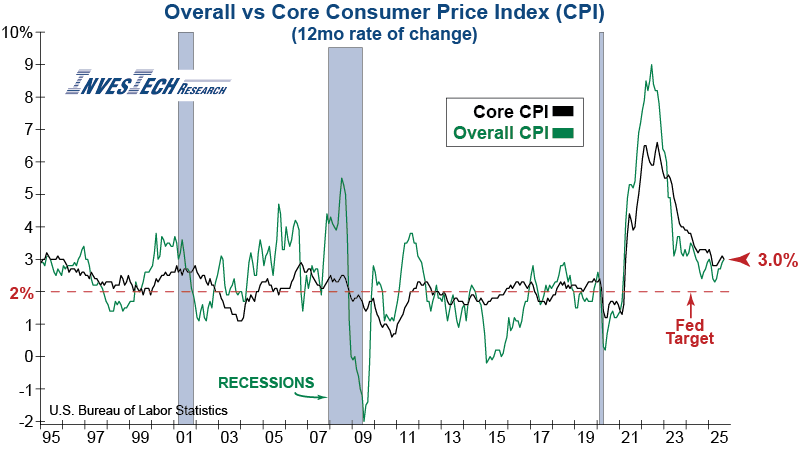

The overall CPI rose 3% year-over-year, up from 2.9%. The Core rate, which excludes the volatile food and energy components, also came in at 3% year-over-year in a minor decrease from 3.1% last month. This slightly cooler than anticipated reading all but confirms a rate cut next week as it indicates the Fed does not have to draw their focus back to inflation – for now.

However, the CPI remains at a concerningly high level – well above the Fed’s 2% target. Inflation still has further to fall before the Fed can be confident it is tamed, and this report tells us it could still be a long and bumpy journey.