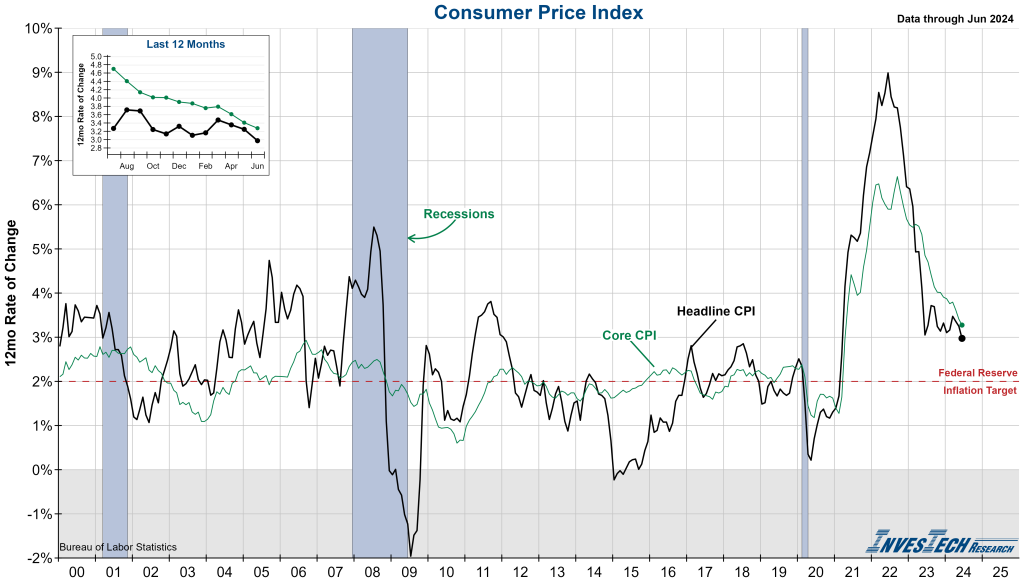

This morning, the Bureau of Labor Statistics released their June report for CPI. Both Headline and Core CPI came in lower than expected and below the previous month’s figures. Headline CPI for June registered at 3.0%, down from 3.3%, and Core CPI came in at 3.3%, down from 3.4% in May.

Core CPI, which excludes Food & Energy, is now at its lowest level since April 2021, but is still well above pre-pandemic levels of around 2%. This is largely a result of still-increasing shelter costs. On a month-over-month basis (MoM), Core CPI saw its smallest increase since January 2021.

Most sub-indexes of Headline CPI saw increases at a slower rate in June with the bulk of the remaining price increases in motor vehicle insurance, medical care, personal care, and recreation. While shelter remains a serious thorn in inflation’s side, June’s report showed some signs of alleviating pressures.

This report emphasizes that inflation has clearly peaked, and it increases the probability of a long-awaited first rate cut from the Federal Reserve. However, inflation remains a considerable distance above the Fed’s 2.0% target and this report does not negate the growing list of warning flags in the weight of the evidence. It’s also worth noting that in both the unwinding of the Tech Bubble in 2001 and Housing Bubble in 2007, the first rate cuts were ineffective in preventing a recession within the following four months.