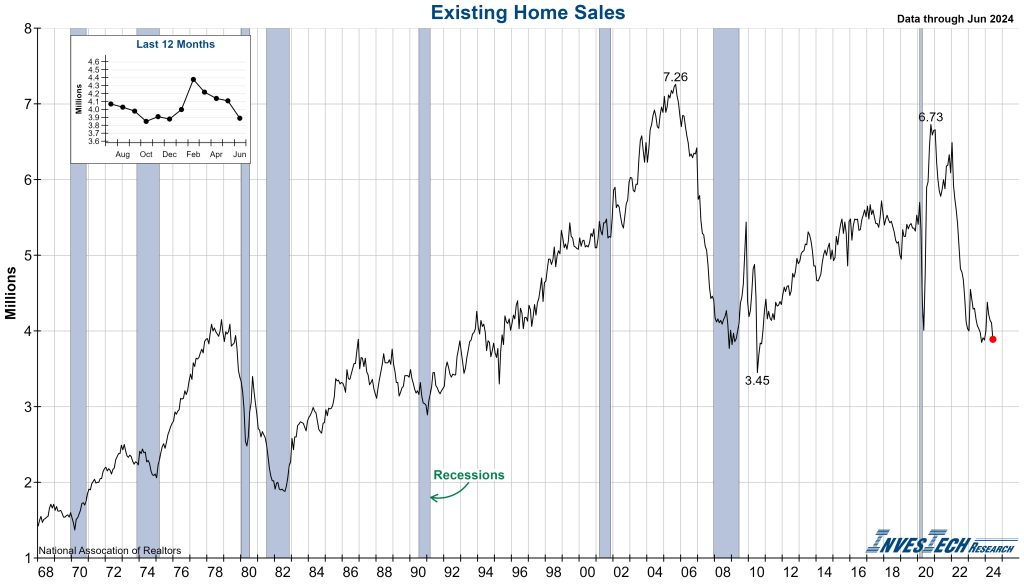

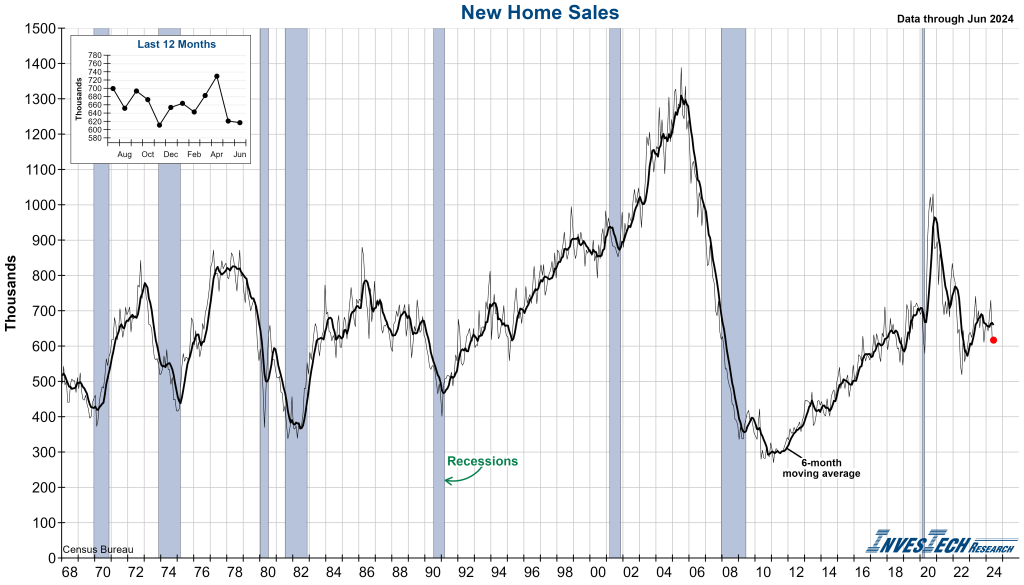

Existing Home Sales from the National Association of Realtors and New Home Sales from the Census Bureau were released this week for the month of June. Both saw sales continue to decline and inventory rise and as housing shifts from a seller’s to a buyer’s market.

Existing Home Sales fell once again, continuing its downward trend as a result of decades-high mortgage rates and still-limited inventory. Sales activity slipped 5.4% in June and fell by the same on a year-over-year basis. It is now at its lowest reading this year, which is near its lowest levels since the unwinding of the housing bubble in 2010.

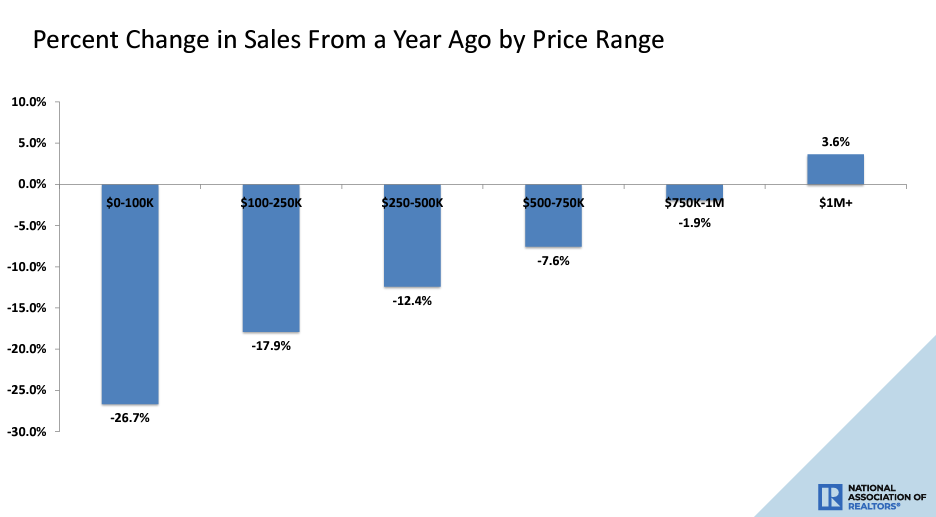

Interestingly, sales of homes priced under $500K have seen the largest declines. This is significant as these lower-priced homes account for approximately 64% of sales, highlighting the broader weakness being masked by higher-end home sales ($1M+).

Many homeowners have been reluctant to relocate due to locked-in low mortgage rates. Those who have decided to make that jump more recently have seen an uptick in homes to choose from. While still far too low relative to historical averages, existing home inventory has slowly increased over the past year, rising 3.1% in June. This is the highest inventory level since Dec 2020 and the equivalent of 4.1 months’ supply at current prices.

Despite this increase in inventory, soaring home prices remain a major affordability issue. The price of an existing single-family home jumped 3.1% in June and is at an all-time high, but may be slowing according to the National Association of Realtors.

“Even as the median home price reached a new record high, further large accelerations are unlikely,” Yun added. “Supply and demand dynamics are nearing a balanced market condition. The months’ supply of inventory reached its highest level in more than four years.”

On the other side of the coin, New Home Sales have seen more dramatic trends than Existing Homes Sales since the pandemic. New Home Sales continue to trend downward in June falling 0.6% month-over-month and 7.4% year-over-year, which marks its lowest level this year.

New construction has seen its highest unsold inventory since the Great Financial Crisis, partially due to a flurry of new building activity post-pandemic. It is also at its highest months’ supply since late 2022, which is 9.3 months at current prices. As a result, new home prices are down 9.3% from their all-time high in October 2022 and look to be falling further as inventory continues to rise.

Underlying fundamental housing data tell a very different story than that of housing-related stocks and home prices, which have remained relatively strong. If these negative trends in housing sales activity and inventory continue, they will most certainly have far-reaching effects on the broader economy.