Major market indexes tumbled today, with the S&P 500 closing down -12% from its peak in February and the Nasdaq Composite down -18% from its top last December. InvesTech’s Model Fund Portfolio, however, has exhibited remarkable resilience, remaining in positive territory for the year.

While much of today’s drop in the stock market was attributed to fears regarding the potential impact of tariffs announced on April 2nd, that overlays a larger problem as is clear in InvesTech’s “Critical” 4 indicators. Market Leadership deteriorated significantly, with a strong warning flag waving in InvesTech’s Negative Leadership Composite, which broke decisively through the cautionary threshold of -50, falling to -73 at today’s close.

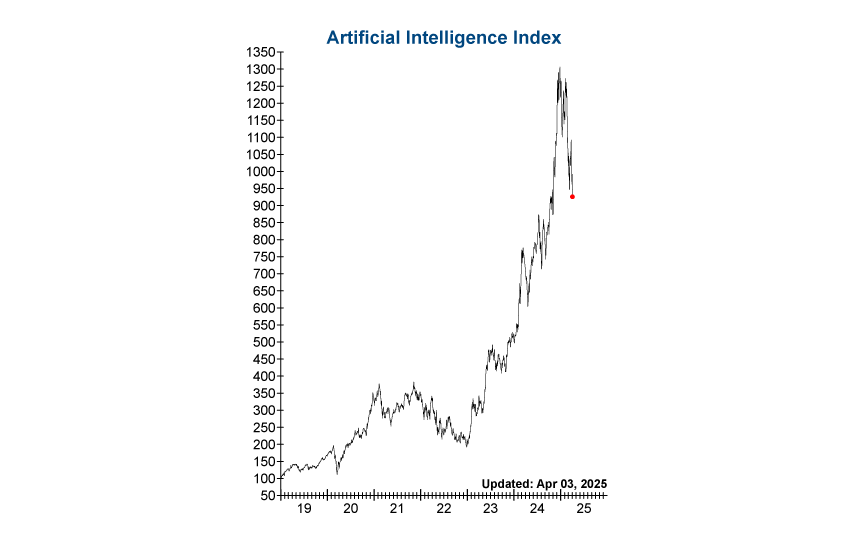

Additionally, speculative names in the Artificial Intelligence realm have been struggling since late last year, as illustrated in InvesTech’s AI Index which is down -29% from its peak last December.

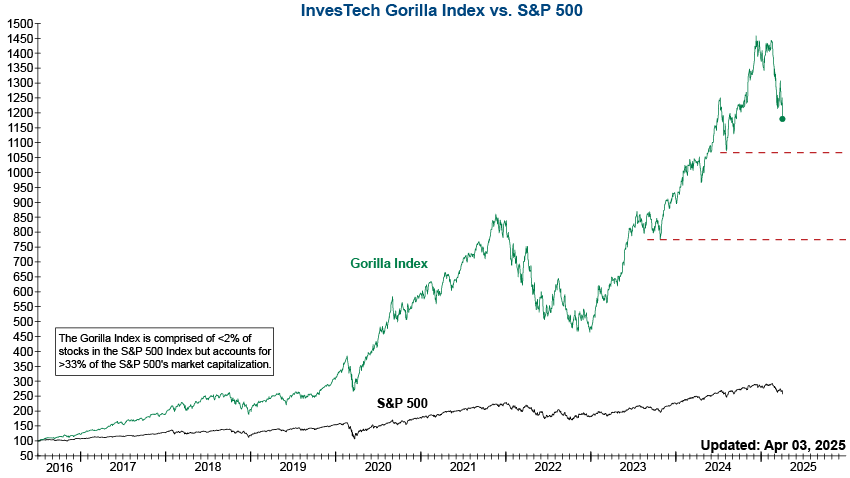

Wall Street’s darling mega-cap stocks have also been crumbling long before today as tracked by InvesTech’s Gorilla Index, which is down -19% from its peak also last December.

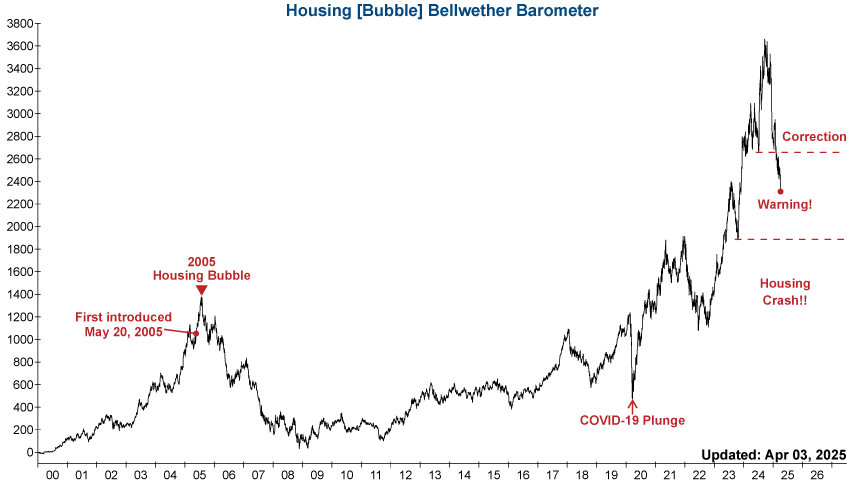

The largest —and longest running— collapse is in InvesTech’s Housing [Bubble] Bellwether Barometer, which was down -6% today and is now off -37% from its September high last year, showing no sign of recovery.

The widespread breakdown in InvesTech’s “Critical 4” indicators signals that this single-day, event-driven decline is not the end, and the real trouble is likely still to come.