Note: The following Market Insight was originally posted on April 26. However, given the fallout in crypto markets since this was first posted, the graphs below have been updated through May 9.

Earlier this year, we began tracking 10 of the leading crypto mining stocks to warn of a potential loss of exuberance surrounding the crypto-mania. As shown by the graph below, our InvesTech Crypto Miners Index has just broken critical support and is trading more than -70% off its high from just five months ago. The carnage in these once-favored crypto stocks is shocking and raises serious questions as to whether this loss of psychology will soon spread to Bitcoin and cryptocurrencies in general.

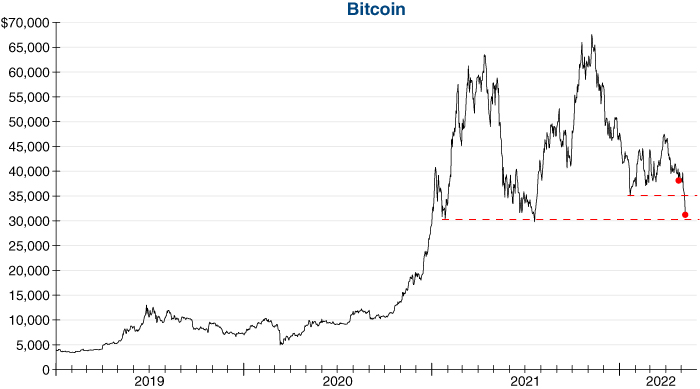

Psychology has rapidly unwound on Wall Street to start 2022, with both the Nasdaq and Russell 2000 Indexes dipping into bear market territory. While our Canary Index, Gorilla Index, and Housing Bellwether Barometer have all broken or are threatening key technical support levels, Bitcoin has remained remarkably resilient following last year’s sell-off (see graph below). For those watching this psychological tug-of-war in the crypto markets, there are two important support levels to watch for Bitcoin… if both are broken, then loss of investor confidence in cryptocurrencies could accelerate.