Once again, all eyes on Wall Street are fixed on the debt limit showdown and there is a steady stream of headlines and news reports about the impending crisis that is quickly approaching. We touched on this in January on Market Insights and it is worth repeating: DON’T PANIC! Here’s an update on what we know and what we don’t know as the deadline draws near…

What we know

The debt ceiling showdown has largely been a game of political posturing going back to the 1990s but has been even more politically driven in recent years. In 1995, with President Clinton (a Democrat) in the White House and Republicans controlling both houses of Congress, the government did in fact shut down for about 4 weeks before a resolution was reached, yet there was no default.

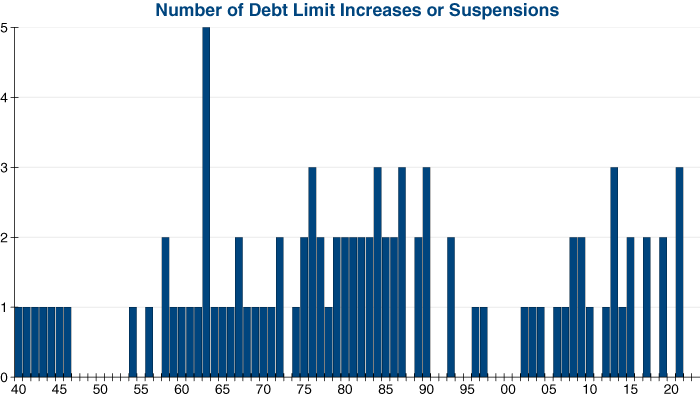

As we mentioned in our July 2011 issue of InvesTech Research, the looming default date that is plastered all over the media is never truly carved in stone. It can and has moved several times with minimal congressional cooperation. Additionally, the debt ceiling has been raised or suspended 93 times since 1940.

What we don’t know

We don’t know which side of the aisle will blink first, but historically, the most likely outcome will be an agreed “mutual blink” with both sides taking the credit for a win after compromises from both sides. It’s of mutual interest for Washington to reach a deal.

Pop quiz – name the date on these headlines:

“Analysts: Failure To Raise Debt Ceiling Means 44% Spending Cut, 10% Drop In GDP, Recession”

“Debt ceiling: Chaos if Congress blows it”

If you guessed that these were recent headlines, you’re out of luck! Both are from the contentious 2011 debt limit showdown. After a resolution was reached, spending was not cut by 44%, GDP did not drop 10%, and there certainly was no recession!

What to watch

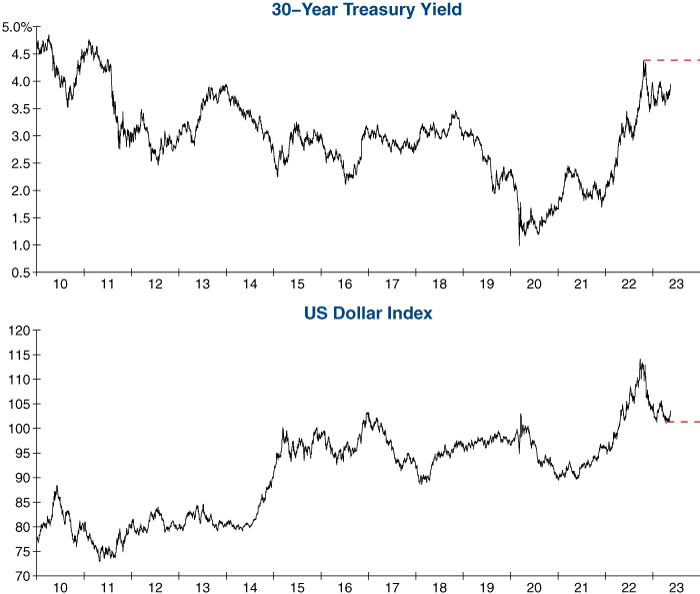

The majority of hoopla surrounding the debt ceiling limit tends to relate to how the market will react. The best bet for positioning your portfolio is to be safe and not sorry…to avoid any volatility or loss in the coming months, it’s best to watch two important warning flags (as we did in 2011): the 30-year Treasury bond yield and the U.S. Dollar Index. Neither are signaling imminent default – the Dollar appears firm and 30-year yields are stable. If a serious default does become imminent, we would expect either the 30-year Treasury Yield to rise sharply or the U.S. Dollar to fall dramatically. If either of these tools start flashing red, we will update subscribers immediately.

For now, it’s best to sit back, watch the show in Washington, and keep an eye on those two important tools.