This week’s economic news has been light due to the shortened holiday week. However, housing market data continues to highlight extreme dichotomies.

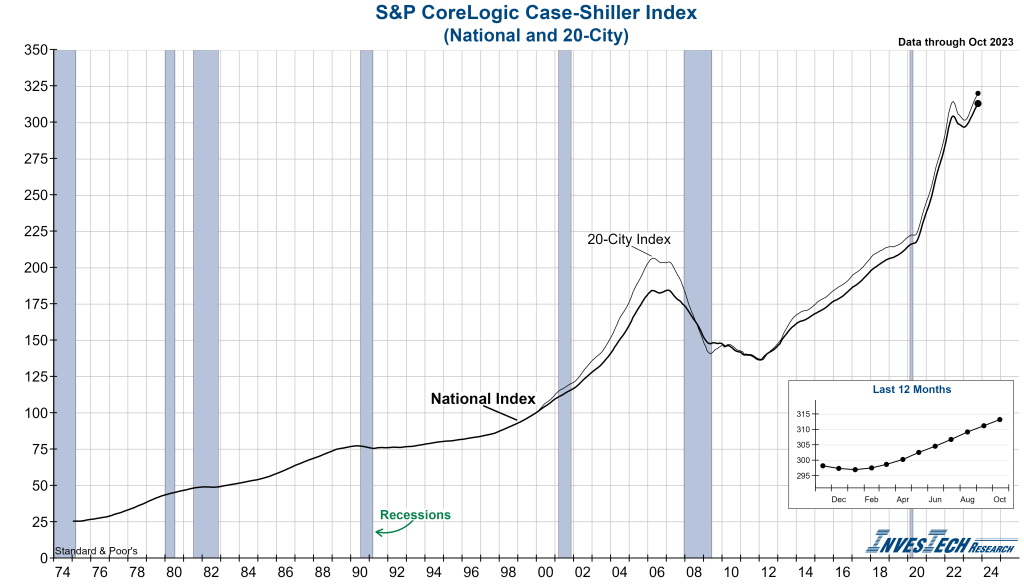

The S&P CoreLogic Case-Shiller US National Home Price Index was released Tuesday morning and increased 0.6% (seasonally adjusted) from September and was up 4.8% year-over-year. The 20-city and 10-city Indexes also saw increases both month-over-month and year-over-year. Of all 20 major metropolitan markets, 11 had month-over-month home price increases in October. The National, 20-city, and 10-city Indexes are at record highs (not adjusted for inflation). Home prices continue to rise, and in fact accelerate, despite high interest rates.

Here’s an excerpt from the S&P Global press release:

“U.S. home prices accelerated at their fastest annual rate of the year in October,” says Brian D. Luke, Head of Commodities, Real & Digital assets at S&P DJI. “Our National Composite rose by 0.2% in October, marking nine consecutive monthly gains and the strongest national growth rate since 2022.”

“Home prices leaned into the highest mortgage rates recorded in this market cycle and continued to push higher. With mortgage rates easing and the Federal Reserve guiding toward a slightly more accommodative stance, homeowners may be poised to see more appreciation.”

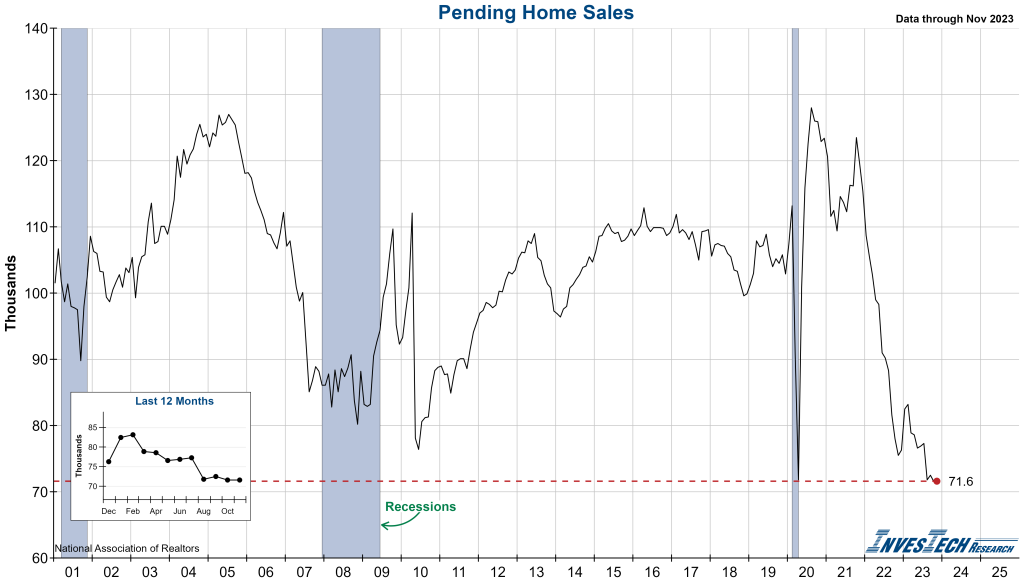

Pending Home Sales for November was released this morning and came in flat month-over-month while forecasts predicted a 1% increase. There was no change from the October reading and pending sales were down 5.2% from last year. All four regions saw declines year-over-year but monthly gains were seen in the Northeast, Midwest, and West regions while the South posted decreases.

Here is an excerpt from today’s press release:

“Although declining mortgage rates did not induce more homebuyers to submit formal contracts in November, it has sparked a surge in interest, as evidenced by a higher number of lockbox openings,” said Lawrence Yun, NAR chief economist.

“With mortgage rates falling further in December – leading to savings of around $300 per month from the recent cyclical peak in rates – home sales will improve in 2024,” Yun added.

Despite the recent pullback in mortgage rates, prospective buyers who borrow are still struggling with today’s massive unaffordability problem. We will continue to be cautious regarding the housing market as we enter 2024 with record low existing home sales, record high prices, and mortgage rates that remain at multi-decade highs.