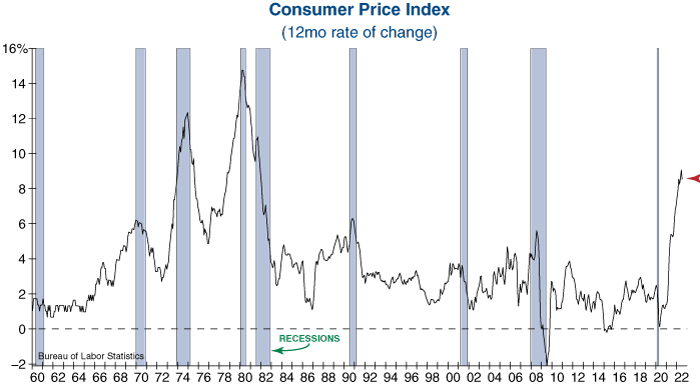

In a welcome respite, the Consumer Price Index (CPI) declined from 9.1% in June to 8.5% in July on an annual basis, which was lower than economists’ expectations of 8.7%. Equity markets rallied on this lower-than-expected reading, yet data behind the decline in inflation suggests investors may be celebrating prematurely…

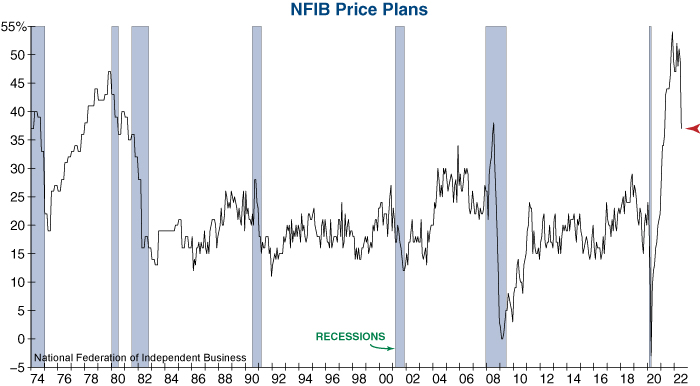

NFIB Price Plans is a useful leading indicator of inflation as it tracks the share of small businesses planning to raise prices in the next 3 months. After hitting a record high last November and remaining at a high level throughout the first half of 2022, NFIB Price Plans suddenly cratered by -12 points in this week’s release. Price plans have only fallen by this margin two other times in history, both of which were in recession, reinforcing that inflation has likely peaked.

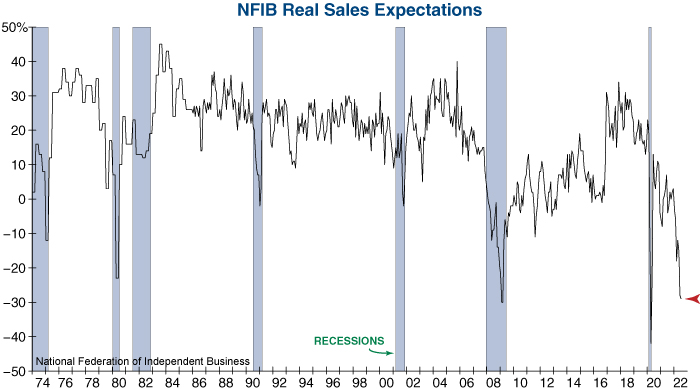

So why did price plans fall so dramatically? As shown in the graph below, it’s primarily because the share of small businesses expecting real sales to grow over the next three months has reached one of the lowest levels on record – indicating that small businesses are seeing a significant slowdown in demand. Furthermore, every other time NFIB Real Sales Expectations has reached this level, it has been during a recession. So, while the evidence shows that inflation has likely peaked, the fact that it is corresponding with a rising risk of recession is not reason for exuberance.

Eli Petropoulos, CFA – Sr. Market Analyst