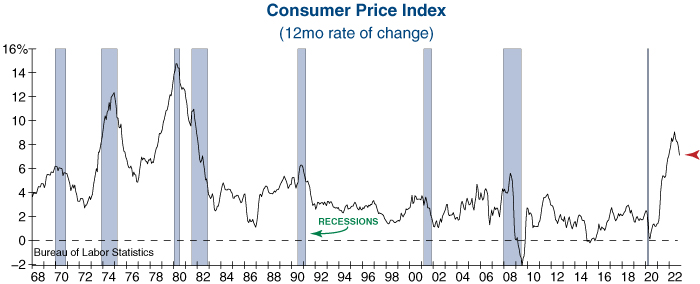

The Consumer Price Index (CPI) dropped to 7.1% in November from 7.7% the month prior. The decline was primarily driven by falling energy and goods prices, as supply chain bottlenecks continue to resolve, and consumers shift their focus from goods to services. While the downward trend in the CPI is encouraging, inflation remains uncomfortably high and underlying pressures continue to complicate the Federal Reserve’s inflation fight…

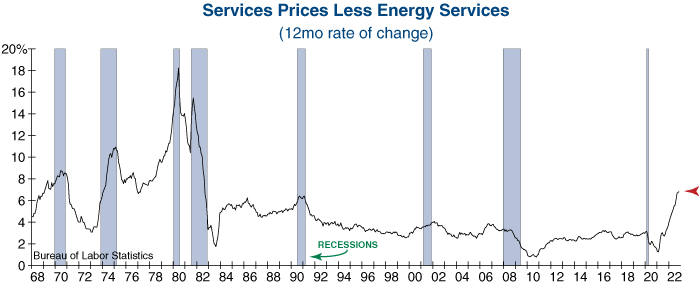

Services is one inflation factor that Fed Chair Jerome Powell has highlighted as being particularly important to watch, as it provides a useful gauge of how wages are impacting prices. Today’s CPI report revealed that services prices (excluding energy services) increased to another 40-year high – which indicates that robust wage growth continues to place upward pressure on inflation. So, while headline inflation has likely peaked for the cycle, the stickiness of wages is not letting the Fed abandon its tightening cycle just yet.

Eli Petropoulos, CFA – Sr. Market Analyst