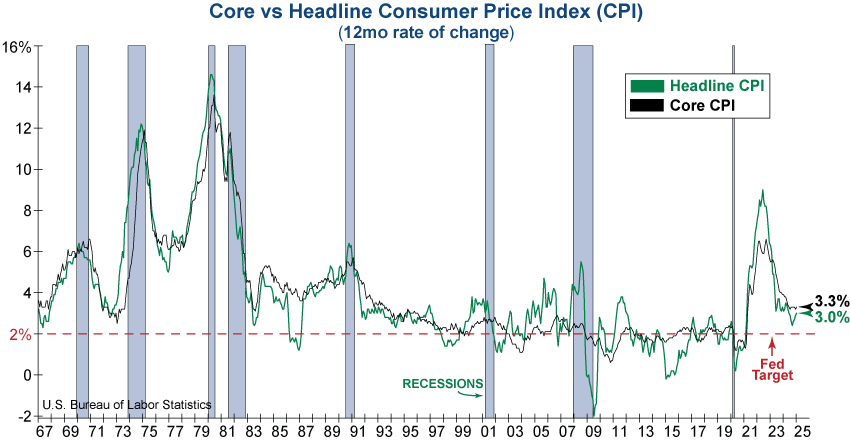

This morning’s Consumer Price Index (CPI) report for the month of January came in hotter than expected and showed accelerating inflation, making the Federal Reserve’s inflation battle much more complicated… Headline CPI rose to 3% on a year-over-year (YoY) basis and core CPI, which excludes the volatile food and energy components, ticked up to 3.3% YoY, showing today’s inflation problem extends beyond just eggs!

A major contributor to the rise in headline CPI was shelter costs, which accounted for roughly 30% of the overall increase. Other notable monthly increases include motor vehicle insurance, recreation, and medical care, many of which are non-cyclical and non-discretionary.

While inflation has seen improvements since its post-pandemic highs, it has not gotten meaningfully close enough to the Fed’s 2% target. In fact, it has recently reaccelerated as evidenced by the monthly increases. January’s 0.5% month-over-month increase in headline CPI is its largest since August 2023. In addition, the one-month annualized Sticky CPI rose to 4.9% in January.

Today’s inflation reports show the Fed’s goal of price stability and their path toward 2% is getting harder… The possibility of further rate cuts in 2025 is becoming much more uncertain and the Fed may have to rethink their strategy moving forward. In any case, today’s data reinforces the idea that the path ahead remains bumpy.