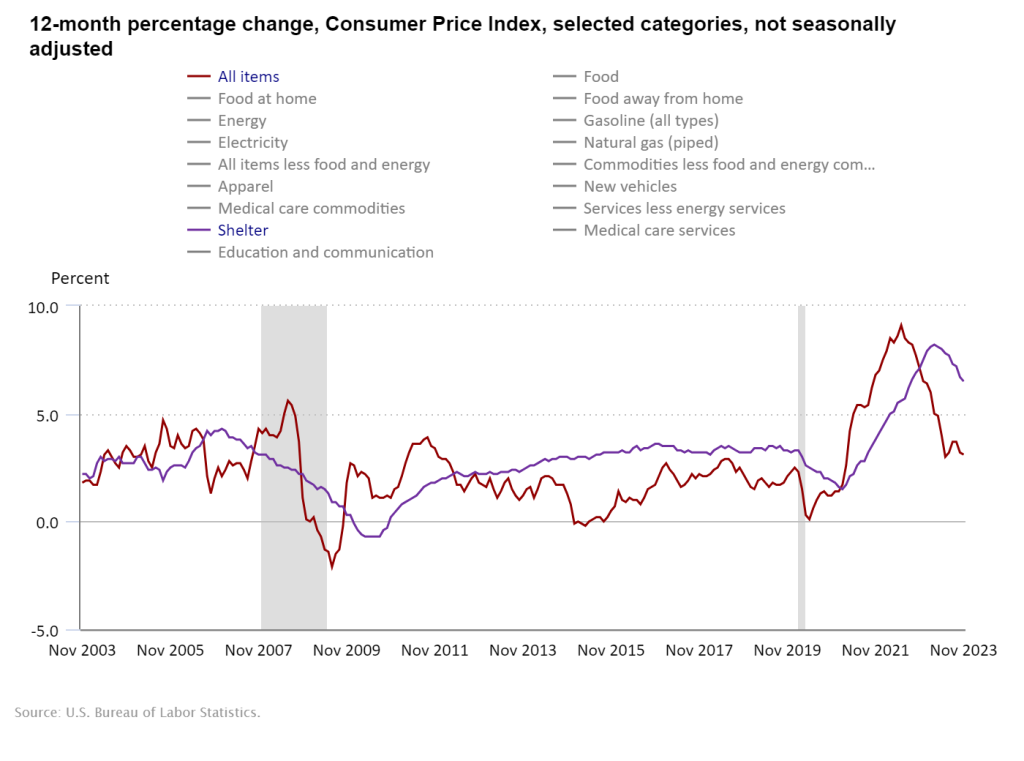

The Consumer Price Index for November was released this morning, with Headline CPI coming in at 3.1% as expected and unchanged from October’s inflation figure. Core CPI was at 4.0%, also unchanged from October and as expected. However, on a month-over-month basis, headline and core inflation increased 0.1% and 0.3%, respectively, from the previous month, which was more than consensus.

Monthly increases were seen in shelter and food, but a decrease in the energy costs offset these significantly. The increases in Core CPI came from rent, owner’s equivalent of rent, medical care, and motor vehicle insurance. Core CPI has essentially been flat for three months as prices continue to increase, but at a more consistent pace. If inflation does not fall toward the Fed’s 2% target in 2024 as widely anticipated, then rate cuts may fail to appear.*

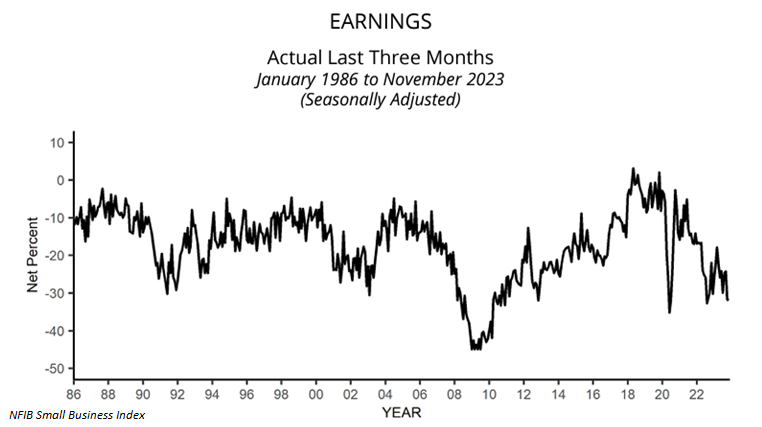

Also released today was the National Federation of Independent Businesses (NFIB) Small Business Optimism Index (SBOI) for November. The NFIB collects small business trend data by surveying their membership base on a monthly basis, and the series goes back to 1973 (quarterly surveys, monthly starting in 1986). This release is an important one to follow each month as small businesses are a large part of the U.S. economy – at least 2 of every 3 new jobs are in small businesses.

Today’s report showed that the overall Index decreased by 0.1 points, it’s 23rd consecutive month below its 50-year average of 98. Of the ten components, four decreased, five increased, and one remained unchanged. The two major issues small business owners face today are filling open positions with qualified employees and continued inflation pressures. Highlights from the release include a net negative 17% of owners reporting higher nominal sales in the past three months – its lowest reading since July 2020. Additionally, 30% of owners plan to raise compensation in the next three months, its highest reading since December 2021.

Both of today’s reports seem benign or even positive, but weakness may lurk under the surface. Inflation did not budge last month, and the majority of this stability is attributable to a large decline in energy prices. Despite media reports of a strong economy and a plethora of open jobs, small businesses are still really struggling.

*[Edited 12/14/23]