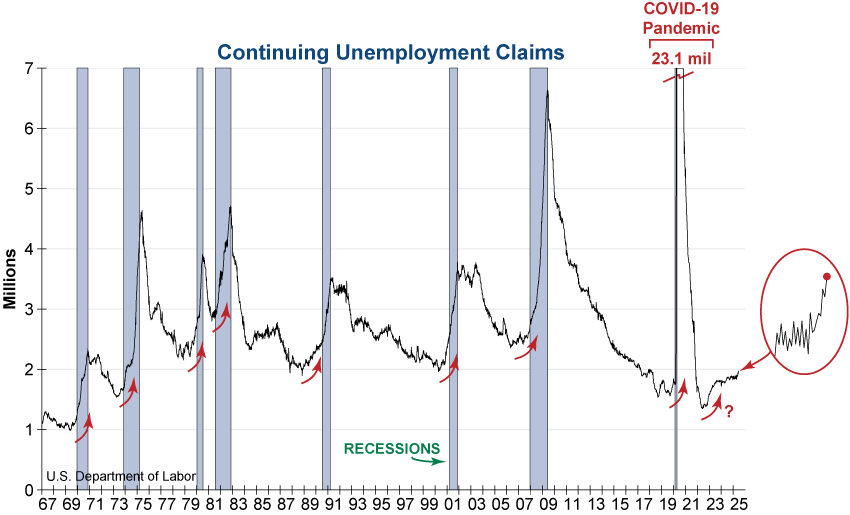

Continuing Unemployment Claims rose this week more than expected, surpassing their early June high. They are now at the highest level since late 2021 (and early 2018 excluding the pandemic spike).

Although this indicator remains at a historically low level, the trend is worrisome as continuing Unemployment Claims rise rapidly going into recessions (red arrows on graph). This early sign of weakness in the labor market could flow through to a rise in the Unemployment Rate which will be released next Thursday, July 3rd.

If the labor market continues to weaken, it will likely signal an impending recession. With uncertainty also surrounding the path of inflation, the Fed is on track for a dual mandate dilemma. While they are taking a wait-and-see approach for now, this strategy rarely, if ever, works out well for the economy.