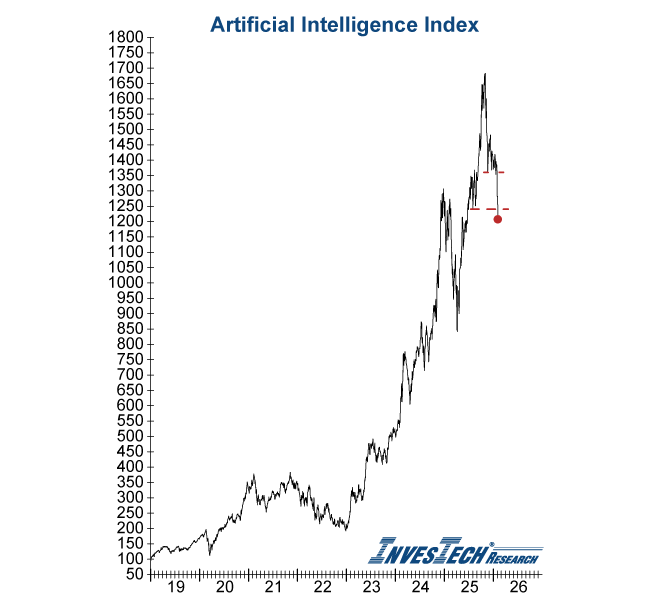

Technical alarm bells are ringing as InvesTech’s Artificial Intelligence (AI) Index tumbled on souring investor sentiment, falling more than -13% in less than two weeks. It now sits -28% off its peak from early November 2025.

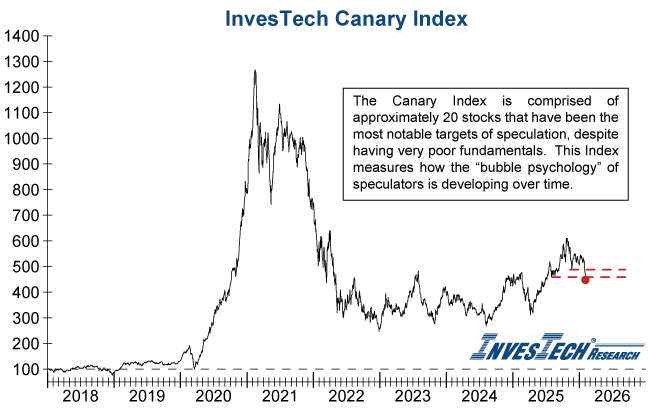

The structural weakness in speculative areas of the market has been confirmed by InvesTech’s Canary Index which is comprised of approximately 20 of what were the hottest, most speculative, and overvalued stocks in the market in 2020. It registered warning signals by breaking down in 2021 ahead of the 2022 bear market. While these stocks failed to even come close to their peak of the past, the renewed breakdown is confirmation that some of the most speculative (and least fundamentally supported) investments are losing steam.

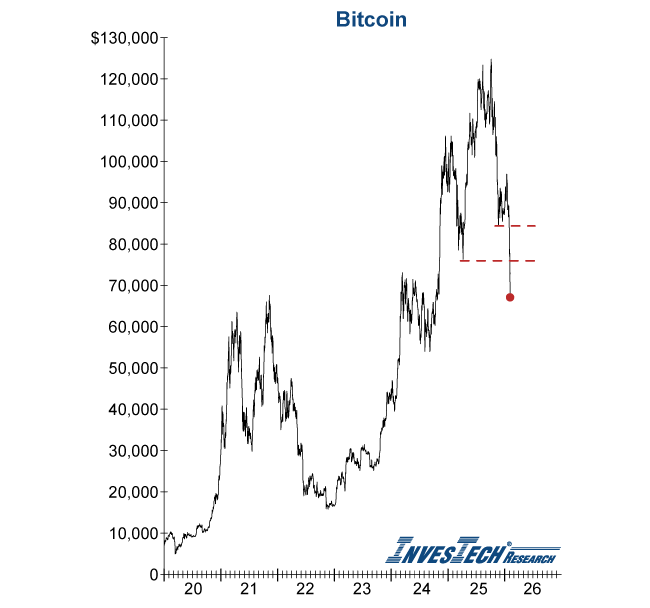

The decline in investors’ risk appetite is further exposed in the collapse of Bitcoin. Bitcoin peaked in early October, prior to both the AI Index and Nasdaq Composite, rapidly falling -32% in under two months. Following a brief period of stability, Bitcoin has tumbled even further in recent weeks, now sitting -42% below its high from last year.

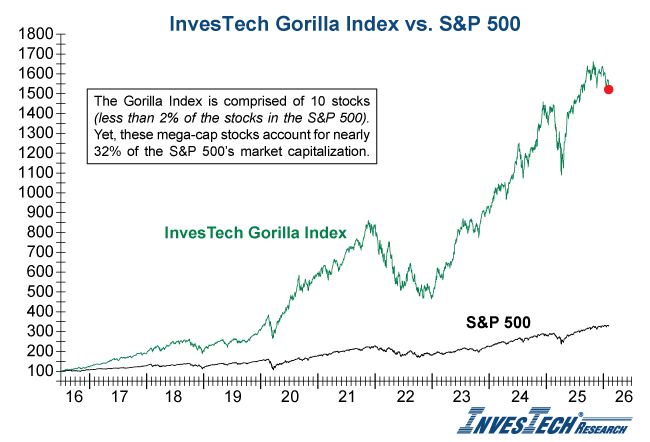

Looking forward, it will be essential to watch the InvesTech Gorilla Index for a decisive breakdown indicating that the weakness in the speculative assets has reached the mega-cap giants. If the Gorilla Index confirms the breakdown in the AI Index, Canary Index, and Bitcoin, it would be a sign that big investors in the market are starting to head for the exit.