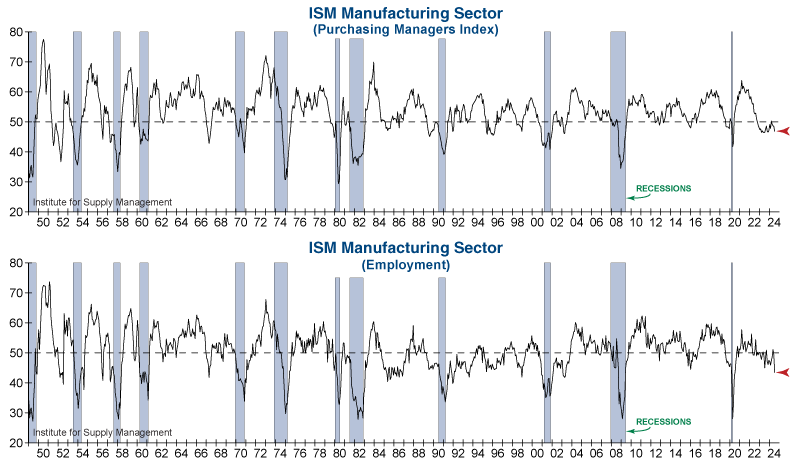

The July report for the Manufacturing Purchasing Managers Index (PMI) from the Institute for Supply Management fell further into contraction territory as it declined 1.7 percentage points below the June figure as shown in top graph below. This is the Index’s fourth consecutive month below 50 and it has contracted for 20 out of the last 21 months.

The manufacturing sector saw further weakness as demand softened and output slowed. In fact, 86% of manufacturing GDP contracted in July and all six of the largest manufacturing industries declined.

Additionally, the New Orders component of the report fell deeper into contraction as did the Production and Inventories Indexes. This is important as these subindexes tend to be leading and could indicate that we are once again entering a more prolonged decline. Also, despite the overall reduction in demand, the Prices Index remained in expansion territory, increasing 0.8 percentage points from the previous month.

More importantly, the Employment Index (bottom graph below) plunged to its lowest level since the pandemic. Prior to that, this Index was only lower during the Great Financial Crisis.

Here are a few quotes from survey respondents in the report:

“Even though we are used to a seasonal reduction in business over the summer, consumer behavior is changing more than normal. Sales are lighter, and customer orders are coming in under forecasts. It seems consumers are starting to pull back on spending.”

[Food, Beverage & Tobacco Products]

“It seems that the economy is slowing down significantly. The number of sales calls received from new suppliers is increasing significantly. Our own order backlog is also diminishing. We are hoping for an increase in customer demand, or we will possibly need to make organizational changes.”

“Business is slowing, and we are taking cost actions.”

[Electrical Equipment, Appliances & Components]

While just 30% of the economy, Manufacturing is highly impactful because it can be an excellent indicator of overall economic health. Continued and faster contraction in this sector could soon spill over into the broader economy.