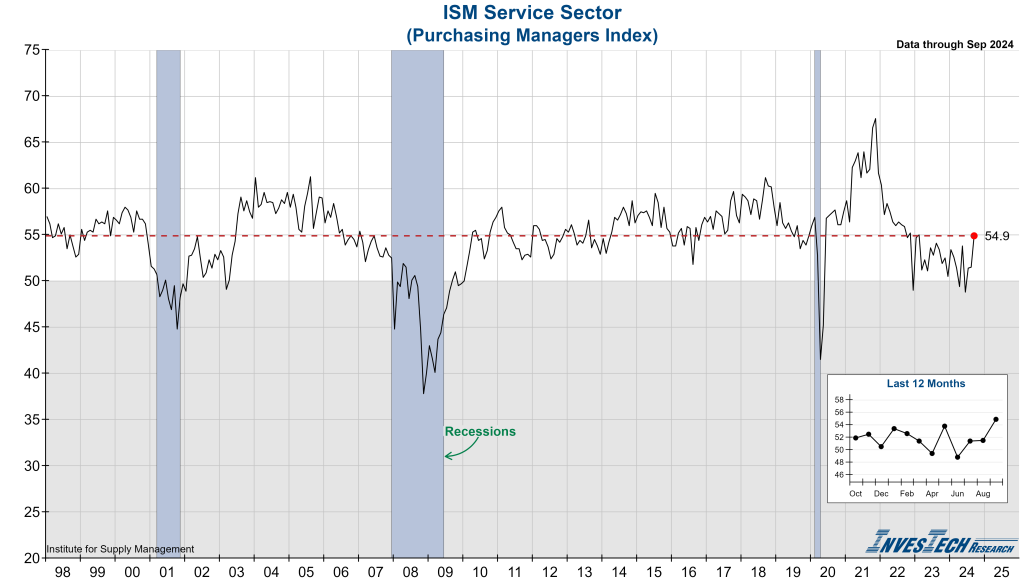

This morning, the Institute for Supply Management (ISM) released their Services Purchasing Managers Index (PMI) for September. Most components saw some degree of improvement, and the report was headlined by stronger growth in the Business Activity and New Orders Indexes. However, this increase in activity drove the Prices Paid Index to its highest level since January of this year – highlighting the tight rope the Fed must walk moving forward.

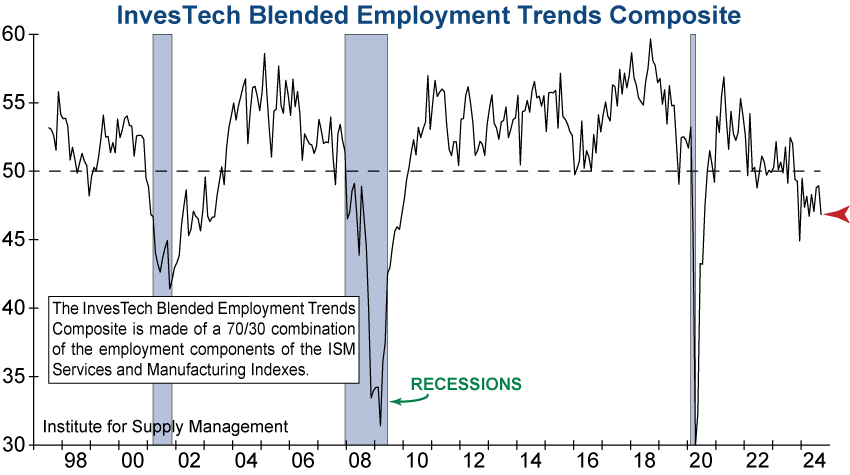

Despite today’s more positive report, two subcomponents saw declines. Most notably, the Employment Index fell into contraction, while Supplier Deliveries slowed. The Employment Index contracted for the first time in three months and reflects widespread concerns over labor costs and availability.

Additionally, we have updated our InvesTech Blended Employment Trends Composite for this release, which uses the Employment Indexes of the ISM reports and a 70/30 ratio of Services to Manufacturing. This has been in contraction since September 2023 and is now moving lower once again. This is sending a message that is normally only associated with recessionary outcomes.

Within this morning’s ISM Services report, comments from managers were surprisingly subdued:

“New projects have not been consolidated in the U.S., which has led my organization to cut costs, especially by dismissing employees from departments with a lower activity volume.” [Information]

“Back orders from manufacturers have increased, resulting in supply constraints.” [Health Care & Social Assistance]

“Overall, economic factors are somewhat stable in the last month. Volatility was limited, based more on seasonal aspects than geopolitical issues or election season. That stability may be short-lived due to looming port labor issues heading into October.” [Accommodation & Food Services]

Despite today’s improved report, contracting employment and increasing prices are a concern and pose a dilemma for the Federal Reserve after they recently opted for a larger-than-expected rate cut. While the Fed’s battle is changing, this report reinforces it is far from over…